Related Research Articles

Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card.

Sukuk is the Arabic name for financial certificates, also commonly referred to as "sharia compliant" bonds. Sukuk are defined by the AAOIFI as "securities of equal denomination representing individual ownership interests in a portfolio of eligible existing or future assets." The Fiqh academy of the OIC legitimized the use of sukuk in February 1988.

A smart contract is a computer program or a transaction protocol that is intended to automatically execute, control or document events and actions according to the terms of a contract or an agreement. The objectives of smart contracts are the reduction of need for trusted intermediators, arbitration costs, and fraud losses, as well as the reduction of malicious and accidental exceptions. Smart contracts are commonly associated with cryptocurrencies, and the smart contracts introduced by Ethereum are generally considered a fundamental building block for decentralized finance (DeFi) and NFT applications.

Bitcoin is a protocol which implements a public, permanent, and decentralized ledger.

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. It is a decentralized system for verifying that the parties to a transaction have the money they claim to have, eliminating the need for traditional intermediaries, such as banks, when funds are being transferred between two entities.

The Bitcoin network is a peer-to-peer network of nodes which implement the Bitcoin protocol. The protocol itself implements a highly available, public, and decentralized ledger. The nodes verify that each update to the ledger follows the rules of the Bitcoin protocol.

Ethereum is a decentralized blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Among cryptocurrencies, ether is second only to bitcoin in market capitalization. It is open-source software.

NXT is an open source cryptocurrency and payment network launched in 2013 by anonymous software developer BCNext. It uses proof-of-stake to reach consensus for transactions—as such, there is a static money supply. Unlike Bitcoin, there is no mining. NXT was specifically conceived as a flexible platform around build applications and financial services, and serves as basis for ARDR (Ardor), a blockchain-as-a-service multichain platform developed by Jelurida, and IoTeX (cryptocurrency) the current steward of NXT as of 2021. NXT has been covered extensively in the "Call for Evidence" report by ESMA.

Counterparty is a peer-to-peer financial platform and distributed, open source Internet protocol built on top of the Bitcoin blockchain and network. It was one of the most well-known "Bitcoin 2.0" platforms in 2014, along with Mastercoin, Ethereum, Colored Coins, Ripple and BitShares.

A blockchain is a distributed ledger with growing lists of records (blocks) that are securely linked together via cryptographic hashes. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Since each block contains information about the previous block, they effectively form a chain, with each additional block linking to the ones before it. Consequently, blockchain transactions are irreversible in that, once they are recorded, the data in any given block cannot be altered retroactively without altering all subsequent blocks.

Digital Asset is a financial technology company founded in 2014 by Sunil Hirani, Don R. Wilson, Yuval Rooz, Shaul Kfir and Eric Saraniecki. It builds products based on distributed ledger technology (DLT) for banks and other financial institutions.

Hyperledger is an umbrella project of open source blockchains and related tools that the Linux Foundation started in December 2015. IBM, Intel, and SAP Ariba have contributed to support the collaborative development of blockchain-based distributed ledgers. It was renamed the Hyperledger Foundation in October 2021.

A decentralised application is an application that can operate autonomously, typically through the use of smart contracts, that run on a decentralized computing, blockchain or other distributed ledger system. Like traditional applications, DApps provide some function or utility to its users. However, unlike traditional applications, DApps operate without human intervention and are not owned by any one entity, rather DApps distribute tokens that represent ownership. These tokens are distributed according to a programmed algorithm to the users of the system, diluting ownership and control of the DApp. Without any one entity controlling the system, the application is therefore decentralised.

A distributed ledger is the consensus of replicated, shared, and synchronized digital data that is geographically spread (distributed) across many sites, countries, or institutions. In contrast to a centralized database, a distributed ledger does not require a central administrator, and consequently does not have a single (central) point-of-failure.

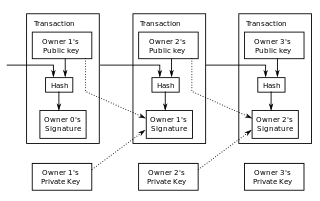

A cryptocurrency wallet is a device, physical medium, program or a service which stores the public and/or private keys for cryptocurrency transactions. In addition to this basic function of storing the keys, a cryptocurrency wallet more often offers the functionality of encrypting and/or signing information. Signing can for example result in executing a smart contract, a cryptocurrency transaction, identification or legally signing a 'document'.

Distributed ledger technology law is not yet defined and recognized but an emerging field of law due to the recent dissemination of distributed ledger technology application in business and governance environment. Smart contracts, which are also enforceable legal contracts and were created through interaction of lawyers and developers, are called smart legal contracts.

