Related Research Articles

The economy of New Zealand is a highly developed free-market economy. It is the 50th-largest national economy in the world when measured by nominal gross domestic product (GDP) and the 63rd-largest in the world when measured by purchasing power parity (PPP). New Zealand has a large GDP for its population of 5 million, and sources of revenue are spread throughout the large island nation. The country has one of the most globalised economies and depends greatly on international trade, mainly with Australia, Canada, China, the European Union, Japan, Singapore, South Korea, and the United States. New Zealand's 1983 Closer Economic Relations agreement with Australia means that the economy aligns closely with that of Australia.

The economy of Nicaragua is focused primarily on the agricultural sector. Nicaragua itself is the least developed country in Central America, and the second poorest in the Americas by nominal GDP. In recent years, under the administrations of Daniel Ortega, the Nicaraguan economy has expanded somewhat, following the Great Recession, when the country's economy actually contracted by 1.5%, due to decreased export demand in the American and Central American markets, lower commodity prices for key agricultural exports, and low remittance growth. The economy saw 4.5% growth in 2010 thanks to a recovery in export demand and growth in its tourism industry. Nicaragua's economy continues to post growth, with preliminary indicators showing the Nicaraguan economy growing an additional 5% in 2011. Consumer Price inflation have also curtailed since 2008, when Nicaragua's inflation rate hovered at 19.82%. In 2009 and 2010, the country posted lower inflation rates, 3.68% and 5.45%, respectively. Remittances are a major source of income, equivalent to 15% of the country's GDP, which originate primarily from Costa Rica, the United States, and European Union member states. Approximately one million Nicaraguans contribute to the remittance sector of the economy.

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster.

The United States is a highly developed mixed-market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest per capita GDP (nominal) and the eighth-highest per capita GDP (PPP) as of 2022. US share of Global economy is 15.78% in PPP terms in 2022. The United States has the most technologically powerful and innovative economy in the world. Its firms are at or near the forefront in technological advances, especially in artificial intelligence, computers, pharmaceuticals, and medical, aerospace, and military equipment. The U.S. dollar is the currency most used in international transactions and is the world's foremost reserve currency, backed by its economy, stable government, and military, its role as the reference standard for the petrodollar system, and its linked eurodollar and large U.S. treasuries market. Several countries use it as their official currency and in others it is the de facto currency. The largest U.S. trading partners are China, the European Union, Canada, Mexico, India, Japan, South Korea, the United Kingdom, and Taiwan. The U.S. is the world's largest importer and second-largest exporter. It has free trade agreements with several countries, including the USMCA, Australia, South Korea, Switzerland, Israel and several others that are in effect or under negotiation.

In economics, inflation refers to a general increase in the prices of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States.

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks, which represent ownership claims on businesses; these may include securities listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment is usually made with an investment strategy in mind.

Purchasing power parity (PPP) is the measurement of prices in different countries that uses the prices of specific goods to compare the absolute purchasing power of the countries' currencies, and, to some extent, their people's living standards. In many cases, PPP produces an inflation rate equal to the price of the basket of goods at one location divided by the price of the basket of goods at a different location. The PPP inflation and exchange rate may differ from the market exchange rate because of tariffs, and other transaction costs.

Trade barriers are government-induced restrictions on international trade. According to the theory of comparative advantage, trade barriers are detrimental to the world economy and decrease overall economic efficiency.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

Incomes policies in economics are economy-wide wage and price controls, most commonly instituted as a response to inflation, and usually seeking to establish wages and prices below free market level.

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic community". The NBER is well known for providing start and end dates for recessions in the United States.

Nouriel Roubini is a Turkish-born Iranian-American economist. He is Professor Emeritus (2021–present) and was Professor of Economics (1995–2021) at the Stern School of Business, New York University, and also chairman of Roubini Macro Associates LLC, an economic consultancy firm.

The Japanese asset price bubble was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble burst and Japan's economy stagnated. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity, as well as an uncontrolled money supply and credit expansion. More specifically, over-confidence and speculation regarding asset and stock prices were closely associated with excessive monetary easing policy at the time. Through the creation of economic policies that cultivated the marketability of assets, eased the access to credit, and encouraged speculation, the Japanese government started a prolonged and exacerbated Japanese asset price bubble.

The following outline is provided as an overview of and topical guide to economics:

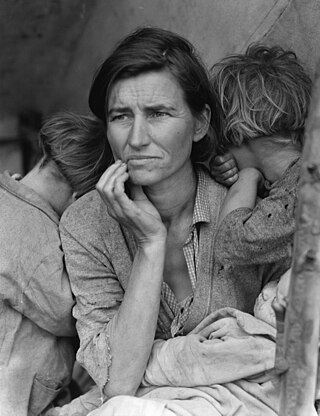

The Great Depression was period of worldwide economic depression between 1929 and 1939. The Depression became evident after a major fall in stock prices in the United States. The economic contagion began around September 1929 and led to the Wall Street stock market crash of October 24. The economic shock impacted most countries across the world to varying degrees. It was the longest, deepest, and most widespread depression of the 20th century.

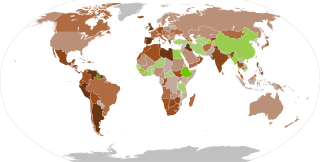

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred between 2007 and 2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations.

While beginning in the United States, the Great Recession spread to Asia rapidly and has affected much of the region.

The financial crisis of 2007–2008, or Global Financial Crisis (GFC), was a severe worldwide economic crisis that occurred in the early 21st century. It was the most serious financial crisis since the Great Depression (1929). Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminated in a "perfect storm." Mortgage-backed securities (MBS) tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

DuterteNomics is a catch-all term referring to the socioeconomic policies of Rodrigo Duterte, the 16th president of the Philippines. A significant part of these policies include the development of infrastructure and industries in the Philippines.

The COVID-19 recession, also referred to as the Great Lockdown, is a global economic recession caused by the COVID-19 pandemic. The recession began in most countries in February 2020.

References

- "International Economics Glossary: S". U-M Personal World Wide Web Server. 1999-12-03. Retrieved 2021-05-02.