In computing, cross-platform software is computer software that is designed to work in several computing platforms. Some cross-platform software requires a separate build for each platform, but some can be directly run on any platform without special preparation, being written in an interpreted language or compiled to portable bytecode for which the interpreters or run-time packages are common or standard components of all supported platforms.

Data General Corporation was one of the first minicomputer firms of the late 1960s. Three of the four founders were former employees of Digital Equipment Corporation (DEC).

IXI Limited was a British software company that developed and marketed windowing products for Unix, supporting all the popular Unix platforms of the time. Founded in 1987, it was based in Cambridge. The product it was most known for was X.desktop, a desktop environment graphical user interface built on the X Window System. IXI was acquired by the Santa Cruz Operation (SCO) in February 1993.

Business Basic is a category of variants of the BASIC computer programming language which were specialised for business use on minicomputers in the 1970s and 1980s. To the underlying BASIC language, these dialects added record handling instructions similar to those in COBOL, allowing programmers to build complex file-handling applications using what was at that time a much more modern programming language. MAI Systems released the first example as MAI Basic Four in 1972, and several similar versions emerged through the 1970s.

AT&T Computer Systems is the generic name for American Telephone & Telegraph's unsuccessful attempt to compete in the computer business. In return for divesting the local Bell Operating Companies, AT&T was allowed to have an unregulated division to sell computer hardware and software. The company made the 3B series computers.

Oracle Financial Services Software Limited (OFSS) is an Indian subsidiary of Oracle Corporation which is involved in financial and insurance technology. Established in 1990, the company was known as i-flex Solutions until 2008, two years after its acquisition by Oracle. It is headquartered in Mumbai.

NOMAD is a relational database and fourth-generation language (4GL), originally developed in the 1970s by time-sharing vendor National CSS. While it is still in use today, its widest use was in the 1970s and 1980s. NOMAD supports both the relational and hierarchical database models.

LINC is a fourth-generation programming language, used mostly on Unisys computer systems.

Mobile banking is a service provided by a bank or other financial institution that allows its customers to conduct financial transactions remotely using a mobile device such as a smartphone or tablet. Unlike the related internet banking it uses software, usually called an app, provided by the financial institution for the purpose. Mobile banking is usually available on a 24-hour basis. Some financial institutions have restrictions on which accounts may be accessed through mobile banking, as well as a limit on the amount that can be transacted. Mobile banking is dependent on the availability of an internet or data connection to the mobile device.

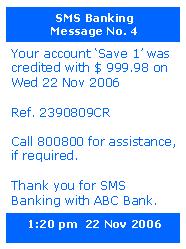

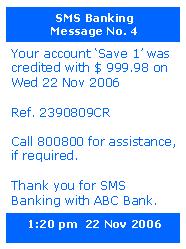

SMS banking is a form of mobile banking. It is a facility used by some banks or other financial institutions to send messages to customers' mobile phones using SMS messaging, or a service provided by them which enables customers to perform some financial transactions using SMS.

Core banking is a banking service provided by a group of networked bank branches where customers may access their bank account and perform basic transactions from any of the member branch offices.

ILOG S.A. was an international software company purchased and incorporated into IBM announced in January, 2009. It created enterprise software products for supply chain, business rule management, visualization and optimization. The main product line for Business Rules Management Systems (BRMS) has been rebranded as IBM Operational Decision Management. Many of the related components retain the ILOG brand as a part of their name.

Fiducia IT AG was a German IT-service provider based in Karlsruhe. In 2015, it merged with the GAD eG to form Fiducia & GAD IT AG.

Finacle is a banking software developed by Infosys. Finacle was created in 1999 as a core banking software suite and has been a part of Infosys' subsidiary EdgeVerve Systems since 2015.

Exigen Services recently merged and renamed to Emergn. Insurance Software production under Exigen Insurance Solutions has separated and was renamed to EIS.

Innovative Routines International (IRI), Inc. is an American software company first known for bringing mainframe sort merge functionality into open systems. IRI was the first vendor to develop a commercial replacement for the Unix sort command, and combine data transformation and reporting in Unix batch processing environments. In 2007, IRI's coroutine sort ("CoSort") became the first product to collate and convert multi-gigabyte XML and LDIF files, join and lookup across multiple files, and apply role-based data privacy functions for fields within sensitive files.

Midas is a line of banking software that was provided by British software company Misys corporation. It was initially developed in the 1970s and gained significant market share through the 1980s and 1990s. The system includes a core banking system and supporting back office systems for treasury and international banking.

Tata Research Development and Design Centre (TRDDC) is a software research centre in Pune, India, established by Tata Group's TCS in 1981. TRDDC undertakes research in Machine Learning, Software Engineering, Process Engineering and Systems Research.

Proposal software also known as proposal management software, proposal writing software, or proposal automation software is a computer program designed to help users develop proposals, presentations, and responses to RFPs. Proposal management software is becoming increasingly popular in companies that manage frequent and extensive proposal writing projects. Such software allows businesses to automate more routine tasks while easily tracking multiple versions.

Digital banking is part of the broader context for the move to online banking, where banking services are delivered over the internet. The shift from traditional to digital banking has been gradual, remains ongoing, and is constituted by differing degrees of banking service digitization. Digital banking involves high levels of process automation and web-based services and may include APIs enabling cross-institutional service composition to deliver banking products and provide transactions. It provides the ability for users to access financial data through desktop, mobile and ATM services.