Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships." Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today.

In statistics, econometrics, epidemiology and related disciplines, the method of instrumental variables (IV) is used to estimate causal relationships when controlled experiments are not feasible or when a treatment is not successfully delivered to every unit in a randomized experiment. Intuitively, IVs are used when an explanatory variable of interest is correlated with the error term (endogenous), in which case ordinary least squares and ANOVA give biased results. A valid instrument induces changes in the explanatory variable but has no independent effect on the dependent variable and is not correlated with the error term, allowing a researcher to uncover the causal effect of the explanatory variable on the dependent variable.

In statistics, a tobit model is any of a class of regression models in which the observed range of the dependent variable is censored in some way. The term was coined by Arthur Goldberger in reference to James Tobin, who developed the model in 1958 to mitigate the problem of zero-inflated data for observations of household expenditure on durable goods. Because Tobin's method can be easily extended to handle truncated and other non-randomly selected samples, some authors adopt a broader definition of the tobit model that includes these cases.

Truncated regression models are a class of models in which the sample has been truncated for certain ranges of the dependent variable. That means observations with values in the dependent variable below or above certain thresholds are systematically excluded from the sample. Therefore, whole observations are missing, so that neither the dependent nor the independent variable is known. This is in contrast to censored regression models where only the value of the dependent variable is clustered at a lower threshold, an upper threshold, or both, while the value for independent variables is available.

The Frisch Medal is an award in economics given by the Econometric Society. It is awarded every two years for empirical or theoretical applied research published in Econometrica during the previous five years. The award was named in honor of Ragnar Frisch, first co-recipient of the Nobel prize in economics and editor of Econometrica from 1933 to 1954. In the opinion of Rich Jensen, Gilbert F. Schaefer Professor of Economics and chairperson of the Department of Economics of the University of Notre Dame, "The Frisch medal is not only one of the top three prizes in the field of economics, but also the most prestigious 'best article' award in the profession". Five Frisch medal winners have also won the Nobel Prize.

George Jesus Borjas is a Cuban-American economist and the Robert W. Scrivner Professor of Economics and Social Policy at the Harvard Kennedy School. He has been described as "America’s leading immigration economist" and "the leading sceptic of immigration among economists". Borjas has published a number of studies that conclude that low-skilled immigration adversely affects low-skilled natives, a proposition that is debated among economists.

Joshua David Angrist is an Israeli–American economist and Ford Professor of Economics at the Massachusetts Institute of Technology. Angrist, together with Guido Imbens, was awarded the Nobel Memorial Prize in Economics in 2021 "for their methodological contributions to the analysis of causal relationships".

The Heckman correction is a statistical technique to correct bias from non-randomly selected samples or otherwise incidentally truncated dependent variables, a pervasive issue in quantitative social sciences when using observational data. Conceptually, this is achieved by explicitly modelling the individual sampling probability of each observation together with the conditional expectation of the dependent variable. The resulting likelihood function is mathematically similar to the tobit model for censored dependent variables, a connection first drawn by James Heckman in 1974. Heckman also developed a two-step control function approach to estimate this model, which avoids the computational burden of having to estimate both equations jointly, albeit at the cost of inefficiency. Heckman received the Nobel Memorial Prize in Economic Sciences in 2000 for his work in this field.

In statistics, the Johansen test, named after Søren Johansen, is a procedure for testing cointegration of several, say k, I(1) time series. This test permits more than one cointegrating relationship so is more generally applicable than the Engle–Granger test which is based on the Dickey–Fuller test for unit roots in the residuals from a single (estimated) cointegrating relationship.

In probability theory, the Mills ratio of a continuous random variable is the function

The methodology of econometrics is the study of the range of differing approaches to undertaking econometric analysis.

The Mincer earnings function is a single-equation model that explains wage income as a function of schooling and experience. It is named after Jacob Mincer. Thomas Lemieux argues it is "one of the most widely used models in empirical economics". The equation has been examined on many datasets. Typically the logarithm of earnings is modelled as the sum of years of education and a quadratic function of "years of potential experience".

Guido Wilhelmus Imbens is a Dutch-American economist whose research concerns econometrics and statistics. He holds the Applied Econometrics Professorship in Economics at the Stanford Graduate School of Business at Stanford University, where he has taught since 2012.

Andrew Donald Roy was a British economist who is known for the Roy model of self-selection and income distribution and Roy's safety-first criterion.

Control functions are statistical methods to correct for endogeneity problems by modelling the endogeneity in the error term. The approach thereby differs in important ways from other models that try to account for the same econometric problem. Instrumental variables, for example, attempt to model the endogenous variable X as an often invertible model with respect to a relevant and exogenous instrument Z. Panel analysis uses special data properties to difference out unobserved heterogeneity that is assumed to be fixed over time.

In statistics, in particular in the design of experiments, a multi-valued treatment is a treatment that can take on more than two values. It is related to the dose-response model in the medical literature.

Susanne Maria Schennach is an economist and professor at Brown University. She is an econometrician whose work focuses on measurement error.

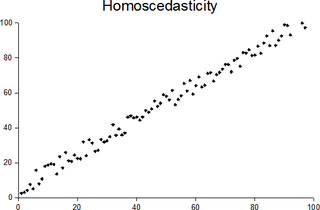

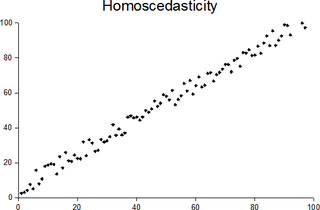

In statistics, a sequence of random variables is homoscedastic if all its random variables have the same finite variance; this is also known as homogeneity of variance. The complementary notion is called heteroscedasticity, also known as heterogeneity of variance. The spellings homoskedasticity and heteroskedasticity are also frequently used. Assuming a variable is homoscedastic when in reality it is heteroscedastic results in unbiased but inefficient point estimates and in biased estimates of standard errors, and may result in overestimating the goodness of fit as measured by the Pearson coefficient.

The 2021 Nobel Memorial Prize in Economic Sciences was divided one half awarded to the American-Canadian David Card "for his empirical contributions to labour economics", the other half jointly to Israeli-American Joshua Angrist and Dutch-American Guido W. Imbens "for their methodological contributions to the analysis of causal relationships." The Nobel Committee stated their reason behind the decision, saying:

"This year's Laureates – David Card, Joshua Angrist and Guido Imbens – have shown that natural experiments can be used to answer central questions for society, such as how minimum wages and immigration affect the labour market. They have also clarified exactly which conclusions about cause and effect can be drawn using this research approach. Together, they have revolutionised empirical research in the economic sciences."