Related Research Articles

Morgan Stanley is an American multinational investment bank and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in 41 countries and more than 75,000 employees, the firm's clients include corporations, governments, institutions, and individuals. Morgan Stanley ranked No. 61 in the 2023 Fortune 500 list of the largest United States corporations by total revenue and in the same year ranked #30 in Forbes Global 2000.

The Vanguard Group, Inc. is an American registered investment advisor founded on May 1, 1975 and based in Malvern, Pennsylvania, with about $9.3 trillion in global assets under management as of May 2024. It is the largest provider of mutual funds and the second-largest provider of exchange-traded funds (ETFs) in the world after BlackRock's iShares. In addition to mutual funds and ETFs, Vanguard offers brokerage services, educational account services, financial planning, asset management, and trust services. Several mutual funds managed by Vanguard are ranked at the top of the list of US mutual funds by assets under management. Along with BlackRock and State Street, Vanguard is considered to be one of the Big Three index fund managers that play a dominant role in corporate America.

The Depository Trust & Clearing Corporation (DTCC) is an American financial market infrastructure company that provides clearing, settlement and trade reporting services to financial market participants. It performs the exchange of securities on behalf of buyers and sellers and functions as a central securities depository by providing central custody of securities.

Sallie L. Krawcheck is the former head of Bank of America's Global Wealth and Investment Management division and is currently the CEO and co-founder of Ellevest, a digital financial advisor for women launched in 2016. She has been called "the most powerful woman on Wall Street."

Drexel Burnham Lambert Inc. was an American multinational investment bank that was forced into bankruptcy in 1990 due to its involvement in illegal activities in the junk bond market, driven by senior executive Michael Milken. At its height, it was a Bulge Bracket bank, as the fifth-largest investment bank in the United States.

Raymond James Financial, Inc. is an American multinational independent investment bank and financial services company providing financial services to individuals, corporations, and municipalities through its subsidiary companies that engage primarily in investment and financial planning, in addition to investment banking and asset management. Headquartered in St. Petersburg, Florida, Raymond James is one of the largest banking institutions in the United States.

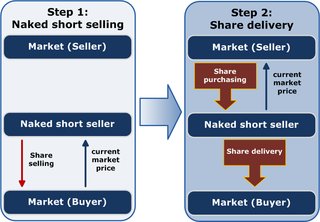

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf.

Richard B. "Rich" Handler is an American businessman and chief executive officer (CEO) of Jefferies since 2001, making him the longest-serving CEO on Wall Street.

Leon David Black is an American private equity investor. He is the former CEO of Apollo Global Management, which he co-founded in 1990 with Marc Rowan and Josh Harris. Black was the chairman of the Museum of Modern Art from 2018 to 2021.

John Washington Rogers Jr. is an American investor and founder of Ariel Capital Management, founded in 1983. He is chairman and co-CEO of the company, which is the United States' largest minority-run mutual fund firm. He has been a regular contributor to Forbes magazine for most of the last decade. Active in the 2008 Barack Obama presidential campaign, Rogers was a leader of the 2009 inauguration committee.

Mary Lovelace Schapiro served as the 29th Chair of the U.S. Securities and Exchange Commission (SEC). She was appointed by President Barack Obama, unanimously confirmed by the U.S. Senate, and assumed the Chairship on January 27, 2009. She is the first woman to be the permanent Chair of the SEC. In 2009, Forbes ranked her the 56th most powerful woman in the world.

The Committee on Capital Markets Regulation is an independent and nonpartisan 501(c)(3) research organization financed by contributions from individuals, foundations, and corporations.

Marc J. Lane is an American attorney and businessman. He is also a founding partner of the Chicago chapter of the Social Enterprise Alliance, a network of philanthropy-minded investors. Lane was involved in creation of the legislation to allow low-profit limited liability companies in Illinois.

Motilal Oswal Financial Services Limited is an Indian financial services company offering a range of financial products and services. The company was founded by Motilal Oswal and Raamdeo Agrawal in 1987.

Merrill, previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment banking arm, both firms engage in prime brokerage and broker-dealer activities. The firm is headquartered in New York City, and once occupied the entire 34 stories of 250 Vesey Street, part of the Brookfield Place complex in Manhattan. Merrill employs over 14,000 financial advisors and manages $2.8 trillion in client assets. The company also operates Merrill Edge, a division for investment and related services, including call center counsultancy.

