Reaganomics, or Reaganism, were the neoliberal economic policies promoted by U.S. President Ronald Reagan during the 1980s. These policies are characterized as supply-side economics, trickle-down economics, or "voodoo economics" by opponents, including some Republicans, while Reagan and his advocates preferred to call it free-market economics.

The economy of Thailand is dependent on exports, which accounted in 2021 for about 58 per cent of the country's gross domestic product (GDP). Thailand itself is a newly industrialized country, with a GDP of 17.367 trillion baht (US$495 billion) in 2022, the 9th largest economy in Asia. As of 2018, Thailand has an average inflation of 1.06% and an account surplus of 7.5% of the country's GDP. Its currency, the Thai Baht, ranked as the tenth most frequently used world payment currency in 2017.

Supply-side economics is a macroeconomic theory postulating that economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics theory, consumers will benefit from greater supply of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices. Such policies are of several general varieties:

- Investments in human capital, such as education, healthcare, and encouraging the transfer of technologies and business processes, to improve productivity. Encouraging globalized free trade via containerization is a major recent example.

- Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.

- Investments in new capital equipment and research and development (R&D), to further improve productivity. Allowing businesses to depreciate capital equipment more rapidly gives them an immediate financial incentive to invest in such equipment.

- Reduction in government regulations, to encourage business formation and expansion.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions in the percentage of tax paid on income, goods and services. As they leave consumers with more disposable income, tax cuts are an example of an expansionary fiscal policy. Tax cuts also include reduction in tax in other ways, such as tax credit, deductions and loopholes.

The economic policy of the Bill Clinton administration, referred to by some as Clintonomics, encapsulates the economic policies of president of the United States Bill Clinton that were implemented during his presidency, which lasted from January 1993 to January 2001.

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

The economic history of the Republic of Turkey had four eras or periods. The first era had the development policy emphasizing private accumulation between 1923 and 1929. The second era had the development policy emphasized state accumulation in a period of global crises between 1929 and 1945. The third era was state-guided industrialization based on import-substituting protectionism between 1950 and 1980. The final, era was the opening of the economy to liberal trade in goods, services and financial market transactions since 1981.

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression.

The European recession is part of the Great Recession that began in mid-2007. The crisis spread rapidly and affected much of the region, with several countries already in recession as of February 2009, and most others suffering marked economic setbacks. The global recession was first seen in Europe, as Ireland was the first country to fall into recession from Q2-Q3 2007 – followed by temporary growth in Q4 2007 – and then a two-year-long recession.

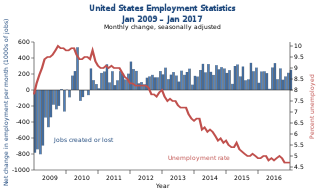

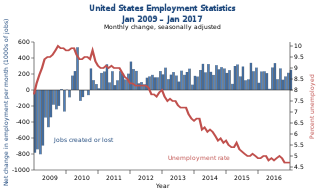

Unemployment in the United States discusses the causes and measures of U.S. unemployment and strategies for reducing it. Job creation and unemployment are affected by factors such as economic conditions, global competition, education, automation, and demographics. These factors can affect the number of workers, the duration of unemployment, and wage levels.

In the United States, the Great Recession was a severe financial crisis combined with a deep recession. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment and output. This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis along with restrained government spending following initial stimulus efforts. It followed the bursting of the housing bubble, the housing market correction and subprime mortgage crisis.

Political debates about the United States federal budget discusses some of the more significant U.S. budgetary debates of the 21st century. These include the causes of debt increases, the impact of tax cuts, specific events such as the United States fiscal cliff, the effectiveness of stimulus, and the impact of the Great Recession, among others. The article explains how to analyze the U.S. budget as well as the competing economic schools of thought that support the budgetary positions of the major parties.

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

The 2010–2014 Portuguese financial crisis was part of the wider downturn of the Portuguese economy that started in 2001 and possibly ended between 2016 and 2017. The period from 2010 to 2014 was probably the hardest and more challenging part of the entire economic crisis; this period includes the 2011–14 international bailout to Portugal and was marked by intense austerity policies, more intense than the wider 2001-2017 crisis. Economic growth stalled in Portugal between 2001 and 2002, and following years of internal economic crisis, the worldwide Great Recession started to hit Portugal in 2008 and eventually led to the country being unable to repay or refinance its government debt without the assistance of third parties. To prevent an insolvency situation in the debt crisis, Portugal applied in April 2011 for bail-out programs and drew a cumulated €78 billion from the IMF, the EFSM, and the EFSF. Portugal exited the bailout in May 2014, the same year that positive economic growth re-appeared following three years of recession. The government achieved a 2.1% budget deficit in 2016 and in 2017 the economy grew 2.7%.

Abenomics refers to the economic policies implemented by the Government of Japan led by the Liberal Democratic Party (LDP) since the December 2012 general election. They are named after Shinzō Abe (1954–2022), who had been appointed as Prime Minister of Japan on his second term from 2012 to 2020. Abe was the longest-serving prime minister in Japanese history. After Abe resigned in September 2020, his successor, Yoshihide Suga, stated that his premiership would focus on continuing the policies and goals of the Abe administration, including the Abenomics suite of economic policies.

The early 1990s recession saw a period of economic downturn affect much of the world in the late 1980s and early 1990s. The economy of Australia suffered its worst recession since the Great Depression.

The Kansas experiment was a name given to a controversial and widely noted tax-cutting policy/agenda of Kansas Governor Sam Brownback that began with Brownback signing a bill cutting state taxes, in May 2012, and ended with the Kansas legislature's repeal of the bill in June 2017. It was one of the largest income tax cuts in the state's history. The Kansas experiment has also been called the "Great Kansas Tax Cut Experiment", the "Red-state experiment", "the tax experiment in Kansas", and "one of the cleanest experiments for how tax cuts affect economic growth in the U.S." The cuts were based on model legislation published by the conservative American Legislative Exchange Council (ALEC), supported by supply-side economist Arthur Laffer, anti-tax leader Grover Norquist, and the influential industrialists Charles and David Koch. The law cut taxes by US$231 million in its first year, and cuts were projected to total US$934 million annually after six years, by eliminating taxes on business income for the owners of almost 200,000 businesses and cutting individual income tax rates.

The economic policy of the Donald Trump administration was characterized by the individual and corporate tax cuts, attempts to repeal the Affordable Care Act ("Obamacare"), trade protectionism, deregulation focused on the energy and financial sectors, and responses to the COVID-19 pandemic.