Related Research Articles

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics.

A monopoly, as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb monopolise or monopolize refers to the process by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business entity that has significant market power, that is, the power to charge overly high prices, which is associated with a decrease in social surplus. Although monopolies may be big businesses, size is not a characteristic of a monopoly. A small business may still have the power to raise prices in a small industry.

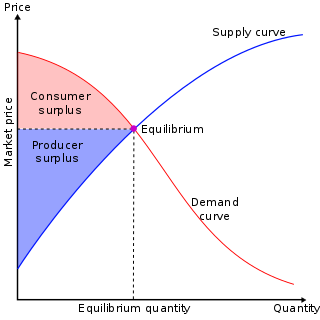

In microeconomics, supply and demand is an economic model of price determination in a market. It postulates that, holding all else equal, in a competitive market, the unit price for a particular good, or other traded item such as labor or liquid financial assets, will vary until it settles at a point where the quantity demanded will equal the quantity supplied, resulting in an economic equilibrium for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics.

In economics, deadweight loss is the difference in production and consumption of any given product or service including government tax. The presence of deadweight loss is most commonly identified when the quantity produced relative to the amount consumed differs in regards to the optimal concentration of surplus. This difference in the amount reflects the quantity that is not being utilized or consumed and thus resulting in a loss. This "deadweight loss" is therefore attributed to both, producers and consumers because neither one of them benefits from the surplus of the overall production.

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus, is either of two related quantities:

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit. In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a "rational agent" which wants to maximize its total profit, which is the difference between its total revenue and its total cost.

In economics, elasticity measures the percentage change of one economic variable in response to a percentage change in another. If the price elasticity of the demand of something is -2, a 10% increase in price causes the demand quantity to fall by 20%.

A price is the quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in the commercial exchange, the payment for this product will likely be called its "price". However, if the product is "service", there will be other possible names for this product's name. For example, the graph on the bottom will show some situations A good's price is influenced by production costs, supply of the desired item, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions.

In economics, economic equilibrium is a situation in which economic forces such as supply and demand are balanced and in the absence of external influences the values of economic variables will not change. For example, in the standard text perfect competition, equilibrium occurs at the point at which quantity demanded and quantity supplied are equal.

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is incremented, the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced.

In economics, aggregate supply (AS) or domestic final supply (DFS) is the total supply of goods and services that firms in a national economy plan on selling during a specific time period. It is the total amount of goods and services that firms are willing and able to sell at a given price level in an economy.

In economics, a demand curve is a graph depicting the relationship between the price of a certain commodity and the quantity of that commodity that is demanded at that price. Demand curves can be used either for the price-quantity relationship for an individual consumer, or for all consumers in a particular market.

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The tax burden measures the true economic weight of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, taking into account how the tax leads prices to change. If a 10% tax is imposed on sellers of butter, for example, but the market price rises 8% as a result, most of the burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. The key concept of tax incidence is that the tax incidence or tax burden does not depend on where the revenue is collected, but on the price elasticity of demand and price elasticity of supply. As a general policy matter, the tax incidence should not violate the principles of a desirable tax system, especially fairness and transparency. The concept of tax incidence is used in political science and sociology to analyze the level of resources extracted from each income social stratum in order to describe how the tax burden is distributed among social classes. That allows one to derive some inferences about the progressive nature of the tax system, according to principles of vertical equity.

The law of supply is a fundamental principle of economic theory which states that, keeping other factors constant, an increase in price results in an increase in quantity supplied. In other words, there is a direct relationship between price and quantity: quantities respond in the same direction as price changes. This means that producers are willing to offer more of a product for sale on the market at higher prices by increasing production as a way of increasing profits.

In economics, demand is the quantity of a good that consumers are willing and able to purchase at various prices during a given time. The relationship between price and quantity demand is also called the demand curve. Demand for a specific item is a function of an item's perceived necessity, price, perceived quality, convenience, available alternatives, purchasers' disposable income and tastes, and many other options.

In economics, supply is the amount of a resource that firms, producers, labourers, providers of financial assets, or other economic agents are willing and able to provide to the marketplace or to an individual. Supply can be in produced goods, labour time, raw materials, or any other scarce or valuable object. Supply is often plotted graphically as a supply curve, with the price per unit on the vertical axis and quantity supplied as a function of price on the horizontal axis. This reversal of the usual position of the dependent variable and the independent variable is an unfortunate but standard convention.

Within economics, margin is a concept used to describe the current level of consumption or production of a good or service. Margin also encompasses various concepts within economics, denoted as marginal concepts, which are used to explain the specific change in the quantity of goods and services produced and consumed. These concepts are central to the economic theory of marginalism. This is a theory that states that economic decisions are made in reference to incremental units at the margin, and it further suggests that the decision on whether an individual or entity will obtain additional units of a good or service depending on the marginal utility of the product.

The AD–AS or aggregate demand–aggregate supply model is a macroeconomic model that explains price level and output through the relationship of aggregate demand (AD) and aggregate supply (AS).

In economics, a factor market is a market where factors of production are bought and sold. Factor markets allocate factors of production, including land, labour and capital, and distribute income to the owners of productive resources, such as wages, rents, etc.

In economics, factor payments are the income people receive for supplying the factors of production: land, labor, capital or entrepreneurship.

References

- ↑ Mathur P.N. (1991) The Role of Scarcity Value and Market Price. In: Why Developing Countries Fail to Develop. Palgrave Macmillan, London. ISBN 9781349213450

- ↑ Fromkin, H. L., Olson, J. C, Dipboye, R. L., & Barnaby, D. (1971). A commodity theory analysis of consumer preferences for scarce products. Proceedings of the 79th Annual Convention of the American Psychological Association, 6, 653-654

- ↑ Twain, Mark (1876). The Adventures of Tom Sawyer.