A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship includes all new businesses including self-employment and businesses that do not intend to go public, startups are new businesses that intend to grow large beyond the solo-founder. During the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to become successful and influential, such as unicorns.

Venture capital (VC) is a form of private equity financing provided by firms or funds to startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovative technology or business model and they are often from high technology industries, such as information technology (IT), clean technology or biotechnology.

Sequoia Capital is an American venture capital firm headquartered in Menlo Park, California which specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors. As of 2022, the firm had approximately US$85 billion in assets under management.

A business incubator is an organization that helps startup companies and individual entrepreneurs to develop their businesses by providing a fullscale range of services, starting with management training and office space, and ending with venture capital financing. The National Business Incubation Association (NBIA) defines business incubators as a catalyst tool for either regional or national economic development. NBIA categorizes its members' incubators by the following five incubator types: academic institutions; non-profit development corporations; for-profit property development ventures; venture capital firms, and a combination of the above.

Christopher Sacca is an American venture investor, company advisor, entrepreneur, and lawyer. He is the proprietor of Lowercase Capital, a venture capital fund in the United States that has invested in seed and early-stage technology companies such as Twitter, Uber, Instagram, Twilio, and Kickstarter, investments that resulted in his placement as No. 2 on Forbes' Midas List: Top Tech Investors for 2017. Sacca held several positions at Google Inc., where he led the alternative access and wireless divisions and worked on mergers and acquisitions. Between 2015 and 2020, he appeared as a "Guest Shark" on ABC's Shark Tank. In early 2017, Sacca announced that he was retiring from venture investing. In 2021, Sacca announced that he was back into venture investing with a focus on Climate issues.

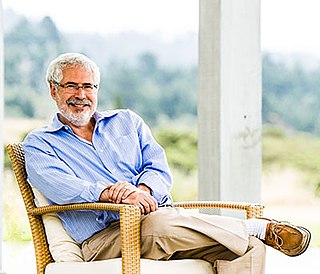

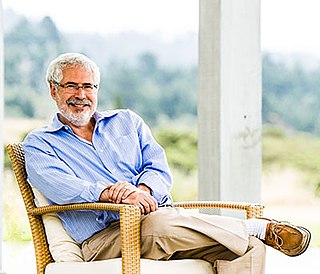

Steve Blank is an American entrepreneur, educator, author and speaker. He created the customer development method that launched the lean startup movement. His work has influenced modern entrepreneurship through the creation of tools and processes for new ventures which differ from those used in large companies.

Accel, formerly known as Accel Partners, is an American venture capital firm. Accel works with startups in seed, early and growth-stage investments. The company has offices in Palo Alto, California and San Francisco, California, with additional operating funds in London, India and China.

Greylock Partners, LLC is one of the oldest venture capital firms, founded in 1965, with committed capital of over $3.5 billion under management. The firm focuses on early-stage companies in consumer and enterprise software.

GGV Capital was an American venture capital firm. The firm was established in 2000 and was headquartered in Menlo Park, California. Formerly known as Granite Global Ventures, the firm had become one of the most active American investors in the Chinese artificial intelligence industry.

James W. Breyer is an American venture capitalist, founder and chief executive officer of Breyer Capital, an investment and venture philanthropy firm, and a former managing partner at Accel Partners, a venture capital firm. Breyer has invested in over 40 companies that have gone public or completed a merger, with some of these investments, including Facebook, earning over 100 times cost and many others over 25 times cost. On the Forbes 2021 list of the 400 richest Americans, he was ranked #389, with a net worth of US$2.9 billion.

Mark Suster is an American businessman and investor. He is a managing partner at Upfront Ventures, the largest venture capital firm in Los Angeles. Aside from his business career, Suster is also a prominent blogger in the American high-technology startup scene and venture capital world.

Uncork Capital is a venture capital firm based in San Francisco, California, founded by Jeff Clavier. Considered one of the most active established seed funds in Silicon Valley, it has invested in companies such as Postmates, Eventbrite, Fitbit, and SendGrid.

Aileen Lee is a U.S. venture capital angel investor and co-founder of Cowboy Ventures.

Women in venture capital or VC are investors who provide venture capital funding to startups. Women make up a small fraction of the venture capital private equity workforce. A widely used source for tracking the number of women in venture capital is the Midas List which has been published by Forbes since 2001. Research from Women in VC, a global community of women venture investors, shows that the percentage of female VC partners is just shy of 5 percent.

Social Capital, formerly known as Social+Capital Partnership, is a venture capital firm based in Palo Alto, California. The firm specializes in technology startups, providing seed funding, venture capital, and private equity.

Shervin Kordary Pishevar is an Iranian-American entrepreneur, venture capitalist, super angel investor, and philanthropist. He is the co-founder and former executive chairman of Hyperloop One and a co-founder and managing director of Sherpa Capital, a venture capital fund which has invested in companies including Airbnb, Uber, GoPuff, Cue Health, Slack, Robinhood, Munchery and Postmates.

Fusion VC is a venture capital firm and an accelerator for Israeli startups in the United States. It was founded in 2017 and is headquartered in the United States with offices in Israel.

Ironclad is a software as a service company that makes contract management software. Founded in 2014 and headquartered in San Francisco, California, Ironclad provides a platform for legal and business teams to create, store, and manage contracts online in a process known as contract lifecycle management.

Janet Bannister is a Canadian business executive and venture capitalist.

The Series Seed Documents were created by Ted Wang and Marc Andreessen in 2010. This set of legal documents are used to help new companies raise money from investors.