In finance, discounted cash flow (DCF) analysis is a method of valuing a security, project, company, or asset using the concepts of the time value of money. Discounted cash flow analysis is widely used in investment finance, real estate development, corporate financial management and patent valuation. It was used in industry as early as the 1700s or 1800s, widely discussed in financial economics in the 1960s, and became widely used in U.S. courts in the 1980s and 1990s.

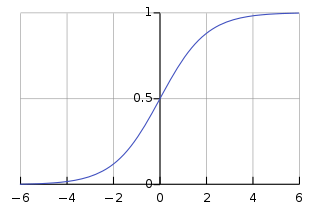

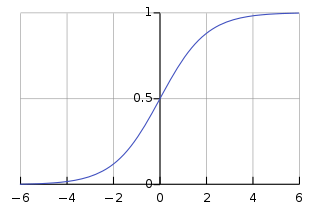

A logistic function or logistic curve is a common S-shaped curve with equation

The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. From the partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of European-style options and shows that the option has a unique price regardless of the risk of the security and its expected return. The formula led to a boom in options trading and provided mathematical legitimacy to the activities of the Chicago Board Options Exchange and other options markets around the world. It is widely used, although often with some adjustments, by options market participants.

The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference.

The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. The WACC is commonly referred to as the firm's cost of capital. Importantly, it is dictated by the external market and not by management. The WACC represents the minimum return that a company must earn on an existing asset base to satisfy its creditors, owners, and other providers of capital, or they will invest elsewhere.

In financial mathematics, put–call parity defines a relationship between the price of a European call option and European put option, both with the identical strike price and expiry, namely that a portfolio of a long call option and a short put option is equivalent to a single forward contract at this strike price and expiry. This is because if the price at expiry is above the strike price, the call will be exercised, while if it is below, the put will be exercised, and thus in either case one unit of the asset will be purchased for the strike price, exactly as in a forward contract.

The Modigliani–Miller theorem is an influential element of economic theory; it forms the basis for modern thinking on capital structure. The basic theorem states that in the absence of taxes, bankruptcy costs, agency costs, and asymmetric information, and in an efficient market, the value of a firm is unaffected by how that firm is financed. Since the value of the firm depends neither on its dividend policy nor its decision to raise capital by issuing stock or selling debt, the Modigliani–Miller theorem is often called the capital structure irrelevance principle.

In marketing, customer lifetime value, lifetime customer value (LCV), or life-time value (LTV) is a prognostication of the net profit contributed to the whole future relationship with a customer. The prediction model can have varying levels of sophistication and accuracy, ranging from a crude heuristic to the use of complex predictive analytics techniques.

In financial markets, stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit from price movement – stocks that are judged undervalued are bought, while stocks that are judged overvalued are sold, in the expectation that undervalued stocks will overall rise in value, while overvalued stocks will generally decrease in value.

In economics and accounting, the cost of capital is the cost of a company's funds, or, from an investor's point of view "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet.

The return on equity (ROE) is a measure of the profitability of a business in relation to the equity. Because shareholder's equity can be calculated by taking all assets and subtracting all liabilities, ROE can also be thought of as a return on assets minus liabilities. ROE measures how many dollars of profit are generated for each dollar of shareholder's equity. ROE is a metric of how well the company utilizes its equity to generate profits.

In finance, the terminal value of a security is the present value at a future point in time of all future cash flows when we expect stable growth rate forever. It is most often used in multi-stage discounted cash flow analysis, and allows for the limitation of cash flow projections to a several-year period; see Forecast period (finance). Forecasting results beyond such a period is impractical and exposes such projections to a variety of risks limiting their validity, primarily the great uncertainty involved in predicting industry and macroeconomic conditions beyond a few years.

The "Fed model" or "Fed Stock Valuation Model" (FSVM), is a disputed theory of equity valuation that compares the stock market's earnings yield to the yield on long-term government bonds, and that the stock market – as a whole – is fairly valued, when the one-year forward-looking I/B/E/S earnings yield equals the 10-year nominal Treasury yield; deviations suggest over-or-under valuation.

In corporate finance, Hamada’s equation, named after Robert Hamada, is used to separate the financial risk of a levered firm from its business risk. The equation combines the Modigliani-Miller theorem with the capital asset pricing model. It is used to help determine the levered beta and, through this, the optimal capital structure of firms.

Earnings growth is the annual compound annual growth rate (CAGR) of earnings from investments. For more general discussion see: Sustainable growth rate#From a financial perspective; Stock valuation#Growth rate; Valuation using discounted cash flows#Determine the continuing value; Growth stock; PEG ratio.

The dividend discount model (DDM) is a method of valuing a company's stock price based on the theory that its stock is worth the sum of all of its future dividend payments, discounted back to their present value. In other words, it is used to value stocks based on the net present value of the future dividends. The equation most widely used is called the Gordon growth model (GGM). It is named after Myron J. Gordon of the University of Toronto, who originally published it along with Eli Shapiro in 1956 and made reference to it in 1959. Their work borrowed heavily from the theoretical and mathematical ideas found in John Burr Williams 1938 book "The Theory of Investment Value."

In finance, the T-model is a formula that states the returns earned by holders of a company's stock in terms of accounting variables obtainable from its financial statements. The T-model connects fundamentals with investment return, allowing an analyst to make projections of financial performance and turn those projections into a required return that can be used in investment selection. Mathematically the model is as follows:

In finance, the capital structure substitution theory (CSS) describes the relationship between earnings, stock price and capital structure of public companies. The CSS theory hypothesizes that managements of public companies manipulate capital structure such that earnings per share (EPS) are maximized. Managements have an incentive to do so because shareholders and analysts value EPS growth. The theory is used to explain trends in capital structure, stock market valuation, dividend policy, the monetary transmission mechanism, and stock volatility, and provides an alternative to the Modigliani–Miller theorem that has limited descriptive validity in real markets. The CSS theory is only applicable in markets where share repurchases are allowed. Investors can use the CSS theory to identify undervalued stocks.

Dividend policy is concerned with financial policies regarding paying cash dividend in the present or paying an increased dividend at a later stage. Whether to issue dividends, and what amount, is determined mainly on the basis of the company's unappropriated profit and influenced by the company's long-term earning power. When cash surplus exists and is not needed by the firm, then management is expected to pay out some or all of those surplus earnings in the form of cash dividends or to repurchase the company's stock through a share buyback program.

Residual income valuation is an approach to equity valuation that formally accounts for the cost of equity capital. Here, "residual" means in excess of any opportunity costs measured relative to the book value of shareholders' equity; residual income (RI) is then the income generated by a firm after accounting for the true cost of capital. The approach is largely analogous to the EVA/MVA based approach, with similar logic and advantages. Residual Income valuation has its origins in Edwards & Bell (1961), Peasnell (1982), and Ohlson (1995).