In the industrial design field of human–computer interaction, a user interface (UI) is the space where interactions between humans and machines occur. The goal of this interaction is to allow effective operation and control of the machine from the human end, while the machine simultaneously feeds back information that aids the operators' decision-making process. Examples of this broad concept of user interfaces include the interactive aspects of computer operating systems, hand tools, heavy machinery operator controls and process controls. The design considerations applicable when creating user interfaces are related to, or involve such disciplines as, ergonomics and psychology.

A web portal is a specially designed website that brings information from diverse sources, like emails, online forums and search engines, together in a uniform way. Usually, each information source gets its dedicated area on the page for displaying information ; often, the user can configure which ones to display. Variants of portals include mashups and intranet dashboards for executives and managers. The extent to which content is displayed in a "uniform way" may depend on the intended user and the intended purpose, as well as the diversity of the content. Very often design emphasis is on a certain "metaphor" for configuring and customizing the presentation of the content and the chosen implementation framework or code libraries. In addition, the role of the user in an organization may determine which content can be added to the portal or deleted from the portal configuration.

The TI-84 Plus is a graphing calculator made by Texas Instruments which was released in early 2004. There is no original TI-84, only the TI-84 Plus, the TI-84 Plus Silver Edition models, the TI-84 Plus C Silver Edition, the TI-84 Plus CE, and TI-84 Plus CE Python. The TI-84 Plus is an enhanced version of the TI-83 Plus. The key-by-key correspondence is relatively the same, but the TI-84 features improved hardware. The archive (ROM) is about 3 times as large, and the CPU is about 2.5 times as fast. A USB port and built-in clock functionality were also added. The USB port on the TI-84 Plus series is USB On-The-Go compliant, similar to the next generation TI-Nspire calculator, which supports connecting to USB based data collection devices and probes, and supports device to device transfers over USB rather than over the serial link port. It is also able to connect to a special TI application for calculator screenshots and image download.

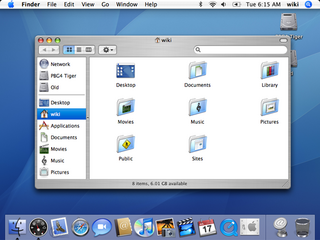

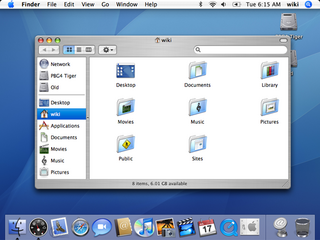

Mac OS X Tiger is the 5th major release of macOS, Apple's desktop and server operating system for Mac computers. Tiger was released to the public on April 29, 2005 for US$129.95 as the successor to Mac OS X 10.3 Panther. Included features were a fast searching system called Spotlight, a new version of the Safari web browser, Dashboard, a new 'Unified' theme, and improved support for 64-bit addressing on Power Mac G5s. Mac OS X 10.4 Tiger also had a number of additional features that Microsoft had spent several years struggling to add to Windows with acceptable performance, such as fast file search and improved graphics processing.

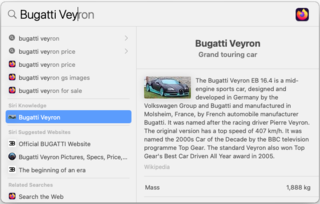

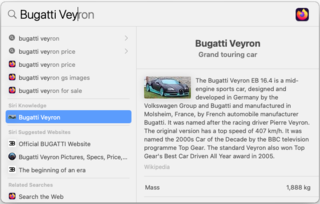

Spotlight is a system-wide desktop search feature of Apple's macOS, iOS, iPadOS, and visionOS operating systems. Spotlight is a selection-based search system, which creates an index of all items and files on the system. It is designed to allow the user to quickly locate a wide variety of items on the computer, including documents, pictures, music, applications, and System Settings. In addition, specific words in documents and in web pages in a web browser's history or bookmarks can be searched. It also allows the user to narrow down searches with creation dates, modification dates, sizes, types and other attributes. Spotlight also offers quick access to definitions from the built-in New Oxford American Dictionary and to calculator functionality. There are also command-line tools to perform functions such as Spotlight searches.

LinkedIn is a business and employment-focused social media platform that works through websites and mobile apps. It was launched on May 5, 2003 by Reid Hoffman and Eric Ly. Since December 2016, LinkedIn has been a wholly owned subsidiary of Microsoft. The platform is primarily used for professional networking and career development, and allows jobseekers to post their CVs and employers to post jobs. From 2015, most of the company's revenue came from selling access to information about its members to recruiters and sales professionals and has also introduced their own ad portal named LinkedIn Ads to let companies advertise in their platform. LinkedIn has more than 1 billion registered members from over 200 countries and territories.

Desktop search tools search within a user's own computer files as opposed to searching the Internet. These tools are designed to find information on the user's PC, including web browser history, e-mail archives, text documents, sound files, images, and video. A variety of desktop search programs are now available; see this list for examples. Most desktop search programs are standalone applications. Desktop search products are software alternatives to the search software included in the operating system, helping users sift through desktop files, emails, attachments, and more.

