Related Research Articles

SoftBank Group Corp. is a Japanese multinational conglomerate holding company headquartered in Minato, Tokyo, and focuses on investment management. The Group primarily invests in companies operating in technology, energy, and financial sectors. It also runs the Vision Fund, the world's largest technology-focused venture capital fund, with over $100 billion in capital. Fund investors include sovereign wealth funds from countries in the Middle East.

The Vanguard Group, Inc. is an American registered investment advisor based in Malvern, Pennsylvania, with about $7 trillion in global assets under management, as of January 13, 2021. It is the largest provider of mutual funds and the second-largest provider of exchange-traded funds (ETFs) in the world after BlackRock's iShares. In addition to mutual funds and ETFs, Vanguard offers brokerage services, variable and fixed annuities, educational account services, financial planning, asset management, and trust services. Several mutual funds managed by Vanguard are ranked at the top of the list of US mutual funds by assets under management. Along with BlackRock and State Street, Vanguard is considered one of the Big Three index fund managers that dominate corporate America.

TPG Inc., previously known as Texas Pacific Group, is an American investment company. The private equity firm is focused on leveraged buyouts and growth capital. TPG manages investment funds in growth capital, venture capital, public equity, and debt investments. The firm invests in a range of industries including consumer/retail, media and telecommunications, industrials, technology, travel, leisure, and health care.

Providence Equity Partners L.L.C. is a specialist private equity investment firm focused on media, communications, education, technology investments across North America and Europe. The firm specializes in growth-oriented private equity investments and has invested in more than 170 companies globally since its inception in 1989.

UST, formerly known as UST Global, is a provider of digital technology and transformation, information technology and services, headquartered in Aliso Viejo, California, United States. Stephen Ross founded UST in 1998 in Laguna Hills. The company has offices in the Americas, EMEA, APAC, and India.

T. Rowe Price Group, Inc. is an American publicly owned global investment management firm that offers funds, advisory services, account management, and retirement plans and services for individuals, institutions, and financial intermediaries. The firm has assets under management of more than $1.6 trillion and annual revenues of $6.2 billion as of 2020, placing it 447 on the Fortune 500 list of the largest U.S. companies. Headquartered at 100 East Pratt Street in Baltimore, Maryland, it has 5,000 employees in Baltimore and 16 international offices serve clients in 47 countries around the world.

A chief strategy officer (CSO) is an executive, that usually reports to the CEO, and has primary responsibility for strategy formulation and management, including developing the corporate vision and strategy, overseeing strategic planning, and leading strategic initiatives, including M&A, transformation, partnerships, and cost reduction. Some companies give the title of Chief Strategist or Chief Business Officer to its senior executives who are holding the top strategy role.

Corporate venture capital (CVC) is the investment of corporate funds directly in external startup companies. CVC is defined by the Business Dictionary as the "practice where a large firm takes an equity stake in a small but innovative or specialist firm, to which it may also provide management and marketing expertise; the objective is to gain a specific competitive advantage." Examples of CVCs include GV and Intel Capital.

S. D. Shibulal, better known as Shibulal, is an Indian business executive. He was the chief executive officer and managing director of Infosys, and one of its seven founding members. He stepped down from the post of CEO and MD on 31 July 2014 and was succeeded by the first non-founder CEO of Infosys Dr. Vishal Sikka. He is the president of the Infosys Science Foundation for the year 2015.

Pharmaceutical Product Development (PPD) is a global contract research organization (CRO) providing comprehensive, integrated drug development, laboratory and lifecycle management services. In December 2021, PPD became a wholly owned subsidiary of Thermo Fisher Scientific.

SEAF is an international investment management group that provides growth capital and business assistance to small and medium enterprises (SMEs) in emerging and transition markets underserved by traditional sources of capital.

Samena Capital is an Asia, India and MENA-focused alternative investments group, co-established in 2008 by Shirish Saraf and key partners from a cross section of industries and regions. This name was chosen due to the markets that Samena invests in. These are the Indian Subcontinent, Asia, Middle East and North Africa – a region collectively known as SAMENA. Also in ancient Buddhist script, Samena means "together" or "collective", which reflects the collective investment model the company is based on. The company and its subsidiaries employ 26 people in 3 locations worldwide, and has 48 shareholders.

