Related Research Articles

Renaissance Technologies LLC, also known as RenTech or RenTec, is an American hedge fund based in East Setauket, New York, on Long Island, which specializes in systematic trading using quantitative models derived from mathematical and statistical analysis. Their signature Medallion fund is famed for the best record in investing history. Renaissance was founded in 1982 by James Simons, a mathematician who formerly worked as a code breaker during the Cold War.

Julian Hart Robertson Jr. was an American hedge fund manager, and philanthropist.

Soros Fund Management, LLC is a privately held American investment management firm. It is currently structured as a family office, but formerly as a hedge fund. The firm was founded in 1970 by George Soros and, in 2010, was reported to be one of the most profitable firms in the hedge fund industry, averaging a 20% annual rate of return over four decades. It is headquartered at 250 West 55th Street in New York. As of 2023, Soros Fund Management, LLC had $25 billion in AUM.

Bridgewater Associates, LP is an American investment management firm founded by Ray Dalio in 1975. The firm serves institutional clients including pension funds, endowments, foundations, foreign governments, and central banks. As of 2022, Bridgewater has posted the second highest gains of any hedge fund since its inception in 1975. The firm began as an institutional investment advisory service, graduated to institutional investing, and pioneered the risk parity investment approach in 1996.

David Frederick Swensen was an American investor, endowment fund manager, and philanthropist. He was the chief investment officer at Yale University from 1985 until his death in May 2021.

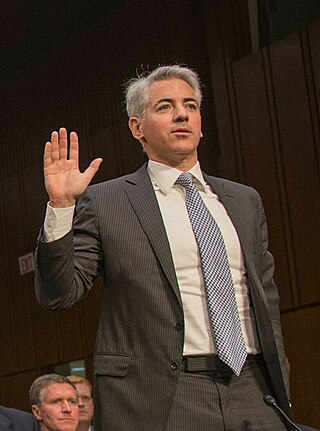

William Albert Ackman is an American billionaire hedge fund manager who is the founder and chief executive officer of Pershing Square Capital Management, a hedge fund management company. His investment approach has made him an activist investor. As of June 2024, Ackman's net worth was estimated at $9.3 billion by Forbes.

John Alfred Paulson is an American billionaire hedge fund manager. He leads Paulson & Co., a New York–based investment management firm he founded in 1994. He has been called "one of the most prominent names in high finance", and "a man who made one of the biggest fortunes in Wall Street history."

Farallon Capital Management, L.L.C. is an American multi-strategy hedge fund headquartered in San Francisco, California. Founded by Tom Steyer in 1986, the firm employs approximately 230 professionals in eight countries around the world.

Marc Lasry is a Moroccan American billionaire businessman and private equity manager. He is the co-founder and chief executive officer (CEO) of Avenue Capital Group. He was a co-owner of the NBA's Milwaukee Bucks basketball team from 2014 to 2023.

SkyBridge Capital is a global investment firm based in New York City, United States. It is run by founder Anthony Scaramucci, Brett S. Messing, and Raymond Nolte.

Robert Leroy Mercer is an American hedge fund manager, computer scientist, and political donor. Mercer was an early artificial intelligence researcher and developer and is the former co-CEO of the hedge fund company Renaissance Technologies.

Millennium Management is an investment management firm with a multistrategy hedge fund offering. It is one of the world's largest alternative asset management firms with over $67.9 billion assets under management as of August 2024. The firm operates in America, Europe and Asia. As of 2022, Millennium had posted the fourth highest net gains of any hedge fund since its inception in 1989.

Quantedge Capital is an alternative investment asset manager based in Singapore and New York City. It manages over US$3 billion under its flagship Quantedge Global Master Fund primarily on behalf of high-net-worth individuals, family offices and institutions.

Jonathan Tivadar Soros is co-founder and partner of One Madison Group, a private investment firm. Before joining One Madison Group, Soros had been chief executive officer of JS Capital Management LLC, a private investment firm and, prior to that, co-deputy chairman of Soros Fund Management.

Jeffrey Marc Talpins is the founder and Chief Investment Officer of New York-based hedge fund, Element Capital Management. He is a “macro” trader who uses options to try to capture the upside of — and limit potential losses from — strategies aimed at anticipating global economic shifts.The Wall Street Journal referred to Talpins as “the hedge fund king you’ve never heard of” and “the hottest investor on Wall Street."

