The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government of the United Kingdom, it is the world's eighth-oldest bank. It was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry.

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a state or formal monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks.

The euro is the official currency of 19 out of the 27 member states of the European Union. This group of states is known as the eurozone or, officially, the euro area, and includes about 349 million citizens as of 2019. The euro is divided into 100 cents.

The European Central Bank (ECB) is the prime component of the Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important central banks.

In economics, inflation is a general increase in the prices of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States.

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. Inflation reduces the value of currency over time, but sudden deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slow-down in the inflation rate, i.e. when inflation declines to a lower rate but is still positive.

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed.

Black Wednesday occurred on 16 September 1992 when the UK Government was forced to withdraw the pound sterling from the European Exchange Rate Mechanism (ERM), after a failed attempt to keep the pound above the lower currency exchange limit required for the ERM participation. At that time, the United Kingdom held the Presidency of the Council of the European Union.

Norman Stewart Hughson Lamont, Baron Lamont of Lerwick, is a British politician and former Conservative MP for Kingston-upon-Thames. He served as Chancellor of the Exchequer from 1990 until 1993. He was created a life peer in 1998. Lamont was a supporter of the Eurosceptic organisation Leave Means Leave.

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing or the money supply, often as an attempt to reduce inflation or the interest rate, to ensure price stability and general trust of the value and stability of the nation's currency.

The Taylor rule is one kind of targeting monetary policy used by central banks. The Taylor rule was proposed by the American economist John B. Taylor, economic adviser in the presidential administrations of Gerald Ford and George H. W. Bush, in 1992 as a central bank technique to stabilize economic activity by setting an interest rate.

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region, is increased. In most modern economies, money creation is controlled by the central banks. Money issued by central banks is termed base money. Central banks can increase the quantity of base money directly, by engaging in open market operations. However, the majority of the money supply is created by the commercial banking system in the form of bank deposits. Bank loans issued by commercial banks that practice fractional reserve banking expands the quantity of broad money to more than the original amount of base money issued by the central bank.

Inflation targeting is a monetary policy where a central bank follows an explicit target for the inflation rate for the medium-term and announces this inflation target to the public. The assumption is that the best that monetary policy can do to support long-term growth of the economy is to maintain price stability, and price stability is achieved by controlling inflation. The central bank uses interest rates as its main short-term monetary instrument.

Quantitative easing (QE) is a monetary policy whereby a central bank purchases predetermined amounts of government bonds or other financial assets in order to inject money into the economy to expand economic activity. Quantitative easing is an unconventional form of monetary policy, which is usually used when inflation is very low or negative, and when standard monetary policy instruments have become ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its own held or previously purchased government bonds or other financial assets, to a mix of commercial banks and other financial institutions, usually after periods of their own, earlier, quantitative easing purchases.

James Brian Bullard is the chief executive officer and 12th president of the Federal Reserve Bank of St. Louis, positions he has held since 2008. He is currently serving a term that began on March 1, 2021. In 2014, he was named the 7th most influential economist in the world in terms of media influence.

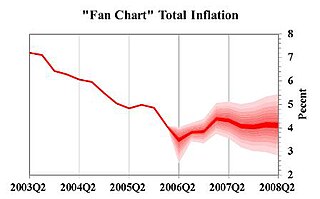

In time series analysis, a fan chart is a chart that joins a simple line chart for observed past data, by showing ranges for possible values of future data together with a line showing a central estimate or most likely value for the future outcomes. As predictions become increasingly uncertain the further into the future one goes, these forecast ranges spread out, creating distinctive wedge or "fan" shapes, hence the term. Alternative forms of the chart can also include uncertainty for past data, such as preliminary data that is subject to revision.

Market monetarism is a school of macroeconomic thought that advocates that central banks target the level of nominal income instead of inflation, unemployment, or other measures of economic activity, including in times of shocks such as the bursting of the real estate bubble in 2006, and in the financial crisis that followed. In contrast to traditional monetarists, market monetarists do not believe monetary aggregates or commodity prices such as gold are the optimal guide to intervention. Market monetarists also reject the New Keynesian focus on interest rates as the primary instrument of monetary policy. Market monetarists prefer a nominal income target due to their twin beliefs that rational expectations are crucial to policy, and that markets react instantly to changes in their expectations about future policy, without the "long and variable lags" postulated by Milton Friedman.

Nicoletta Batini is an Italian economist, notable as a scholar of innovative monetary and fiscal policy practices. During the crisis she pioneered the IMF work exposing the dangers of excessive fiscal austerity and designed ways to consolidate public debt successfully during phases of financial deleveraging. Since 2003 at the International Monetary Fund, she has served as Advisor of the Bank of England’s Monetary Policy Committee between 2000-2003 and was Professor of Economics at the University of Surrey (2007-2012), and Director of the International Economics and Policy office of the Department of the Treasury of Italy’s Ministero dell’Economia e delle Finanze (MEF) between 2013-2015. Batini's fields of expertise include monetary policy, public finance, open economy macroeconomics, labor economics, energy and environmental economics, and economic modeling. She has handled extensive consultancy roles in the public sector in advanced and emerging market countries. She holds a Ph.D. in international finance from the Scuola Superiore S. Anna and a Ph.D. in monetary economics from the University of Oxford.

The 2021–2022 inflation surge is the elevated economic inflation throughout much of the world that began in early 2021. It has been attributed primarily to supply shortages caused by the COVID-19 pandemic and the Russian invasion of Ukraine, coupled with strong consumer demand, driven by historically robust job and wage growth as the pandemic receded. As a result, many countries have seen their highest rates of inflation in decades.