Related Research Articles

ISO 4217 is a standard published by the International Organization for Standardization (ISO) that defines alpha codes and numeric codes for the representation of currencies and provides information about the relationships between individual currencies and their minor units. This data is published in three tables:

Real-time gross settlement (RTGS) systems are specialist funds transfer systems where the transfer of money or securities takes place from one bank to any other bank on a "real-time" and on a "gross" basis to avoid settlement risk. Settlement in "real time" means a payment transaction is not subjected to any waiting period, with transactions being settled as soon as they are processed. "Gross settlement" means the transaction is settled on a one-to-one basis, without bundling or netting with any other transaction. "Settlement" means that once processed, payments are final and irrevocable.

ISO 20022 is an ISO standard for electronic data interchange between financial institutions. It describes a metadata repository containing descriptions of messages and business processes, and a maintenance process for the repository content. The standard covers financial information transferred between financial institutions that includes payment transactions, securities trading and settlement information, credit and debit card transactions and other financial information.

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, payment instruments such as payment cards, people, rules, procedures, standards, and technologies that make its exchange possible. A payment system is an operational network which links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment.

The Swiss National Bank is the central bank of Switzerland, responsible for the nation's monetary policy and the sole issuer of Swiss franc banknotes. The primary goal of its mandate is to ensure price stability, while taking economic developments into consideration.

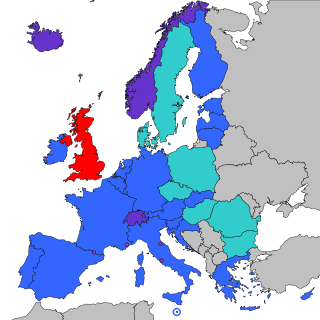

The Single Euro Payments Area (SEPA) is a payment integration initiative of the European Union for simplification of bank transfers denominated in euros. As of 2020, there were 36 members in SEPA, consisting of the 27 member states of the European Union, the four member states of the European Free Trade Association, and the United Kingdom. Some microstates participate in the technical schemes: Andorra, Monaco, San Marino, and Vatican City.

The Asian Clearing Union (ACU) was established on December 9, 1974, at the initiative of the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP). The primary objective of ACU, at the time of its establishment, was to secure regional co-operation regarding the clearing of eligible monetary transactions among the members of the Union to provide a system for clearing payments among the member countries on a multilateral basis.

The Malaysian Electronic Payment System (MEPS) is an interbank network service provider in Malaysia. In August 2017, MEPS merged with Malaysian Electronic Clearing Corporation Sdn Bhd (MyClear) to form Payments Network Malaysia Sdn Bhd (PayNet).

Canadian Payments Association, carrying on business under the brand name Payments Canada, is an organization that operates a payment clearing and settlement system in Canada. The Canadian Payments Association was established by the Canadian Payments Act in 1980. Among other responsibilities, it regulates and maintains directories of bank routing numbers in Canada.

The Clearing House Automated Transfer System, or CHATS, is a real-time gross settlement (RTGS) system for the transfer of funds in Hong Kong. It is operated by Hong Kong Interbank Clearing Limited (HKICL), a limited-liability private company jointly owned by the Hong Kong Monetary Authority (HKMA) and the Hong Kong Association of Banks. Transactions in four currency denominations may be settled using CHATS: Hong Kong dollar, renminbi, euro, and US dollar. In 2005, the value of Hong Kong dollar CHATS transactions averaged HK$467 billion per day, which amounted to a third of Hong Kong's annual Gross Domestic Product (GDP); the total value of transactions that year was 84 times the GDP of Hong Kong. CHATS has been referred by authors at the Bank for International Settlements to as "the poster child of multicurrency offshore systems".

SIX is a key financial market infrastructure company in Switzerland. The company provides services relating to securities transactions, the processing of financial information, payment transactions and is building a digital infrastructure. The company name SIX is an abbreviation and stands for Swiss Infrastructure and Exchange. SIX is globally active, with its headquarters in Zurich.

