Related Research Articles

Citigroup Inc. or Citi is an American multinational investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in 1998; Travelers was subsequently spun off from the company in 2002. Citigroup owns Citicorp, the holding company for Citibank, as well as several international subsidiaries. Citigroup is incorporated in Delaware.

The ING Group is a Dutch multinational banking and financial services corporation headquartered in Amsterdam. Its primary businesses are retail banking, direct banking, commercial banking, investment banking, wholesale banking, private banking, asset management, and insurance services. With total assets of US$1.1 trillion, it is one of the biggest banks in the world, and consistently ranks among the top 30 largest banks globally. It is among the top ten in the list of largest European companies by revenue.

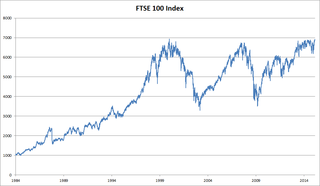

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group.

Swiss Bank Corporation was a Swiss investment bank and financial services company located in Switzerland. Prior to its merger, the bank was the third largest in Switzerland with over CHF300 billion of assets and CHF11.7 billion of equity.

ICICI Bank Limited is an Indian multinational bank and financial services company headquartered in Vadodara. It offers a wide range of banking products and financial services for corporate and retail customers through a variety of delivery channels and specialized subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management.

Lehman Brothers Holdings Inc. was a global financial services firm founded in 1847. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States, with about 25,000 employees worldwide. It was doing business in investment banking, equity and fixed-income sales and trading, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

Close Brothers Group plc is a UK merchant banking group, providing lending, deposit taking, wealth management and securities trading. The company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

A special purpose acquisition company, also known as a "blank check company", is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thus making it public without going through the traditional initial public offering process. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a merger or acquisition opportunity within a set timeframe. The opportunities usually have yet to be identified.

A financial centre (BE), financial center (AE), or financial hub, is a location with a concentration of participants in banking, asset management, insurance or financial markets with venues and supporting services for these activities to take place. Participants can include financial intermediaries, institutional investors, and issuers. Trading activity can take place on venues such as exchanges and involve clearing houses, although many transactions take place over-the-counter (OTC), that is directly between participants. Financial centres usually host companies that offer a wide range of financial services, for example relating to mergers and acquisitions, public offerings, or corporate actions; or which participate in other areas of finance, such as private equity and reinsurance. Ancillary financial services include rating agencies, as well as provision of related professional services, particularly legal advice and accounting services.

Intesa Sanpaolo S.p.A. is an Italian international banking group. It is Italy's largest bank by total assets and the world's 27th largest. It was formed through the merger of Banca Intesa and Sanpaolo IMI in 2007, but has a corporate identity stretching back to its first foundation as Istituto Bancario San Paolo di Torino in 1583.

Hottinger Group is an international wealth management business headquartered in London providing family office, Investment banking and other associated financial services. Hottinger is known as one of the first private banks created on 1 August 1786 by the Hottinguer family.

Arjowiggins is an independent paper manufacturer based in Scotland.

Kroll, LLC, formerly Duff & Phelps LLC, is an American multinational financial consultancy firm based in New York City. It was founded as Duff & Phelps in 1932 by William Duff and George Phelps. Since then, the firm has added more than 30 complementary companies to its portfolio, including the acquisition of Kroll Inc. in 2018. Duff & Phelps decided to start rebranding itself using the Kroll name in 2021, and it completed the renaming process in February 2022.

Conqueror is a manufacturer of distinctive, high-quality watermarked paper in the United Kingdom. The company was founded in the late 1880s by E.P. Barlow, director of the London-based stationer Wiggins Teape.

The Lombard Odier Group is an independent Swiss banking group based in Geneva. Its operations are organised into three divisions: private banking, asset management, and IT and back and middle office services for other financial institutions. As of 31 December 2021, the bank had total client assets of CHF 358 billion, which makes it one of the biggest players in the Swiss private banking sector.

Barclays is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services.

Rothschild & Co is a multinational investment bank and financial services company, and the flagship of the Rothschild banking group controlled by the French and British branches of the Rothschild family.

ODDO BHF is an independent Franco-German financial services group. It was created from the alliance of a French family-owned business built up by five generations of stockbrokers and a German bank specialising in Mittelstand companies. With 2,300 employees, and more than 100 billion euros in assets under management, ODDO BHF operates in three main businesses, based on significant investment in market expertise: private banking, asset management and corporate and investment banking.

The Banque Worms was a merchant bank founded by Hypolite Worms in 1928 as a division of Worms & Cie. The banking services division provided financing services to other branches of Worms & Cie, which were involved in ship building, shipping and the coal trade. During World War II (1939–45), Worms & Cie was placed under German supervision, and was subject to intense scrutiny after the war on suspicions of collaboration. The banking services division was spun off as the independent Banque Worms et Cie in 1964. The bank was nationalized in 1982 by the socialist government of François Mitterrand. The bank engaged in risky real estate investments, and lost most of its value. After being re-privatized, it was owned in turn by two insurance groups, then was acquired by Deutsche Bank. The bank was wound down in 2004.

Hypolite Worms, or Hippolyte Worms was a French businessman who inherited an interest in Worms et Cie, a major operator in the coal trade and in merchant shipping. He expanded the firm into ship building and merchant banking, and founded the Banque Worms.

References

- ↑ Bonin, Hubert; Valério, Nuno (2015). Colonial and Imperial Banking History. Routledge. ISBN 978-1848935822.

- ↑ "Takeover talk lifts Arjo Wiggins shares". The Herald. 17 May 2000. Retrieved 15 May 2020.

- ↑ "Worms & Cie turns a page in its history". Les Echos. 18 June 2004. Retrieved 15 May 2020.

- ↑ "Sequana reveals 2007 acquisition intentions". Print Week. 18 April 2007. Retrieved 15 May 2020.

- ↑ "Sequana is in liquidation". Paper Industry World. 27 June 2019. Retrieved 15 May 2020.