Dashboard is a discontinued feature of Apple Inc.'s macOS operating systems, used as a secondary desktop for hosting mini-applications known as widgets. These are intended to be simple applications that do not take time to launch. Dashboard applications supplied with macOS included a stock ticker, weather report, calculator, and notepad; while users could create or download their own.

Federated search retrieves information from a variety of sources via a search application built on top of one or more search engines. A user makes a single query request which is distributed to the search engines, databases or other query engines participating in the federation. The federated search then aggregates the results that are received from the search engines for presentation to the user. Federated search can be used to integrate disparate information resources within a single large organization ("enterprise") or for the entire web.

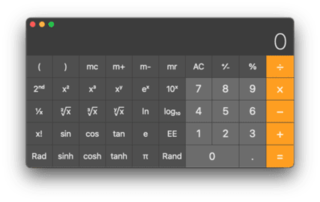

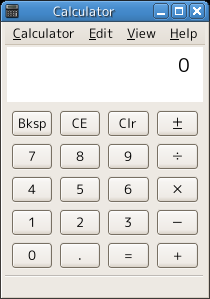

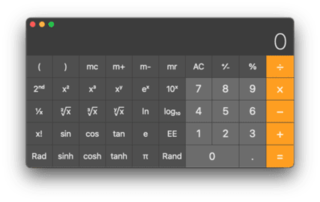

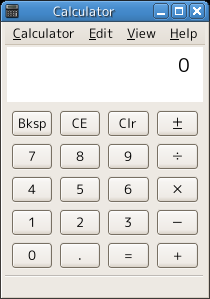

Calculator is a basic calculator application made by Apple Inc. and bundled with its macOS, iOS, iPadOS, and watchOS operating systems. It has three modes: basic, scientific, and programmer. The basic mode includes a number pad, buttons for adding, subtracting, multiplying, and dividing, as well as memory keys. Scientific mode supports exponents and trigonometric functions. The macOS version of Calculator also has a programmer mode that gives the user access to more options related to computer programming.

A search engine results page (SERP) is a webpage that is displayed by a search engine in response to a query by a user. The main component of a SERP is the listing of results that are returned by the search engine in response to a keyword query.

Ladders, Inc. is a United States–based company providing career news, advice, and tools and an online job search service. Their search service only lists vetted job offers with annual salaries of $100,000 or more.

The Facebook Platform is the set of services, tools, and products provided by the social networking service Facebook for third-party developers to create their own applications and services that access data in Facebook.

A software calculator is a calculator that has been implemented as a computer program, rather than as a physical hardware device.

In computing, a script is a relatively short and simple set of instructions that typically automate an otherwise manual process. The act of writing a script is called scripting. A scripting language or script language is a programming language that is used for scripting.

JobSerf, Inc. was an employment service and job search outsourcing (JSO) company. It was founded in 2004 by three Dallas executives: Jay Martin, Phil Miller, and David Micek. Jay Martin is a former Strategy and Supply Chain Consultant who worked for Arthur D. Little, IBM and PepsiCo. Phil Miller is a Dallas-based Financial Executive and former CFO. David Micek has been a CEO of multiple companies, and was also the president of internet leader AltaVista. In 2004, JobSerf was the first company to demonstrate the feasibility of job search outsourcing.

Since the arrival of early social networking sites in the early 2000s, online social networking platforms have expanded exponentially, with the biggest names in social media in the mid-2010s being Facebook, Instagram, Twitter and Snapchat. The massive influx of personal information that has become available online and stored in the cloud has put user privacy at the forefront of discussion regarding the database's ability to safely store such personal information. The extent to which users and social media platform administrators can access user profiles has become a new topic of ethical consideration, and the legality, awareness, and boundaries of subsequent privacy violations are critical concerns in advance of the technological age.

BranchOut was a Facebook application designed for finding jobs, networking professionally, and recruiting employees. It was founded by Rick Marini in July 2010, and was, as of March 2012, the largest professional networking service on Facebook. The company sold its assets to HR Software Company 1-Page in November 2014 and the staff was picked up by Hearst.

Microsoft mobile services are a set of proprietary mobile services created specifically for mobile devices; they are typically offered through mobile applications and mobile browser for Windows Phone platforms, BREW, and Java. Microsoft's mobile services are typically connected with a Microsoft account and often come preinstalled on Microsoft's own mobile operating systems while they are offered via various means for other platforms. Microsoft started to develop for mobile computing platforms with the launch of Windows CE in 1996 and later added Microsoft's Pocket Office suite to their Handheld PC line of PDAs in April 2000. From December 2014 to June 2015, Microsoft made a number of corporate acquisitions, buying several of the top applications listed in Google Play and the App Store including Acompli, Sunrise Calendar, Datazen, Wunderlist, Echo Notification Lockscreen, and MileIQ.