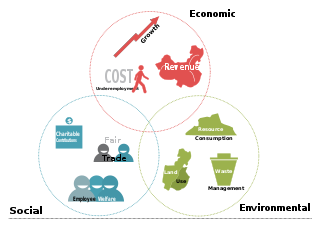

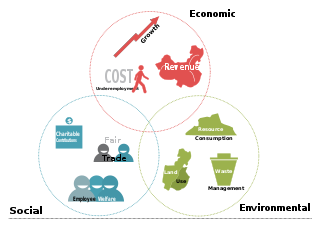

The triple bottom line is an accounting framework with three parts: social, environmental and economic. Some organizations have adopted the TBL framework to evaluate their performance in a broader perspective to create greater business value. Business writer John Elkington claims to have coined the phrase in 1994.

BlackRock, Inc. is an American multinational investment company. It is the world's largest asset manager, with $10 trillion in assets under management as of December 31, 2023. Headquartered in New York City, BlackRock has 78 offices in 38 countries, and clients in 100 countries. BlackRock is the manager of the iShares group of exchange-traded funds, and along with The Vanguard Group and State Street, it is considered to be one of the Big Three index fund managers. Its Aladdin software keeps track of investment portfolios for many major financial institutions and its BlackRock Solutions division provides financial risk management services. As of 2023, BlackRock was ranked 229th on the Fortune 500 list of the largest United States corporations by revenue.

The Global Reporting Initiative is an international independent standards organization that helps businesses, governments, and other organizations understand and communicate their impacts on issues such as climate change, human rights, and corruption.

Socially responsible investing (SRI) is any investment strategy which seeks to consider financial return alongside ethical, social or environmental goals. The areas of concern recognized by SRI practitioners are often linked to environmental, social and governance (ESG) topics. Impact investing can be considered a subset of SRI that is generally more proactive and focused on the conscious creation of social or environmental impact through investment. Eco-investing is SRI with a focus on environmentalism.

John Elkington is an author, advisor and serial entrepreneur. He is an authority on corporate responsibility and sustainable development. He has written and co-authored 20 books, including the Green Consumer Guide, Cannibals with Forks: The Triple Bottom Line of 21st Century Business, The Power of Unreasonable People: How Social Entrepreneurs Create Markets That Change the World, and The Breakthrough Challenge: 10 Ways to Connect Tomorrow's Profits with Tomorrow's Bottom Line.

Van Lanschot Kempen N.V. is a specialised, independent wealth manager that provides private banking, investment management and investment banking services to wealthy individuals and institutions. It is headquartered in 's-Hertogenbosch, the Netherlands. With a history dating back to 1737, it is the oldest independent financial institution in the Netherlands and the Benelux and one of the oldest independent financial institutions in the world.

Environmental, social, and governance (ESG), is a set of aspects, including environmental issues, social issues and corporate governance that can be considered in investing. Investing with ESG considerations is sometimes referred to as responsible investing or, in more proactive cases, impact investing.

Responsible Research Pte Ltd is an independent Environmental Social and Corporate Governance (ESG) research firm for global institutional asset owners and asset managers. Based in Singapore, Responsible Research analyses the ESG factors and regulatory landscapes that increasingly threaten portfolio returns in Asian markets.

The Dwight Hall Socially Responsible Investment Fund at Yale is an undergraduate-run socially responsible investment fund in the United States. Initially seeded with $50,000 from the Dwight Hall organization endowment, the fund is expected by the Dwight Hall Board of Directors and Trustees to grow to a $500,000 fundraising target. Managed by a committee of twenty undergraduate Yale College students, the fund makes use of traditional methods of socially responsible investing (SRI) to have a positive environmental and social impact while aiming to outperform standard investment benchmarks and maximize financial return.

Institutional Shareholder Services Inc. (ISS) is a proxy advisory firm. Hedge funds, mutual funds and similar organizations that own shares of multiple companies pay ISS to advise regarding share holder votes. As the leading firm in the industry, ISS commands a 48 percent market share as of 2021, with its nearest rival, Glass Lewis, holding a 42 percent market share.

The Sustainability Accounting Standards Board (SASB) is a non-profit organization, founded in 2011 by Jean Rogers to develop sustainability accounting standards. Investors, lenders, insurance underwriters, and other providers of financial capital are increasingly attuned to the impact of environmental, social, and governance (ESG) factors on the financial performance of companies, driving the need for standardized reporting of ESG data. Just as the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) have established International Financial Reporting Standards and Generally Accepted Accounting Principles (GAAP), respectively, which are currently used in the financial statements, SASB's stated mission “is to establish industry-specific disclosure standards across ESG topics that facilitate communication between companies and investors about financially material, decision-useful information. Such information should be relevant, reliable and comparable across companies on a global basis.”

RepRisk AG is an environmental, social, and corporate governance (ESG) data science company based in Zurich, Switzerland, specializing in ESG and business-conduct risk research, and quantitative solutions.

Arabesque Partners is an Anglo-German investment management firm founded in 2013, with headquarters in London and a research hub in Frankfurt.

The Islamic Reporting Initiative (IRI) is an independent nonprofit organization leading the creation of the IRI Standard: a reporting standard for Environmental, social and corporate governance (ESG) based on Islamic principles and values. Its objective is to enable organizations to inclusively assess, report, verify and certify their ESG and philanthropic programs in support of the United Nations Sustainable Development Goals.

Philipp Aeby is the Chief Executive Officer of RepRisk, an environmental, social, and governance (ESG) data science company based in Zürich, specializing in ESG and business conduct risk research and quantitative solutions. He has served in that capacity since 2010 and is also a Board Member of RepRisk. He previously held the position of Chief Operating Officer and Managing Partner, when RepRisk was part of the environmental and social consultancy, Ecofact.

NN Investment Partners was a Netherlands-based asset manager, with headquarters in The Hague and offices in 15 countries in Europe, Asia and the Americas. The company was acquired by Goldman Sachs Asset Management, the asset management division of Goldman Sachs in April 2022.

Sustainable finance is the set of practices, standards, norms, regulations and products that pursue financial returns alongside environmental and/or social objectives. It is sometimes used interchangeably with Environmental, Social & Governance (ESG) investing. However, many distinguish between ESG integration for better risk-adjusted returns and a broader field of sustainable finance that also includes impact investing, social finance and ethical investing.

The DWS Group commonly referred to as DWS, is a German asset management company. It previously operated as part of Deutsche Bank until 2018 where it became a separate entity through an initial public offering on the Frankfurt Stock Exchange. It is currently headquartered in Frankfurt, Germany and is a constituent member of the SDAX index.

The Responsible Investment Brand Index (RIBI) is a scale to evaluate the global asset management industry on its ability to demonstrate its commitment to sustainable investment into their respective brands. The annual index was created in 2018 by Jean-Francois Hirschel and Markus Kramer.

Engine No. 1 is an American activist and impact-focused investment firm. It attracted attention with its campaign to replace four members of ExxonMobil's board of directors despite owning only 0.02% of the company's shares. The firm describes its investment approach as "active ownership", as it prefers to work with management instead of launching activist campaigns.