The New York Times Best Seller list is widely considered the preeminent list of best-selling books in the United States. It has been published weekly in The New York Times Book Review since October 12, 1931. In the 21st century, it has evolved into multiple lists, grouped by genre and format, including fiction and non-fiction, hardcover, paperback and electronic.

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information.

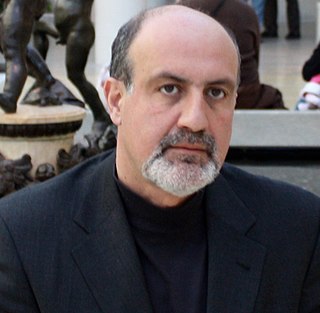

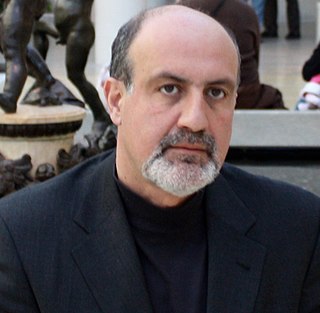

Nassim Nicholas Taleb is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty. The Sunday Times called his 2007 book The Black Swan one of the 12 most influential books since World War II.

A bestseller is a book or other media noted for its top selling status, with bestseller lists published by newspapers, magazines, and book store chains. Some lists are broken down into classifications and specialties. An author may also be referred to as a bestseller if their work often appears in a list. Well-known bestseller lists in the U.S. are published by Publishers Weekly, USA Today, The New York Times and The Washington Post. Most of these lists track book sales from national and independent bookstores, as well as sales from major internet retailers such as Amazon.com and Barnes & Noble.

Robert J. Ringer is an American entrepreneur, motivational and political speaker, and author of several best-selling personal-development and political books.

Kenneth Lawrence Fisher is an American billionaire investment analyst, author, and the founder and chairman of Fisher Investments, a fee-only financial adviser. Fisher's Forbes "Portfolio Strategy" column ran from 1984 to 2017, making him the longest continuously-running columnist in the magazine's history. Fisher has authored eleven books on investing, and research papers in the field of behavioral finance. He is on the Forbes 400 list of richest Americans and as of 2020 is worth $4.3 billion. In 2010, he was named to Investment Advisor magazine's "30 for 30" list of the 30 most influential people in the investment advisory business over the last 30 years. As of September 2020, Fisher's firm managed $135 billion.

Stephen T. McClellan is a prominent American securities analyst. He was a first vice president at Merrill Lynch for 18 years, and ranked on the Institutional Investor All-American Research Team 19 consecutive years, the Wall Street Journal Poll for seven years, and is in the Journal's Hall of Fame.

CAN SLIM refers to the acronym developed by the American stock research and education company Investor's Business Daily (IBD). IBD claims CANSLIM represents the seven characteristics that top-performing stocks often share before making their biggest price gains. It was developed in the 1950s by Investor's Business Daily founder William O'Neil. The method was named the top-performing investment strategy from 1998-2009 by the American Association of Individual Investors. In 2015, an exchange-traded fund (ETF) was launched focusing on the companies listed on the IBD 50, a computer generated list published by Investors Business Daily that highlights stocks based on the CAN SLIM investment criteria.

David Meerman Scott is an American online marketing strategist and author of several books on marketing, including The New Rules of Marketing and PR.

Jay Papasan is an American writer and business executive. He is best known for co-authoring, with Gary Keller, books such as The Millionaire Real Estate Investor, which both became a New York Times best-seller and a BusinessWeek best-seller, and The ONE Thing, which reached #1 on the Wall Street Journal business best-seller list. Papasan is the vice president of publishing and executive editor at KellerINK, the publishing arm of Keller Williams Realty. He and his wife Wendy are owners of The Papasan Real Estate Team. In 2014 he was named one of the Most Powerful People in Real Estate by Swanepoel Power 200.

Lawrence 'Larry' G. McDonald is a New York Times bestselling author and CNBC contributor, currently founder of 'The Bear Traps Report', an investment newsletter focused on Political and Systemic Risk with actionable trade ideas and Macro perspective. Former Head of U.S. Macro Strategy at Societe Generale and former vice-president of distress debt and convertible securities trading at Lehman Brothers.

What the Dog Saw: And Other Adventures is the fourth book released by author Malcolm Gladwell, on October 20, 2009. The book is a compilation of the journalist's articles published in The New Yorker.

Delivering Happiness: A Path to Profits, Passion, and Purpose (2010) is a book by Zappos CEO Tony Hsieh. It details his life as an entrepreneur, with emphasis on the founding of LinkExchange and Zappos.

The 4-Hour Body: An Uncommon Guide to Rapid Fat-Loss, Incredible Sex, and Becoming Superhuman is a nonfiction book by American writer Tim Ferriss. It was published by Crown Publishing Group in 2010.

Start-up Nation: The Story of Israel's Economic Miracle is a 2009 book by Dan Senor and Saul Singer about the economy of Israel. It examines how Israel, a 60-year-old nation with a population of 7.1 million, was able to reach such economic growth that "at the start of 2009, some 63 Israeli companies were listed on the NASDAQ, more than those of any other foreign country."

ResultSource is a San Diego-based book marketing company that conducts "bestseller campaigns" on behalf of authors. The company states "'We create campaigns that reach a specific goal, like: "On the bestsellers list," or "100,000 copies sold.'" For example, for a negotiated fee ResultSource will guarantee that a book becomes a bestseller. It does this through bulk book buying programs designed to manipulate the metrics used by Nielsen BookScan and the New York Times Best Seller list, among other strategies. As a result of ResultSource's business practices, Amazon.com has stopped doing business with the company. The company was founded by Kevin Small.

The Organized Mind: Thinking Straight in the Age of Information Overload is a bestselling popular science book written by the McGill University neuroscientist Daniel J. Levitin, PhD, and first published by Dutton Penguin in the United States and Canada in 2014. It is Levitin's 3rd consecutive best-seller, debuting at #2 on the New York Times Best Seller List, #1 on the Canadian best-seller lists, #1 on Amazon, and #5 on The London Times bestseller list.

Crippled America: How to Make America Great Again is a non-fiction book by businessman Donald Trump, first published in hardcover by Simon & Schuster in 2015. A revised edition was subsequently republished eight months later in trade paperback format under the title Great Again: How to Fix Our Crippled America. Like his previous work Time to Get Tough (2011) did for the U.S. presidential election in 2012, Crippled America outlined Trump's political agenda as he ran in the 2016 election on a conservative platform.

Midas Touch: Why Some Entrepreneurs Get Rich — And Why Most Don't is a non-fiction book about personal finance, co-authored by Donald Trump and Robert Kiyosaki. The book was published in hardcover format in 2011. The coauthors became familiar with each other through mutual work at The Learning Annex, and The Art of the Deal. Trump was impressed by Kiyosaki's writing success with Rich Dad Poor Dad. The coauthors then wrote Why We Want You to be Rich together in 2006, and followed it up with Midas Touch in 2011.

What Happened is a 2017 memoir by Hillary Clinton about her experiences as the Democratic Party's nominee and general election candidate for President of the United States in the 2016 election. Published on September 1, 2017, it is her seventh book with her publisher, Simon & Schuster.