CLS Group, or simply CLS, is a specialized financial market infrastructure group whose main entity is the New York-based CLS Bank. It started operations in 2002 and operates a unique and global central multicurrency cash settlement system, known as the CLS System, which plays a critical role in the foreign exchange market. Although the forex market is decentralised and has no central exchange or clearing facility, firms that chose to use CLS to settle their FX transactions can mitigate the settlement risk associated with their trades. CLS achieve this thanks to a central net and gross payment versus payment settlement service directly connected to the real-time gross settlement systems of participating jurisdictions through accounts at each of their respective central banks.

Vocalink is a payment systems company headquartered in the United Kingdom, created in 2007 from the merger between Voca and LINK. It designs, builds and operates the UK payments infrastructure, which underpins the provision of the Bacs payment system and the UK ATM LINK switching platform covering 65,000 ATMs and the UK Faster Payments systems.

SIX Interbank Clearing AG, based in Zürich, Switzerland, is a subsidiary of SIX Group.

"Fintech", a clipped compound of "financial technology", refers to the application of innovative technologies to products and services in the financial industry. This broad term encompasses a wide array of technological advancements in financial services, including mobile banking, online lending platforms, digital payment systems, robo-advisors, and blockchain-based applications such as cryptocurrencies. Fintech companies include both startups and established technology and financial firms that aim to improve, complement, or replace traditional financial services.

The Cross-border Interbank Payment System (CIPS) is a Chinese payment system that offers clearing and settlement services for its participants in cross-border renminbi (RMB) payments and trade. CIPS is backed by the People's Bank of China and was launched in 2015 as part of a policy effort to internationalize the use of China’s currency.

SIA S.p.A. is an Italian company operating in the area of ICT, providing services to the banking and finance sector in addition to platforms for financial markets and e-payment services.

The Digital Rupee (e₹) or eINR or E-Rupee is a tokenised digital version of the Indian Rupee, issued by the Reserve Bank of India (RBI) as a central bank digital currency (CBDC). The Digital Rupee was proposed in January 2017 and launched on 1 December 2022. Digital Rupee is using blockchain distributed-ledger technology.

FedNow is an instant payment service developed by the Federal Reserve for depository institutions in the United States, which allows individuals and businesses to send and receive money. The service launched on July 20, 2023. Banks will be able to build products on top of the FedNow platform. By 2024, hundreds of banks and credit unions were reportedly utilizing the service.

The Swiss Euro Clearing Bank or SECB is a special-purpose bank based in Frankfurt, Germany, whose role is to facilitate transactions in euros by banks in Switzerland and Liechtenstein. It is the centerpiece of the euroSIC system, which is the euro counterpart to the Swiss Interbank Clearing (SIC) system for transactions in Swiss francs.

References

- 1 2 3 "The Swiss Interbank Clearing (SIC) payment system" (PDF). Snb.ch. November 2019. Retrieved 7 January 2020.

- 1 2 3 4 Heller, Daniel; Nellen, Thomas; Sturm, Andy (June 2000). "The Swiss Interbank Clearing System". CiteSeerX 10.1.1.195.2655 .

- ↑ Vital, Christian; Mengle, David (1988). "SIC: Switzerland's New Electronic Interbank Payment System". FRB Richmond Economic Review. 74 (6): 12–27. SSRN 2122464.

- ↑ Meola, Andrew. "Switzerland launches new national payment system". Business Insider. Retrieved 2020-01-07.

- ↑ "Swiss banks finish migration to ISO 20022". Finextra Research. 2017-12-06. Retrieved 2020-01-07.

- ↑ "Swiss National Bank and BIS use innovation hub to explore digital central bank money and DLT". Finextra Research. 2019-10-08. Retrieved 2020-01-07.

- ↑ "SNB Opens Itself to Fintech". finews.com. 2019-03-28. Retrieved 2020-01-07.