Single deposit is one-time lump sum investment. The Investment is made at the start of the period; grows over the period and matures at the end of the period. Examples of a single deposit are certificates of deposit or Fixed Deposits.

Single deposit is one-time lump sum investment. The Investment is made at the start of the period; grows over the period and matures at the end of the period. Examples of a single deposit are certificates of deposit or Fixed Deposits.

Ericka has US$5,000.00 for her daughter's wedding. She may need the money after 4 years. She is planning to invest the money for the period. Her bank offers her an interest rate of 3.50% per annum compounded annually on a new CD (certificate of deposit) that she opens.

Input

| Amount | Period | Interest Rate | Compounding |

|---|---|---|---|

| US$5,000.00 | 4 Year | 3.50% | Annually |

Returns

| Interest Accrued | Maturity Amount | Gain |

|---|---|---|

| US$737.62 | US$5,737.62 | 14.75% |

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has interest-earning potential, a characteristic referred to as the time value of money, except during times of negative interest rates, when the present value will be equal or more than the future value. Time value can be described with the simplified phrase, "A dollar today is worth more than a dollar tomorrow". Here, 'worth more' means that its value is greater than tomorrow. A dollar today is worth more than a dollar tomorrow because the dollar can be invested and earn a day's worth of interest, making the total accumulate to a value more than a dollar by tomorrow. Interest can be compared to rent. Just as rent is paid to a landlord by a tenant without the ownership of the asset being transferred, interest is paid to a lender by a borrower who gains access to the money for a time before paying it back. By letting the borrower have access to the money, the lender has sacrificed the exchange value of this money, and is compensated for it in the form of interest. The initial amount of borrowed funds is less than the total amount of money paid to the lender.

Saving is income not spent, or deferred consumption. Methods of saving include putting money aside in, for example, a deposit account, a pension account, an investment fund, or as cash. Saving also involves reducing expenditures, such as recurring costs. In terms of personal finance, saving generally specifies low-risk preservation of money, as in a deposit account, versus investment, wherein risk is a lot higher; in economics more broadly, it refers to any income not used for immediate consumption. Saving does not automatically include interest.

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed.

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less.

In economics, hot money is the flow of funds from one country to another in order to earn a short-term profit on interest rate differences and/or anticipated exchange rate shifts. These speculative capital flows are called "hot money" because they can move very quickly in and out of markets, potentially leading to market instability.

Eurodollars are U.S. dollars held in time deposit accounts in banks outside the United States, which are not subject to the legal jurisdiction of the U.S. Federal Reserve. Consequently, such deposits are subject to much less regulation than deposits within the U.S. The term was originally applied to U.S. dollar accounts held in banks situated in Europe, but it expanded over the years to cover US dollar accounts held anywhere outside the U.S. Thus, a U.S. dollar-denominated deposit in Tokyo or Beijing would likewise be deemed a Eurodollar deposit. The offshore locations of the Eurodollar make it exposed to potential country risk and economic risk.

A certificate of deposit (CD) is a time deposit sold by banks, thrift institutions, and credit unions in the United States. CDs typically differ from savings accounts in that the CD has a specific, fixed term before money can be withdrawn without penalty and generally higher interest rates. The bank expects the CDs to be held until maturity, at which time they can be withdrawn and interest paid.

A guaranteed investment certificate is a Canadian investment that offers a guaranteed rate of return over a fixed period of time, most commonly issued by trust companies or banks. Due to its low risk profile, the return is generally less than other investments such as stocks, bonds, or mutual funds. It is similar to a time or term deposit as it is known in other countries.

A time deposit or term deposit is a deposit in a financial institution with a specific maturity date or a period to maturity, commonly referred to as its "term". Time deposits differ from at call deposits, such as savings or checking accounts, which can be withdrawn at any time, without any notice or penalty. Deposits that require notice of withdrawal to be given are effectively time deposits, though they do not have a fixed maturity date.

Regulation Q is a Federal Reserve regulation which sets out capital requirements for banks in the United States. The version of Regulation Q current as of 2023 was enacted in 2013.

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows which the investor receives from that investment over a specified time period, such as interest payments, coupons, cash dividends and stock dividends. It may be measured either in absolute terms or as a percentage of the amount invested. The latter is also called the holding period return.

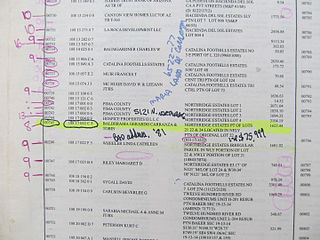

A tax sale is the forced sale of property by a governmental entity for unpaid taxes by the property's owner.

An investment certificate is an investment product offered by an investment company or brokerage firm in the United States designed to offer a competitive yield to an investor with the added safety of their principal.

A life annuity is an annuity, or series of payments at fixed intervals, paid while the purchaser is alive. The majority of life annuities are insurance products sold or issued by life insurance companies however substantial case law indicates that annuity products are not necessarily insurance products.

The Public Provident Fund (PPF) is a savings-cum-tax-saving instrument in India, introduced by the National Savings Institute of the Ministry of Finance in 1968. The main objective of the scheme is to mobilize small savings by offering an investment with reasonable returns combined with income tax benefits. The scheme is offered by the Central Government. Balance in the PPF account is not subject to attachment under any order or decree of court under the Government Savings Banks Act, 1873. However Income Tax & other Government authorities can attach the account for recovering tax dues.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

The interbank lending market is a market in which banks lend funds to one another for a specified term. Most interbank loans are for maturities of one week or less, the majority being overnight. Such loans are made at the interbank rate. A sharp decline in transaction volume in this market was a major contributing factor to the collapse of several financial institutions during the financial crisis of 2007–2008.

The Indiana Treasurer of State is a constitutional and elected office in the executive branch of the government of Indiana. The treasurer is responsible for managing the finances of the U.S. state of Indiana. The position was filled by appointment from 1816 until the adoption of the new Constitution of Indiana in 1851, which made the position filled by election. As of 2023, there have been fifty-five treasurers. The incumbent is Republican Dan Elliott who has served in the position since January 9, 2023.

A fixed deposit (FD) is a tenured deposit account provided by banks or non-bank financial institutions which provides investors a higher rate of interest than a regular savings account, until the given maturity date. It may or may not require the creation of a separate account. The term fixed deposit is most commonly used in India and the United States. It is known as a term deposit or time deposit in Canada, Australia, New Zealand, and as a bond in the United Kingdom.