Merrill Edge is an electronic trading platform and investment advisory service that provides self-directed and guided investment options for individuals and businesses. It is a subsidiary of Bank of America and was launched in 2010 after the merger between Merrill Lynch and Bank of America. Merrill Edge offers a wide range of investment products, including stocks, bonds, exchange-traded funds (ETFs), margin lending, mutual funds, and options.

Joseph S. Deitch is an American business executive and philanthropist, and the author of Elevate: An Essential Guide to Life. In 2018, he founded the Elevate Prize Foundation. The organization awards $5 million annually amongst its recipients as well as providing resources in marketing, media, and planning to scale their enterprises. He is the founder and Chairman of Commonwealth Financial Network, the largest privately owned independent RIA-broker/dealer in the United States with over $270 billion in assets under management. In addition, Deitch is the chairman of Southworth Development, a golf and leisure real estate company. He has also served as a Broadway Producer and won a Tony Award as co-producer of The Gershwin’s Porgy and Bess in 2012. Deitch also founded the Deitch Leadership Institute at the Boston Latin School, the oldest public school in the United States (1635).

Quintin E. Primo III is the Co-Founder, Chairman and CEO of Capri Capital Partners, LLC, one of the largest minority-owned real estate investment management firms in the United States. Primo, whose firm has $6.04 billion in assets under management in domestic and international commercial real estate, is ranked on the Forbes' Top Twenty Richest African American's in the World list. Primo, a regular contributor on CNBC, has been recognized in the real estate industry for his achievements.

Babak"Bobby"Samini is an Iranian-American trial attorney and the managing partner of the Samini Firm. Samini has been described as a "celebrity attorney". He has represented many high-profile clients, including serving as lead counsel to former Los Angeles Clippers owner Donald Sterling in the highly publicized litigation with the National Basketball Association, TMZ, and V. Stiviano. Samini has also represented Grammy Award winning rapper T-Pain and DJ Paul of the Oscar winning hip hop group, Three 6 Mafia.

References

- ↑ "Hotlist 05: they're bold, innovative, powerful--and all under 40". Black Enterprise . 2005-12-01. Archived from the original on 2009-07-10. Retrieved 2009-10-24.

- ↑ "Shawn Baldwin, Chairman of AIA Group, among top business leaders attending Bloomberg Technology Conference: Code and the Corner". Bloomberg Business . Bloomberg L.P. 2015-06-18. Archived from the original on 2015-09-24.

- ↑ "Shawn Baldwin, Chairman of AIA Group, joins world leaders at Milken Institute Global Conference". Chicago Tribune . Tribune Publishing. 2015-05-11. Archived from the original on 2015-07-08.

- ↑ Hughes, Alan (2002-04-01). "On the fast track: Shawn Baldwin is building a financial services firm one acquisition at a time". BlackEnterprise . Archived from the original on 2024-05-24. Retrieved 2009-04-06.

- ↑ O'Connor, Colleen Marie (2006-11-27). "Investment Dealers Digest 40 Under 40". Investment Dealers' Digest.

- ↑ Strahler, Steven R. (2007-06-11). "A star broker fades as creditors, NASD move in". Financial Week . Archived from the original on March 26, 2009.

- 1 2 "Speaker: Shawn Baldwin". Milken Institute . 2009-08-27. Archived from the original on 2009-04-06. Retrieved 2009-10-24.

- ↑ Brown, Carolyn M. (October 2006). "75 most powerful blacks on wall street". Black Enterprise . Archived from the original on 2010-05-21. Retrieved 2009-10-23.

- ↑ "Shawn Baldwin". Fast Company . Archived from the original on 2009-11-06. Retrieved 2009-04-06.

- ↑ Owens, Anna. "All The Right Moves: Investment Banker Shawn Baldwin Heads East- the Middle East". Bears and Bulls. Archived from the original on 2009-06-15. Retrieved 2009-10-24.

- ↑ Staney, Nasil (2010-07-01). "Reality Check: Most Stock Markets Still Below '07 Highs". The Wall Street Journal . Yahoo! Finance. Archived from the original on 2012-10-24. Retrieved 2011-05-30.