The Russian Direct Investment Fund (RDIF) is Russia's sovereign wealth fund established in 2011 by the Russian government to make investments in companies of high-growth sectors of the Russian economy. Its mandate is to co-invest alongside the world’s largest institutional investors — direct investment funds, sovereign wealth funds and leading companies.

Wealthfront Inc. is an automated investment service firm based in Palo Alto, California, founded by Andy Rachleff and Dan Carroll in 2008. As of September 2019, Wealthfront had $21 billion AUM across 400,000 accounts.

redBus is an Indian online bus ticketing platform, providing ticket booking facility through its website, iOS and Android mobile apps. Headquartered in Bangalore, it connects bus travellers with a network of more than 2000 bus operators, across India, Malaysia, Indonesia, Singapore, Peru and Colombia. It claims to have registered over 180 million trips, with a customer base of over 20 million. In 2018, the company achieved a GMV of ₹50 billion, with a 70% share in the Indian online bus ticketing segment.

Patrizia SE has been active as an investment manager in the real estate market across Europe for more than 38 years. Based in Augsburg, Germany, the company is listed on the Frankfurt stock exchange and, among others, is a member of the SDAX and MSCI World Small Cap Index.

Blooom, often stylized as "blooom", is an online Registered Investment Adviser that manages individual participant accounts in IRAs and in employer sponsored retirement plans such as 401(k), 403(b), or TSP. The company was founded in 2013 by Chris Costello, who now serves as chief executive officer. As of January 2021, Blooom manages $5 billion in assets.

Section 32 is a California-based venture fund founded by Google Ventures founder, Bill Maris. Section 32 funds technology, biotechnology, healthcare and life sciences companies and has approximately $1 billion under management.

Delhivery is an Indian logistics and supply chain company, based in Gurgaon. It was founded in 2011 by Sahil Barua, Mohit Tandon, Bhavesh Manglani, Suraj Saharan, and Kapil Bharati. The company has over 85 fulfillment centers, 24 automated sort centers, 70 hubs, 7,500+ partner centers, and 3,000+ direct delivery centers, as of 2021. About two-thirds of its revenue comes from providing third-party logistics and delivery services to e-commerce companies.

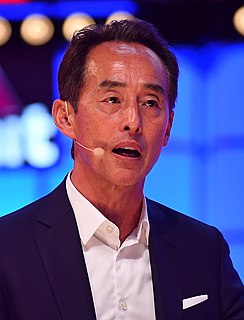

Young Sohn (Korean: 손영권) is a Korean-American business executive and investor. He is the president and chief strategy officer of Samsung Electronics. Sohn is also the chairman of the board of Harman International Industries, a subsidiary of Samsung Electronics.

References

- ↑ "Sajan Pillai to set up $75 million VC fund for startups". The Economic Times.

- ↑ "LEADERS Interview with Sajan Pillai, Chief Executive Officer, UST Global". www.leadersmag.com.

- ↑ Pillai, Sajan. "Sajan Pillai". Entrepreneur.

- ↑ Abrar, Peerzada (4 August 2020). "Former UST CEO Sajan Pillai on his investment plans amid coronavirus". Business Standard India.

- ↑ "LEADERS Interview with Sajan Pillai, Chief Executive Officer, UST Global". www.leadersmag.com.

- ↑ "UST Announces CEO Retirement and Succession Plan". www.ust.com.

- ↑ "Company launched by US-based Keralite lists on Nasdaq bourse, worth Rs 1,500 crore". The New Indian Express.

- ↑ Marcial, Gene. "A Venture Capitalist Disinterested In Finding The Next Unicorn". Forbes.

- ↑ "Behind the Buyouts: Sajan Pillai Strengthens India's Ties to Silicon Valley". The Deal. February 10, 2021.

- ↑ baiju, Kalesh. "UST Co-Founder Targets $1 Billion Funding for Tech Investment". www.bloomberg.com.