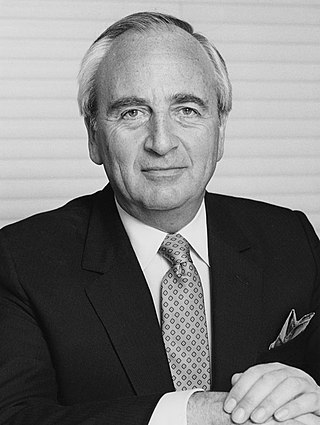

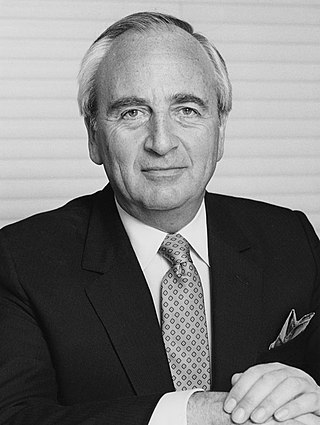

David Ivor Young, Baron Young of Graffham, was a British Conservative politician, cabinet minister and businessman.

The Prince's Trust is a United Kingdom-based charity founded in 1976 by King Charles III to help vulnerable young people get their lives on track. It supports 11-to-30-year-olds who are unemployed or struggling at school and at risk of exclusion. Many of the young people helped by the trust face issues such as homelessness, disability, mental health problems, or trouble with the law.

A micro-enterprise is generally defined as a small business employing nine people or fewer, and having a balance sheet or turnover less than a certain amount. The terms microenterprise and microbusiness have the same meaning, though traditionally when referring to a small business financed by microcredit the term microenterprise is often used. Similarly, when referring to a small, usually legal business that is not financed by microcredit, the term microbusiness is often used. Internationally, most microenterprises are family businesses employing one or two persons. Most microenterprise owners are primarily interested in earning a living to support themselves and their families. They only grow the business when something in their lives changes and they need to generate a larger income. According to information found on the Census.gov website, microenterprises make up 95% of the 28 million US companies tracked by the census.

SSAT Limited is a UK-based, independent educational membership organisation working with primary, secondary, special and free schools, academies and UTCs. It provides support and training in four main areas: teaching and learning, curriculum, networking, and leadership development.

James Nicholas Murray Wells OBE is an English entrepreneur and was founder, owner and executive chairman of Prescription Eyewear Limited, London, which he started whilst at university in 2004 and sold to Cipio Partners in 2013. At the time of the sale, the business had grown to employ more than 150 people, with sales of £29.9m in the year ending April 2013 and was selling to 50 overseas markets. He is currently Industry Head of Retail at Google UK.

IWG plc, formerly Regus, is a British holding company. It provides serviced offices under several brand-names, including Regus. It was started in Brussels, Belgium, by Mark Dixon in 1989. It is registered in Saint Helier, Jersey, and has its head office in Zug, Switzerland. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

James Caan is a British-Pakistani entrepreneur and television personality.

The Enterprise Finance Guarantee (EFG) is a UK government-guaranteed lending scheme intended to help smaller viable businesses who may be struggling to secure finance, by facilitating bank loans of between £1,000 and £1 million.

Michael Morris Hayman is an entrepreneur, broadcaster and author in the United Kingdom. He is a co-founder of Seven Hills, a London-based campaigning communication consultancy. Michael is chairman of Entrepreneurs at the private bank Coutts & Co, Chairs GRADVenture, the University of London Entrepreneur Pitch and serves on the Advisory Council of the Royal Philharmonic Orchestra.

The 2011 United Kingdom budget, officially called 2011 Budget – A strong and stable economy, growth and fairness, was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on 23 March 2011.

The National Citizen Service (NCS) is a voluntary personal and social development program for 16–17-year-olds in England funded largely by money from the UK Government. It was founded in 2009 and formally announced in 2010 by Prime Minister David Cameron as part of the Conservative–Liberal Democrat coalition government's Big Society initiative, and it was launched in England in 2011. After the 2015 general election, the programme was continued under the Conservative government. In October 2016 Cameron, who had resigned as Prime Minister, became chairman of the NCS Trust's patrons' board. The scheme was made permanent through the National Citizen Service Act 2017. With cross-party support, NCS became a Royal Charter Body in 2018.

International Citizen Service (ICS) is a global volunteering programme. It is aimed at young people aged 18-35 and supports them on 12-week long sustainable and locally-owned volunteering placements focused on working towards the Sustainable Development Goals.

Adzuna is a search engine for job advertisements. The company operates in 19 countries worldwide and the UK website aggregates job ads from several thousand sources.

Duncan Cheatle is an entrepreneur and supporter of UK enterprise. He has founded and co-founded multiple enterprise support initiatives, including The Supper Club, a London-based membership club for fast-growth entrepreneurs; Startup Britain, a privately sector funded, not-for-profit national campaign to 'celebrate, inspire, and accelerate enterprise in the UK'; and LearnAmp, a learning platform that aggregates and curates learning content from across the web.

British Business Bank plc (BBB) is a state-owned economic development bank established by the UK Government. Its aim is to increase the supply of credit to small and medium enterprises (SMEs) as well as providing business advice services. It is structured as a public limited company and is owned by the Department for Business and Trade. The bank has its headquarters in Sheffield.

Prime Minister's Youth Programme is an initiative by the former prime minister of Pakistan Nawaz Sharif established in 2013. The purpose of the programme is to ensure the provision of quality education, and meaningful employment to the youth through integrated, sustainable youth initiatives. The programme provided government-subsidised business loans of up to 25 million rupees, under three tiers: first-tier for 10000 to 1 million, the second tier for 1 million to 10 million, and the third tier for 10 million to 25 million. The programme also provided a skills scholarship program, a talent hunt for youth sports, and a national youth council.

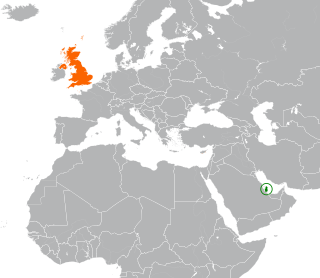

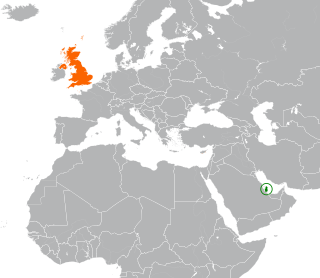

Qatar – United Kingdom relations are the bilateral relations between the State of Qatar and the United Kingdom of Great Britain and Northern Ireland, covering a wide range of issues and activities of mutual interest.

Holly Lee Tucker is a British entrepreneur, and UK Ambassador for Creative Small Businesses. Tucker is founder of Holly & Co, and founder of notonthehighstreet.

The Ghana Enterprises Agency (GEA) is a Ghanaian government agency under the Ministry of Trade and Industry. The GEA is mandated by the Ghana Enterprises Agency Act, 2020 to promote and develop MSMEs in Ghana. It replaced the National Board for Small-Scale Industries (NBSSI).

The Greensill scandal is a political controversy in the United Kingdom related to lobbying activities on behalf of financial services company Greensill Capital. It implicated former Prime Minister David Cameron, former Cabinet Secretary Lord Heywood and several other civil servants, and occurred during the COVID-19 pandemic.