Related Research Articles

Charles I, commonly called Charles of Anjou or Charles d'Anjou, was a member of the royal Capetian dynasty and the founder of the second House of Anjou. He was Count of Provence (1246–1285) and Forcalquier in the Holy Roman Empire, Count of Anjou and Maine (1246–1285) in France; he was also King of Sicily (1266–1285) and Prince of Achaea (1278–1285). In 1272, he was proclaimed King of Albania, and in 1277 he purchased a claim to the Kingdom of Jerusalem.

Charles II, also known as Charles the Lame, was King of Naples, Count of Provence and Forcalquier (1285–1309), Prince of Achaea (1285–1289), and Count of Anjou and Maine (1285–1290); he also styled himself King of Albania and claimed the Kingdom of Jerusalem from 1285. He was the son of Charles I of Anjou—one of the most powerful European monarchs in the second half of the 13th century—and Beatrice of Provence. His father granted Charles the Principality of Salerno in the Kingdom of Sicily in 1272 and made him regent in Provence and Forcalquier in 1279.

The Kingdom of Naples, also known as the Kingdom of Sicily, was a state that ruled the part of the Italian Peninsula south of the Papal States between 1282 and 1816. It was established by the War of the Sicilian Vespers (1282–1302), when the island of Sicily revolted and was conquered by the Crown of Aragon, becoming a separate kingdom also called the Kingdom of Sicily. This left the Neapolitan mainland under the possession of Charles of Anjou. Later, two competing lines of the Angevin family competed for the Kingdom of Naples in the late 14th century, which resulted in the death of Joanna I by Charles III of Naples. Charles' daughter Joanna II adopted King Alfonso V of Aragon as heir, who would then unite Naples into his Aragonese dominions in 1442.

The Parliament of England was the legislature of the Kingdom of England from the 13th century until 1707 when it was replaced by the Parliament of Great Britain. Parliament evolved from the great council of bishops and peers that advised the English monarch. Great councils were first called Parliaments during the reign of Henry III. By this time, the king required Parliament's consent to levy taxation.

Corvée is a form of unpaid forced labour that is intermittent in nature, lasting for limited periods of time, typically only a certain number of days' work each year. Statute labour is a corvée imposed by a state for the purposes of public works. As such it represents a form of levy (taxation). Unlike other forms of levy, such as a tithe, a corvée does not require the population to have land, crops or cash.

The Kingdom of Sicily was a state that existed in Sicily and the south of the Italian Peninsula plus, for a time, in Northern Africa from its founding by Roger II of Sicily in 1130 until 1816. It was a successor state of the County of Sicily, which had been founded in 1071 during the Norman conquest of the southern peninsula. The island was divided into three regions: Val di Mazara, Val Demone and Val di Noto.

The Crown of Aragon was a composite monarchy ruled by one king, originated by the dynastic union of the Kingdom of Aragon and the County of Barcelona and ended as a consequence of the War of the Spanish Succession. At the height of its power in the 14th and 15th centuries, the Crown of Aragon was a thalassocracy controlling a large portion of present-day eastern Spain, parts of what is now southern France, and a Mediterranean empire which included the Balearic Islands, Sicily, Corsica, Sardinia, Malta, Southern Italy and parts of Greece.

The Personal Rule was the period in England from 1629 to 1640 when King Charles I ruled as an autocratic absolute monarch without recourse to Parliament. Charles claimed that he was entitled to do this under the royal prerogative and that he had a divine right.

In medieval and early modern Europe, a tenant-in-chief was a person who held his lands under various forms of feudal land tenure directly from the king or territorial prince to whom he did homage, as opposed to holding them from another nobleman or senior member of the clergy. The tenure was one which denoted great honour, but also carried heavy responsibilities. The tenants-in-chief were originally responsible for providing knights and soldiers for the king's feudal army.

