Related Research Articles

Electronic data interchange (EDI) is the concept of businesses electronically communicating information that was traditionally communicated on paper, such as purchase orders and invoices. Technical standards for EDI exist to facilitate parties transacting such instruments without having to make special arrangements.

An intermodal container is a large standardized shipping container, designed and built for intermodal freight transport, meaning these containers can be used across different modes of transport – from ship to rail to truck – without unloading and reloading their cargo. Intermodal containers are primarily used to store and transport materials and products efficiently and securely in the global containerized intermodal freight transport system, but smaller numbers are in regional use as well. These containers are known under a number of names, such as simply container, cargo or freight container, ISO container, shipping, sea or ocean container, sea van or (Conex) box, sea can or c can.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provides physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

FOB, "Free On Board", is a term in international commercial law specifying at what point respective obligations, costs, and risk involved in the delivery of goods shift from the seller to the buyer under the Incoterms standard published by the International Chamber of Commerce. FOB is only used in non-containerized sea freight or inland waterway transport. As with all Incoterms, FOB does not define the point at which ownership of the goods is transferred.

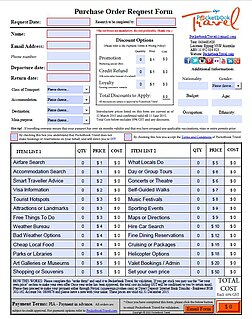

A purchase order (PO) is a commercial document and first official offer issued by a buyer to a seller indicating types, quantities, and agreed prices for products or services. It is used to control the purchasing of products and services from external suppliers. Purchase orders can be an essential part of enterprise resource planning system orders.

An invoice, bill or tab is a commercial document issued by a seller to a buyer, relating to a sale transaction and indicating the products, quantities, and agreed prices for products or services the seller had provided the buyer.

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, where the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter, where it assumes the counterparty risk of the buyer paying the seller for goods.

A standard form contract is a contract between two parties, where the terms and conditions of the contract are set by one of the parties, and the other party has little or no ability to negotiate more favorable terms and is thus placed in a "take it or leave it" position.

A boat or ship engaged in the tramp trade is one which does not have a fixed schedule or published ports of call. As opposed to freight liners, tramp ships trade on the spot market with no fixed schedule or itinerary/ports-of-call(s). A steamship engaged in the tramp trade is sometimes called a tramp steamer; the similar terms tramp freighter and tramper are also used. Chartering is done chiefly on London, New York, and Singapore shipbroking exchanges. The Baltic Exchange serves as a type of stock market index for the trade.

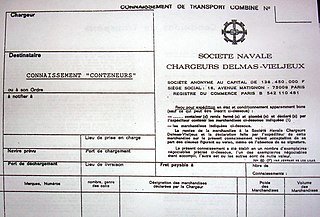

In a contract of carriage, the consignee is the entity who is financially responsible for the receipt of a shipment. Generally, but not always, the consignee is the same as the receiver.

Marine insurance covers the loss or damage of ships, cargo, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination. Cargo insurance is the sub-branch of marine insurance, though Marine insurance also includes Onshore and Offshore exposed property,, Hull, Marine Casualty, and Marine Liability. When goods are transported by mail or courier, shipping insurance is used instead.

A contract of carriage is a contract between a carrier of goods or passengers and the consignor, consignee or passenger. Contracts of carriage typically define the rights, duties and liabilities of parties to the contract, addressing topics such as acts of God and including clauses such as force majeure. Among common carriers, they are usually evidenced by standard terms and conditions printed on the reverse of a ticket or carriage document. Notification of a shipment’s arrival is usually sent to the "notify party", whose address appears on the shipping document. This party is usually either the buyer or the importer.

Butler Machine Tool Co Ltd v Ex-Cell-O Corp (England) Ltd [1977] EWCA Civ 9 is a leading English contract law case. It concerns the problem found among some large businesses, with each side attempting to get their preferred standard form agreements to be the basis for a contract.

Fine print, small print, or "mouseprint" is less noticeable print smaller than the more obvious larger print it accompanies that advertises or otherwise describes or partially describes a commercial product or service. The larger print that is used in conjunction with fine print by the merchant often has the effect of deceiving the consumer into believing the offer is more advantageous than it really is. This may satisfy a legal technicality which requires full disclosure of all terms or conditions, but does not specify the manner of disclosure. There is strong evidence that suggests the fine print is not read by the majority of consumers.

A contractual term is "any provision forming part of a contract". Each term gives rise to a contractual obligation, breach of which can give rise to litigation. Not all terms are stated expressly and some terms carry less legal gravity as they are peripheral to the objectives of the contract.

A specification often refers to a set of documented requirements to be satisfied by a material, design, product, or service. A specification is often a type of technical standard.

International Commercial Law is a body of legal rules, conventions, treaties, domestic legislation and commercial customs or usages, that governs international commercial or business transactions. A transaction will qualify to be international if elements of more than one country are involved.

Affreightment is a legal term used in shipping.

A bill of lading is a document issued by a carrier to acknowledge receipt of cargo for shipment. Although the term historically related only to carriage by sea, a bill of lading may today be used for any type of carriage of goods. A comprehensive article on Bill of Lading Bills of lading are one of three crucial documents used in international trade to ensure that exporters receive payment and importers receive the merchandise. The other two documents are a policy of insurance and an invoice. Whereas a bill of lading is negotiable, both a policy and an invoice are assignable. In international trade outside the United States, bills of lading are distinct from waybills in that the latter are not transferable and do not confer title. Nevertheless, the UK Carriage of Goods by Sea Act 1992 grants "all rights of suit under the contract of carriage" to the lawful holder of a bill of lading, or to the consignee under a sea waybill or a ship's delivery order.

A master contract or master agreement is a collective bargaining agreement which covers all unionized worksites in an industry, market or company, and which establishes the terms and conditions of employment common to all workers in the industry, market or company.

References

- ↑ Training Manual on the Operational Aspects of Multimodal Transport. United Nations Publications. 2003. pp. 16–. ISBN 978-92-1-120372-1.