Passive management is an investing strategy that tracks a market-weighted index or portfolio. Passive management is most common on the equity market, where index funds track a stock market index, but it is becoming more common in other investment types, including bonds, commodities and hedge funds.

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodities market for centuries for price risk management.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars. Many ETFs provide some level of diversification compared to owning an individual stock.

A commodity price index is a fixed-weight index or (weighted) average of selected commodity prices, which may be based on spot or futures prices. It is designed to be representative of the broad commodity asset class or a specific subset of commodities, such as energy or metals. It is an index that tracks a basket of commodities to measure their performance. They are similar to stock market indices but track the price of a basket of specific commodities. These indexes are often traded on exchanges, allowing investors to gain easier access to commodities without having to enter the futures market. The value of these indexes fluctuates based on their underlying commodities, and this value can be traded on an exchange in much the same way as stock index futures.

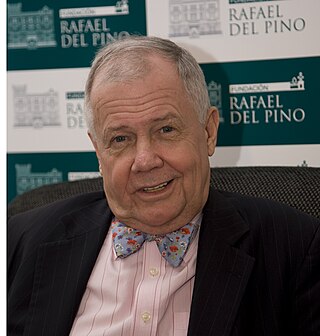

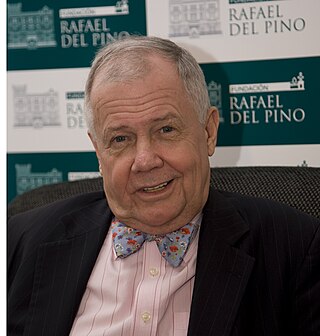

James Beeland Rogers Jr. is an American investor and financial commentator based in Singapore. He is the chairman of Beeland Interests, Inc. He was the co-founder of the Quantum Fund and Soros Fund Management. He was also the creator of the Rogers International Commodities Index (RICI).

The Korea Composite Stock Price Index or KOSPI (Korean: 한국종합주가지수) is the index of all common stocks traded on the Stock Market Division—previously, Korea Stock Exchange—of the Korea Exchange. It is the representative stock market index of South Korea, analogous to the S&P 500 in the United States.

The Dalian Commodity Exchange (DCE) is a Chinese futures exchange based in Dalian, Liaoning province, China. It is a non-profit, self-regulating and membership legal entity established on February 28, 1993.

iTraxx is the brand name for the family of credit default swap index products covering regions of Europe, Australia, Japan and non-Japan Asia. Credit derivative indexes form a large sector of the overall credit derivative market. The indices are constructed on a set of rules with the overriding criterion being that of liquidity of the underlying credit default swaps (CDS).

The Standard & Poor's Commodity Index (SPCI) was a commodity price index that measured the price changes in a cross section of agricultural and industrial commodities with actively traded U.S. futures contracts managed by Standard & Poor. The index covered five sectors - Energy, Metals, Grains, Livestock, and Fibers & Softs. Only commodities that are consumed for industrial use were included in the index. Weights in the index was determined by the dollar value of Commercial Open Interest (COI) for each component commodity, and rebalanced annually each February.

The S&P GSCI serves as a benchmark for investment in the commodity markets and as a measure of commodity performance over time. It is a tradable index that is readily available to market participants of the Chicago Mercantile Exchange. The index was originally developed in 1991, by Goldman Sachs. In 2007, ownership transferred to Standard & Poor's, who currently own and publish it. Futures of the S&P GSCI use a multiple of 250. The index contains a much higher exposure to energy than other commodity price indices such as the Bloomberg Commodity Index.

The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index distributed by Bloomberg Index Services Limited. The index was originally launched in 1998 as the Dow Jones-AIG Commodity Index (DJ-AIGCI) and renamed to Dow Jones-UBS Commodity Index (DJ-UBSCI) in 2009, when UBS acquired the index from AIG. On July 1, 2014, the index was rebranded under its current name.

PFTS index is a benchmark index of PFTS Ukraine Stock Exchange, Ukraine's leading bourse. Beside PFTS Index, there are also the UX Index of the Ukrainian Exchange and the Ukrainian Average Index 50 (UAI-50) being composed by analysts of internet-publisher fundmarket.ua.

An exchange-traded note (ETN) is a senior, unsecured, unsubordinated debt security issued by an underwriting bank or by a special-purpose entity. Similar to other debt securities, ETNs may have a maturity date and are backed by the credit of the issuer, though some ETNs may have a portfolio of assets given as a collateral.

The S&P/ASX 300, or simply, ASX 300, is a stock market index of Australian stocks listed on the Australian Securities Exchange (ASX). The index is market-capitalisation weighted, meaning each company included is in proportion to the indexes total market value, and float-adjusted, meaning the index only considers shares available to public investors.

The Deutsche Bank Liquid Commodity Index (DBLCI) is a commodity price index operated by German based Deutsche Bank. It was launched in February 2003 and tracks the performance of six commodities in the energy, precious metals, industrial metals and grain sectors. The DBLCI has constant weightings for each of the six commodities and the index is rebalanced annually in the first week of November. Consequently, the weights fluctuate during the year according to the price movement of the underlying commodity futures.

DBLCI Optimum Yield Index (DBLCI-OY) is a commodity price index operated by German Deutsche Bank. It is similar to the Deutsche Bank Liquid Commodity Index but has more commodities from more sectors. The DBLCI-OY indices are available for 24 commodities drawn from the energy, precious metals, industrial metals, agricultural and livestock sectors. A DBLCI-OY index based on the DBLCI benchmark weights is also available and the optimum yield technology has also been applied to the energy, precious metals, industrial metals and agricultural sector indices.

S&P Dow Jones Indices LLC is a joint venture between S&P Global, the CME Group, and News Corp that was announced in 2011 and later launched in 2012. It produces, maintains, licenses, and markets stock market indices as benchmarks and as the basis of investable products, such as exchange-traded funds (ETFs), mutual funds, and structured products. The company currently has employees in 15 cities worldwide, including New York, London, Frankfurt, Singapore, Hong Kong, Sydney, Beijing, and Dubai.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

LME Zinc stands for a group of spot, forward, and futures contracts traded on the London Metal Exchange (LME), for delivery of special high-grade Zinc with a 99.995% purity minimum that can be used for price hedging, physical delivery of sales or purchases, investment, and speculation. Producers, semi-fabricators, consumers, recyclers, and merchants can use Zinc futures contracts to hedge Zinc price risks and to reference prices.