Dawn Fitzpatrick is an American investment banker and financial officer based in New York City. She is known for her work as a hedge fund manager and as the chief executive officer (CEO) and chief investment officer (CIO) at Soros Fund Management.

Richard Georgi is an American Real Estate Financier and Investor.

Tiger Global Management, LLC is an American investment firm founded by Chase Coleman III, a former Tiger Management employee under Julian Robertson, in March 2001. It mainly focuses on internet, software, consumer, and financial technology companies.

Deven Parekh is an American venture capitalist, philanthropist, Democratic fundraiser and public servant. He is managing director at Insight Partners, a New York City venture capital and private equity firm. Parekh is a noted donor and fundraiser for Democratic politicians. He has served in multiple government advisory roles, and is currently a member of the board of directors for the Council on Foreign Relations and the US International Development Finance Corporation.

Robert Daniel Soros is an American investor and the founder of Soros Capital Management. The eldest son of billionaire investor George Soros, he was the deputy chairman and president of his father's firm, Soros Fund Management, until June 2017. He then formed Soros Capital Management, a family office based in New York.

References

- 1 2 3 4 “Soros Puts New Man at Helm,” Wall Street Journal, September 20, 2011

- ↑ “Scott Bessent Quits Soros Group to Launch Hedge Fund,” Financial Times, August 4, 2015

- ↑ “Former George Soros Executive Raises $4.5bn For New Fund,” Financial Times, January 5, 2016

- 1 2 3 "Meet The Hedge Fund Superstar George Soros Just Hired To Take Over His $25 Billion Fund," Business Insider, September 19, 2011

- ↑ "Ex-Soros Trader Bessent Returns to $25 Billion Firm as CIO," Bloomberg, September 19, 2011

- 1 2 3 “New Members Appointed to University Council,” YaleNews, November 8, 2016

- ↑ “Life and Money Management,” Yale Alumni Magazine, Sept/Oct 2015

- 1 2 "Soros appoints new CIO to family office," Financial Times, September 19, 2011

- 1 2 “Soros’s Investment Chief to Depart,” Wall Street Journal, August 4, 2015

- 1 2 “Soros’ CIO to Start Own Hedge Fund with $2 Bln,” Reuters, August 4, 2015

- ↑ “Soros’ European Investment Head Bessent Leaves,” Bloomberg, June 8, 2000

- ↑ "Soros Aide Wins Kudos for Japan Bets," Wall Street Journal, February 14, 2013

- ↑ “George Soros’ Protégé Just Nailed One of the Biggest Hedge Fund Launches Ever,” Business Insider, January 5, 2016

- ↑ “Ex-Soros’s Bessent Raises $4.5 Billion For New Hedge Fund Firm,” Bloomberg, January 5, 2016

- 1 2 3 4 “George Soros Gets Most of His $2 Billion Back from Bessent," Bloomberg, May 14, 2018

- 1 2 "Volatility Offers Rich Pickings," The Australian, November 16, 2018

- ↑ Dao, James (Aug 6, 2000). "THE 2000 Campaign: The Vice President; Gore's Theme-a-Day Tour Will Start With a No. 2 Pick". The New York Times.

- ↑ Kight, Stef (April 19, 2017). "The big $$$ donors to Trump's Inaugural Committee". Axios.

- ↑ Kim, Soo Rin; Ibssa, Lalee (February 21, 2024). "Trump brings in more than $6.8 million from Greenville, South Carolina, fundraiser ahead of primary". ABC News.

- ↑ "Trump Campaign Says $50.5 Million Haul Doubled Biden's Fundraiser". Newsweek. April 6, 2024.

- ↑ “New Members Appointed to University Council,” YaleNews, November 8, 2016

- 1 2 “Annual Report of Giving to Yale, 2000-2001," www.giving.yale.edu

- 1 2 3 "Three New Trustees Are Elected to the Board," Rockefeller University Press Release, March 3, 2016

- ↑ “Out 100 -- Money + Business: Scott Bessent,” Out Magazine, January 2001

- ↑ “Palatial Purchase Palmer Home B&B on East Battery, Known as the Pink Palace, Sells for $6.5M,” Post and Courier, June 21, 2016

- ↑ McDermott, John (July 31, 2022). "SC hedge fund investor looks to spread the word about math and financial literacy". Post and Courier.

- ↑ Date, S.V. (March 21, 2024). "RNC already helping raise money for Trump's legal bills, despite campaign's claims". Huffington Post.