A tax is a compulsory financial charge or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund government spending and various public expenditures. A failure to pay, along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labour equivalent. The first known taxation took place in Ancient Egypt around 3000–2800 BC.

Bourgeoisie is a polysemous French term that can mean:

The poverty threshold, poverty limit, poverty line or breadline is the minimum level of income deemed adequate in a particular country. Poverty line is usually calculated by finding the total cost of all the essential resources that an average human adult consumes in one year. The largest of these expenses is typically the rent required for accommodation, so historically, economists have paid particular attention to the real estate market and housing prices as a strong poverty line affect. Individual factors are often used to account for various circumstances, such as whether one is a parent, elderly, a child, married, etc. The poverty threshold may be adjusted annually.

Social class in the United States refers to the idea of grouping Americans by some measure of social status, typically economic, however it could also refer to social status or location. The idea that American society can be divided into social classes is disputed, and there are many competing class systems.

The term downshifting in the English language refers to the act of reducing the gear ratio while driving a vehicle with manual transmission. This title or term has now been re-purposed and applied to describe a social behavior or trend in which individuals live simpler lives to escape from what critics call the rat race.

A tax cut is a reduction in the rate of tax charged by a government. The immediate effects of a tax cut are a decrease in the real income of the government and an increase in the real income of those whose tax rates have been lowered. Due to the perceived benefit in growing real incomes among tax payers, politicians have sought to claim their proposed tax credits as tax cuts. In the longer term, however, the macroeconomic effects of a tax cut are generally not predictable because they depend on how the taxpayers use their additional income and how the government adjusts to its reduced income.

The working poor are working people whose incomes fall below a given poverty line due to low-income jobs and low familial household income. These are people who spend at least 27 weeks in a year working or looking for employment, but remain under the poverty threshold.

Real estate economics is the application of economic techniques to real estate markets. It tries to describe, explain, and predict patterns of prices, supply, and demand. The closely related field of housing economics is narrower in scope, concentrating on residential real estate markets, while the research on real estate trends focuses on the business and structural changes affecting the industry. Both draw on partial equilibrium analysis, urban economics, spatial economics, basic and extensive research, surveys, and finance.

A consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on consumption. Consumption taxes are usually indirect, such as a sales tax or a value-added tax. However, a consumption tax can also be structured as a form of direct, personal taxation, such as the Hall–Rabushka flat tax.

The nipa hut or bahay kubo, is a type of stilt house indigenous to the cultures of the Philippines. It is also known as payag or kamalig in other languages of the Philippines. It often serves as an icon of Philippine culture. Its architectural principles gave way to many of Filipino traditional houses and buildings that rose after the pre-colonial era. These include the Colonial era "bahay na bato", which is a noble version of bahay kubo with Spanish and some Chinese main architectural influence and has become the dominant urban architecture in the past. And there is also contemporary buildings such as the Coconut Palace, Sto. Niño Shrine, and the Modernist; Cultural Center of the Philippines and National Arts Center which are Modern edifices that used bahay kubo as a sub influence.

A food desert is an area that has limited access to affordable and nutritious food, in contrast with an area with higher access to supermarkets or vegetable shops with fresh foods, which is called a food oasis. The designation considers the type and quality of food available to the population, in addition to the accessibility of the food through the size and proximity of the food stores.

Indoor air pollution in developing nations is a significant form of indoor air pollution (IAP) that is little known to those in the developed world.

This article gives an overview about the income in India.

In the olden days, the Chinese economy was characterized by widespread poverty, extreme income inequalities, and endemic insecurity of livelihood. Improvements since then saw the average national life expectancy rise from around forty-four years in 1949 to sixty-eight years in 1985, while the Chinese population estimated to be living in absolute poverty fell from between 200-590 million in 1978 to 70 million in 2017.

In China today, poverty refers mainly to the rural poor, as decades of economic growth have largely eradicated urban poverty. The dramatic progress in reducing poverty over the past three decades in China is well known. According to the World Bank, more than 850 million Chinese people have been lifted out of extreme poverty; China's poverty rate fell from 88 percent in 1981 to 0.7 percent in 2015, as measured by the percentage of people living on the equivalent of US$1.90 or less per day in 2011 purchasing price parity terms.

The Agriculture and Consumer Protection Act of 1973 was the 4-year farm bill that adopted target prices and deficiency payments as a tool that would support farm income but reduce forfeitures to the Commodity Credit Corporation (CCC) of surplus stocks. It reduced payment limitations to $20,000 for all program crops. The Act might be considered the first omnibus farm bill because it went beyond simply authorizing farm commodity programs. It authorized disaster payments and disaster reserve inventories; created the Rural Environmental Conservation Program; amended the Food Stamp Act of 1964, authorized the use of commodities for feeding low income mothers and young children (the origin of the Commodity Supplemental Food Program; and amended the Rural Development Act of 1972.

Brazil has been tackling problems of income inequality despite high rates of growth. Its GDP growth in 2010 was 7.5%. In recent decades, there has been a decline in inequality for the country as a whole. Brazil's GINI coefficient, a measure of income inequality, has slowly decreased from in 0.596 in 2001 to 0.543 in 2009. However, the numbers still point to a rather significant problem of income disparity.

Schizostachyum lima is a flowering species of Bamboo. It is propagated using seeds or rhizome cuttings. In the Philippines, it is often used for making sawali, fishing rods, and musical instruments. In some rural areas of the country, midwives still use sharp knives made of Schizostachyum lima to cut the newborn's umbilical cord.

Indigenous materials are materials that are naturally and locally found in a specific place such as timbers, canes, grass, palms, and rattan. Other indigenous raw materials in the country that are commonly known and used creatively in crafts and decoration are capiz, pearls, corals, and seashells, being an archipelago naturally abundant in beaches and marine resources.

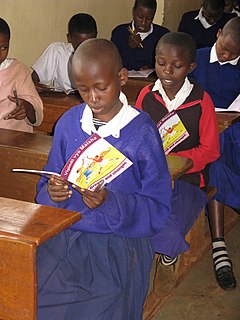

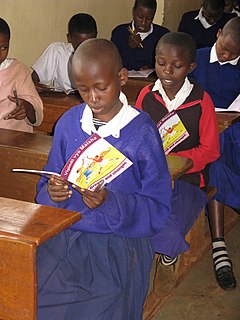

Menstrual hygiene management (MHM) or menstrual health and hygiene (MHH) is about access to menstrual hygiene products to absorb or collect menstrual blood, privacy to change the materials, and access to facilities to dispose of used menstrual management materials. It can also include the "broader systemic factors that link menstruation with health, well-being, gender equality, education, equity, empowerment, and rights". Menstrual hygiene management can be particularly challenging for girls and women in developing countries, where clean water and toilet facilities are often inadequate. Menstrual waste is largely ignored in schools in developing countries, despite it being a significant problem. Menstruation can be a barrier to education for many girls, as a lack of effective sanitary products restricts girls' involvement in educational and social activities.