A blockchain is a shared database that records transactions between two parties in an immutable ledger. Blockchain documents and confirms pseudonymous ownership of all transactions in a verifiable and sustainable way. After a transaction is validated and cryptographically verified by other participants or nodes in the network, it is made into a "block" on the blockchain. A block contains information about the time the transaction occurred, previous transactions, and details about the transaction. Once recorded as a block, transactions are ordered chronologically and cannot be altered. This technology rose to popularity after the creation of Bitcoin, the first application of blockchain technology, which has since catalyzed other cryptocurrencies and applications.

Decentralized finance offers financial instruments without relying on intermediaries such as brokerages, exchanges, or banks by using smart contracts on a blockchain. DeFi platforms allow people to lend or borrow funds from others, speculate on price movements on assets using derivatives, trade cryptocurrencies, insure against risks, and earn interest in savings-like accounts. DeFi uses a layered architecture and highly composable building blocks. Some applications promote high interest rates but are subject to high risk. Coding errors and hacks have been common in DeFi.

The general notion of cryptocurrencies in Europe denotes the processes of legislative regulation, distribution, circulation, and storage of cryptocurrencies in Europe.

Colored Coins is an open-source protocol built on the Bitcoin 2.0 that allows users to represent and manipulate immutable digital resources on top of Bitcoin transactions. They are a class of methods for representing and maintaining real-world assets on the Bitcoin blockchain, which may be used to establish asset ownership. Colored coins are bitcoins with a mark on them that specifies what they may be used for. Colored coins are also considered the initial step toward NFTs built on top of the Bitcoin network.

References

- 1 2 "How Blockchain Could Disrupt Banking". CB Insights Research. 2021-02-11. Archived from the original on 2021-08-04. Retrieved 2021-08-20.

- ↑ Tapscott, Don (2016). Blockchain revolution : how the technology behind bitcoin is changing money, business, and the world. Alex Tapscott. Toronto, Ontario, Canada. ISBN 978-0-670-06997-2. OCLC 919014174. Archived from the original on 2021-08-23. Retrieved 2021-08-20.

- 1 2 3 Pana, Elisabeta; Gangal, Vikas (2021-04-23). "Blockchain Bond Issuance". Journal of Applied Business and Economics. 23 (1). doi: 10.33423/jabe.v23i1.4064 . ISSN 1499-691X. Archived from the original on 2021-08-20. Retrieved 2021-08-20.

- ↑ "Digitizing Bonds on the Blockchain". Goldman Sachs. Archived from the original on 2021-08-20. Retrieved 2021-08-20.

- ↑ "New FinTech applications in bond markets". International Capital Market Association . Archived from the original on 2021-04-27. Retrieved 2021-08-20.

- ↑ Irrera, Anna (2014-10-27). "UBS CIO: Blockchain Technology Can Massively Simplify Banking". Wall Street Journal . Archived from the original on 2016-04-28. Retrieved 2016-05-27.

- ↑ Ross, Rory (2015-09-12). "Smart Money: Blockchains Are the Future of the Internet". Newsweek . Archived from the original on 2016-07-10. Retrieved 2016-05-27.

- ↑ Wigan, David (2015-06-11). "Bitcoin technology will disrupt derivatives, says banker". IFR Asia. Archived from the original on 2016-06-29. Retrieved 2016-05-27.

- ↑ Seaman, David (2016-08-10). "Ethereum: Here Come The Big Banks". Huffington Post . Archived from the original on 2016-08-12. Retrieved 2016-08-11.

- ↑ "World Bank Mandates Commonwealth Bank of Australia for World's First Blockchain Bond". The World Bank. Archived from the original on 22 April 2019. Retrieved 22 April 2019.

- ↑ "Al Hilal Bank Executes World's First Blockchain Sukuk Transaction". 2018-11-26. Archived from the original on 2021-06-07. Retrieved 2021-06-07.

- ↑ "Abu Dhabi's Al Hilal Bank uses blockchain to sell sukuk in secondary market". Reuters. 2018-11-26. Archived from the original on 2021-06-09. Retrieved 2021-06-09.

- ↑ "Blockchain Basics: Introduction to Distributed Ledgers". IBM Developer. Archived from the original on 2021-08-20. Retrieved 2021-08-20.

- 1 2 "ICMA Distributed Ledger Technology (DLT) regulatory directory". www.icmagroup.org. Archived from the original on 2021-02-26. Retrieved 2021-08-20.

- ↑ "Société Générale blockchain issuance a sign of things to come". International Financial Law Review. 16 May 2019. Archived from the original on 2021-08-20. Retrieved 2021-08-20.

- ↑ Varrall, Rowan (20 December 2019). "DLT-related legislation and regulatory frameworks in capital markets" (PDF). ICMA. Archived (PDF) from the original on 20 August 2021. Retrieved 20 August 2021.