The Golden Bull of 1222 was a golden bull, or edict, issued by Andrew II of Hungary. King Andrew II was forced by his nobles to accept the Golden Bull (Aranybulla), which was one of the first examples of constitutional limits being placed on the powers of a European monarch. The Golden Bull was issued at the year 1222 diet of Fehérvár. The law established the rights of the Hungarian nobility, including the right to disobey the King when he acted contrary to law. The nobles and the church were freed from all taxes and could not be forced to go to war outside of Hungary and were not obligated to finance it. This was also a historically important document because it set down the principles of equality for all of the nation's nobility. Seven copies of the edict were created, one for each of the following institutions: to the Pope, to the Knights Templar, to the Knights Hospitaller, to the Hungarian king itself, to the chapters of Esztergom and Kalocsa and to the palatine.

A church tax is a tax collected by the state from members of some religious denominations to provide financial support of churches, such as the salaries of its clergy and to pay the operating cost of the church. Not all countries have such a tax. In some countries that do, people who are not members of a religious community are exempt from the tax; in others it is always levied, with the payer often entitled to choose who receives it, typically the state or an activity of social interest.

The Kingdom of the Two Sicilies was a kingdom in Southern Italy from 1816 to 1861 under the control of a cadet branch of the Spanish Bourbons. The kingdom was the largest sovereign state by population and size in Italy before Italian unification, comprising Sicily and most of the area of today's Mezzogiorno in covering all of the Italian Peninsula south of the Papal States.

Feudal aid is the legal term for one of the financial duties required of a feudal tenant or vassal to his lord. Variations on the feudal aid were collected in England, France, Germany and Italy during the Middle Ages, although the exact circumstances varied.

The House of Commons of England was the lower house of the Parliament of England from its development in the 14th century to the union of England and Scotland in 1707, when it was replaced by the House of Commons of Great Britain after the 1707 Act of Union was passed in both the English and Scottish parliaments at the time. In 1801, with the union of Great Britain and Ireland, that house was in turn replaced by the House of Commons of the United Kingdom.

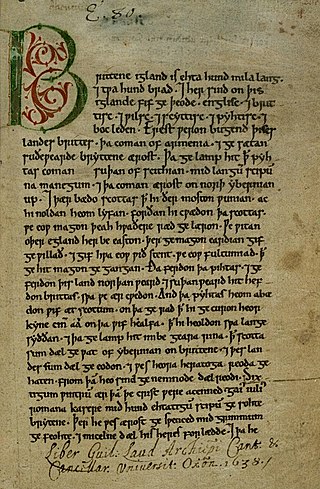

Taxation in medieval England was the system of raising money for royal and governmental expenses. During the Anglo-Saxon period, the main forms of taxation were land taxes, although custom duties and fees to mint coins were also imposed. The most important tax of the late Anglo-Saxon period was the geld, a land tax first regularly collected in 1012 to pay for mercenaries. After the Norman Conquest of England in 1066, the geld continued to be collected until 1162, but it was eventually replaced with taxes on personal property and income.

The royal fifth is a historical royal tax which reserves to the monarch 20% of all precious metals and other commodities acquired by his subjects as war loot, found as treasure or extracted by mining. The 'royal fifth' was first instituted in medieval Muslim states from interpretations of Qur'an, though the extent to which it applied was debated between schools of Islam. During the Age of Exploration, Christian Iberian kingdoms and their overseas colonial empires also instituted the tax, though to encourage exploration, some monarchs allowed colonists to keep some or all of the fifth.

The Transylvanian Diet was an important legislative, administrative and judicial body of the Principality of Transylvania between 1570 and 1867. The general assemblies of the Transylvanian noblemen and the joint assemblies of the representatives of the "Three Nations of Transylvania"—the noblemen, Székelys and Saxons—gave rise to its development. After the disintegration of the medieval Kingdom of Hungary in 1541, delegates from the counties of the eastern and northeastern territories of Hungary proper also attained the Transylvanian Diet, transforming it into a legal successor of the medieval Diets of Hungary.

The freemen's pennies or the pennies of freemen was a direct tax in the Kingdom of Hungary in the 11th-13th centuries.

Andrew of Cicala, known in Italian as Andrea di Cicala or Andrea Cicala, was a nobleman and administrator in the Kingdom of Sicily under the king-emperor Frederick II. He was the lord of Golisano from before 1231 and the lord of Polizzi from 1236.

References

- 1 2 3 4 Percy 1981, p. 70.

- ↑ Sakellariou 2011, p. 90.

- 1 2 3 4 5 6 Percy 1981, p. 71.