A tax is a mandatory financial charge or levy imposed on a taxpayer by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent.

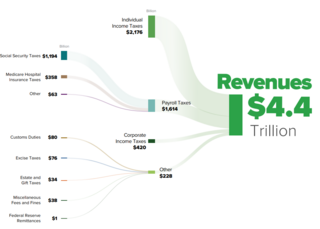

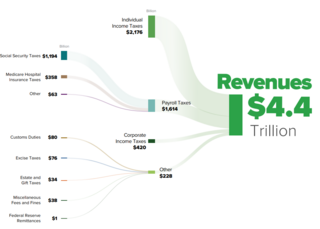

The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture, or an automobile is often referred to as an expense. An expense is a cost that is "paid" or "remitted", usually in exchange for something of value. Something that seems to cost a great deal is "expensive". Something that seems to cost little is "inexpensive". "Expenses of the table" are expenses for dining, refreshments, a feast, etc.

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax.

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income, and are claimable in place of a standard deduction, if available.

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares.

An S corporation, for United States federal income tax, is a closely held corporation that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code. In general, S corporations do not pay any income taxes. Instead, the corporation's income and losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities, including state and federal governments. The methodology can vary depending on local and international tax laws.

1231 Property is a category of property defined in section 1231 of the U.S. Internal Revenue Code. 1231 property includes depreciable property and real property used in a trade or business and held for more than one year. Some types of livestock, coal, timber and domestic iron ore are also included. It does not include: inventory; property held for sale in the ordinary course of business; artistic creations held by their creator; or, government publications.

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office (ATO). Australian GST revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission.

In tax accounting, adjusted basis is the net cost of an asset after adjusting for various tax-related items.

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return.

Treasury Regulation 1.183-2 is a Treasury Regulation in the United States, outlining the taxes owed from income deriving from non-business, non-investment activity. Expenses relating to for profit activities, such as business and investment activities, are generally tax deductible under sections 162 and 212, respectively, of the Internal Revenue Code. However, expenses relating to not for profit activities, such as hobbies, are generally not tax deductible.

Section 165(c) of the United States Internal Revenue Code limits losses that taxpayers can deduct into three categories: business or trade losses, investment losses, and losses incurred from casualty or theft. A loss incurred by a taxpayer from the sale of the taxpayer's personal residential property is not deductible. Personal residential property losses do not fit under any of the enumerated categories under Internal Revenue Code section 165(c). Furthermore, Income Tax Treasury Regulation section 1.165-9 states that a loss sustained on the sale of residential property purchased or constructed by the taxpayer for use as his personal residence and so used by him up to the time of the sale is not deductible under Internal Revenue Code section 165(a).

A casualty loss is a type of tax loss that is a sudden, unexpected, or unusual event. Damage or loss resulting from progressive deterioration of property through a steadily operating cause would not be a casualty loss. “Other casualty” are events similar to “fire, storm, or shipwreck.” It is generally held that wherever force is applied to property which the owner-taxpayer is either unaware of because of the hidden nature of such application or is powerless to act to prevent the same because of the suddenness thereof or some other disability and damage results.

Carpenter v. Commissioner, T.C. Memo. 1966-228 (1966) was a case decided by the United States Tax Court. Carpenter v. Commissioner addressed the issue of whether a husband and wife could deduct the aggregate fair market value of the wife’s engagement ring from their income tax return, as a casualty loss under §165(a) and (c)(3) of the Internal Revenue Code of 1954, after the husband inadvertently dropped the ring in their garbage disposal.

Under U.S. Federal income tax law, a net operating loss (NOL) occurs when certain tax-deductible expenses exceed taxable revenues for a taxable year. If a taxpayer is taxed during profitable periods without receiving any tax relief during periods of NOLs, an unbalanced tax burden results. Consequently, in some situations, Congress allows taxpayers to use the losses in one year to offset the profits of other years.

The dividends-received deduction, under U.S. federal income tax law, is a tax deduction received by a corporation on the dividends it receives from other corporations in which it has an ownership stake.