Related Research Articles

A lien is a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation. The owner of the property, who grants the lien, is referred to as the lienee and the person who has the benefit of the lien is referred to as the lienor or lien holder.

A mortgage is a legal instrument which is used to create a security interest in real property held by a lender as a security for a debt, usually a loan of money. A mortgage in itself is not a debt, it is the lender's security for a debt. It is a transfer of an interest in land from the owner to the mortgage lender, on the condition that this interest will be returned to the owner when the terms of the mortgage have been satisfied or performed. In other words, the mortgage is a security for the loan that the lender makes to the borrower.

Title insurance is a form of indemnity insurance predominantly found in the United States and Canada which insures against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage loans. Unlike some land registration systems in countries outside the United States, US states' recorders of deeds generally do not guarantee indefeasible title to those recorded titles. Title insurance will defend against a lawsuit attacking the title or reimburse the insured for the actual monetary loss incurred up to the dollar amount of insurance provided by the policy.

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

A lease is a contractual arrangement calling for the lessee (user) to pay the lessor (owner) for use of an asset. Property, buildings and vehicles are common assets that are leased. Industrial or business equipment is also leased.

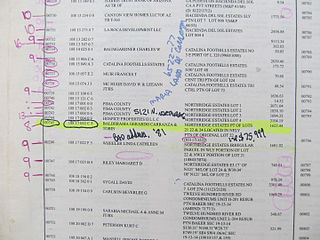

A tax lien is a lien imposed by law upon a property to secure the payment of taxes. A tax lien may be imposed for delinquent taxes owed on real property or personal property, or as a result of failure to pay income taxes or other taxes.

A mechanic's lien is a security interest in the title to property for the benefit of those who have supplied labor or materials that improve the property. The lien exists for both real property and personal property. In the realm of real property, it is called by various names, including, generically, construction lien. It is also called a materialman's lien or supplier's lien when referring to those supplying materials, a laborer's lien when referring to those supplying labor, and a design professional's lien when referring to architects or designers who contribute to a work of improvement. In the realm of personal property, it is also called an artisan's lien. The term "lien" comes from a French root, with a meaning similar to link; it is related to "liaison". Mechanic's liens on property in the United States date from the 18th century.

In property law, a concurrent estate or co-tenancy is any of various ways in which property is owned by more than one person at a time. If more than one person owns the same property, they are commonly referred to as co-owners. Legal terminology for co-owners of real estate is either co-tenants or joint tenants, with the latter phrase signifying a right of survivorship. Most common law jurisdictions recognize tenancies in common and joint tenancies.

Repossession, colloquially repo, is a "self-help" type of action - mainly in the U.S. - in which the party having right of ownership of the property in question takes the property back from the party having right of possession without invoking court proceedings. The property may then be sold by either the financial institution or third party sellers.

In real estate business and law, a title search or property title search is the process of retrieving documents evidencing events in the history of a piece of real property, to determine relevant interests in and regulations concerning that property.

Equitable remedies are judicial remedies developed by courts of equity from about the time of Henry VIII to provide more flexible responses to changing social conditions than was possible in precedent-based common law.

In Mechanics lien law a Preliminary Notice is a notice sent by the general contractor, subcontractor, materialmen, equipment lessors or other parties to a construction project not to create a Mechanics lien but rather to establish the right to file a Mechanics lien in the event of nonpayment. The distinction is important. If the Preliminary Notice is sent but the claimant's bill is paid, the Preliminary Notice has no further legal effect. However, if the bill is not paid the claimant may now file a Mechanics lien on the owner's property. Most states do not allow the filing of a Mechanics lien without claimants being able to prove they first sent a Preliminary Notice.

A tax sale is the forced sale of property by a governmental entity for unpaid taxes by the property's owner.

A short sale is a sale of real estate in which the net proceeds from selling the property will fall short of the debts secured by liens against the property. In this case, if all lien holders agree to accept less than the amount owed on the debt, a sale of the property can be accomplished.

Affreightment is a legal term used in shipping.

The Home Equity Theft Prevention Act is a New York State law passed on July 26, 2006, to provide homeowners of residential property with information and disclosures in order to make informed decisions when approached by persons seeking a sale or transfer of the homeowner's property, particularly when homeowners are in default on their mortgage payments or the property is in foreclosure.

The vast majority of states in the United States employ a system of recording legal instruments that affect the title of real estate as the exclusive means for publicly documenting land titles and interests. This system differs significantly from land registration systems, such as the Torrens system that have been adopted in a few states. The principal difference is that the recording system does not determine who owns the title or interest involved, which is ultimately determined through litigation in the courts. The system provides a framework for determining who the law will protect in relation to those titles and interests when a dispute arises.

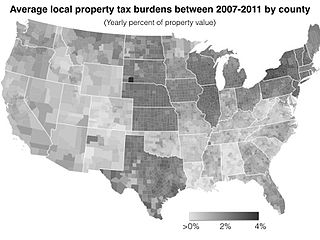

Most local governments in the United States impose a property tax, also known as a millage rate, as a principal source of revenue. This tax may be imposed on real estate or personal property. The tax is nearly always computed as the fair market value of the property times an assessment ratio times a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners. For the taxing authority, one advantage of the property tax over the sales tax or income tax is that the revenue always equals the tax levy, unlike the other taxes. The property tax typically produces the required revenue for municipalities' tax levies. A disadvantage to the taxpayer is that the tax liability is fixed, while the taxpayer's income is not.

American Tax Funding (ATF) is a private company based in Jupiter, Florida that engages in the purchasing and servicing of delinquent municipal real estate tax lien sales. Originally formed in 1997 as Transamerica Municipal Finance (TMF), a division of Transamerica Corporation. In August 2000 the founders completed a form of a management buyout of TMF, creating ATF. ATF currently buys and services real estate tax liens in over 14 states and has provided over $1 billion in relief to local governments. Many ATF tax liens are secured by either Wells Fargo Foot Hill or the Harris Nesbitt Corporation. The process of privatizing the municipal tax foreclosures process and outsourcing to out of state third party, for-profit, private companies has drawn criticism from housing advocates who argue that a for-profit tax foreclosure process leads to more foreclosures, displacement and vacancy. The other argument is that third party purchases of tax liens enables local governments to pay for essential services such as salaries for teachers, health care, police officers and firefighters. To date, no study has shown that the sale of tax liens to third parties leads to any increase in foreclosure activity. In fact, the sale of liens to third party purchasers often extends redemption periods and allows flexible repayment agreements for delinquent tax payers.

In Mechanics lien law a Notice of Intent to Lien is a type of preliminary notice that warns the property owner, prime contractor, and/or other party on a construction that a mechanics lien or bond claim will be filed unless overdue payments are made within a certain period of time.

References

- ↑ Wolfe, Jr., Scott (January 20, 2020). "How To Prepare & Send Texas Monthly Notices – Texas Notices Explained". Levelset.