Related Research Articles

In economics, cash is money in the physical form of currency, such as banknotes and coins.

The Australian dollar is the official currency and legal tender of Australia, including all of its external territories, and three independent sovereign Pacific Island states: Kiribati, Nauru, and Tuvalu. In April 2022, it was the sixth most-traded currency in the foreign exchange market and as of Q4 2023 the seventh most-held reserve currency in global reserves.

Federal Reserve Notes are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System. The Reserve Banks then circulate the notes to their member banks, at which point they become liabilities of the Reserve Banks and obligations of the United States.

A United States Note, also known as a Legal Tender Note, is a type of paper money that was issued from 1862 to 1971 in the United States. Having been current for 109 years, they were issued for longer than any other form of U.S. paper money other than the currently issued Federal Reserve Note. They were known popularly as "greenbacks", a name inherited from the earlier greenbacks, the Demand Notes, that they replaced in 1862. Often termed Legal Tender Notes, they were named United States Notes by the First Legal Tender Act, which authorized them as a form of fiat currency. During the early 1860s the so-called second obligation on the reverse of the notes stated:

This Note is a Legal Tender for all debts public and private except Duties on Imports and Interest on the Public Debt; and is receivable in payment of all loans made to the United States.

A banknote – also called a bill, paper money, or simply a note – is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand. Banknotes were originally issued by commercial banks, which were legally required to redeem the notes for legal tender when presented to the chief cashier of the originating bank. These commercial banknotes only traded at face value in the market served by the issuing bank. Commercial banknotes have primarily been replaced by national banknotes issued by central banks or monetary authorities.

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt.

The Reserve Bank of India, abbreviated as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. Owned by the Ministry of Finance, Government of India, it is responsible for the control, issue and maintaining supply of the Indian rupee. It also manages the country's main payment systems and works to promote its economic development. Bharatiya Reserve Bank Note Mudran (BRBNM) is a specialised division of RBI through which it prints and mints Indian currency notes (INR) in two of its currency printing presses located in Mysore and Salboni. The RBI, along with the Indian Banks' Association, established the National Payments Corporation of India to promote and regulate the payment and settlement systems in India. Deposit Insurance and Credit Guarantee Corporation was established by RBI as one of its specialized division for the purpose of providing insurance of deposits and guaranteeing of credit facilities to all Indian banks.

The Indian rupee is the official currency in India. The rupee is subdivided into 100 paise. The issuance of the currency is controlled by the Reserve Bank of India. The Reserve Bank manages currency in India and derives its role in currency management based on the Reserve Bank of India Act, 1934.

The pound was the currency of New Zealand from 1933 until 1967, when it was replaced by the New Zealand dollar. Prior to this, New Zealand used the pound sterling since the Treaty of Waitangi in 1840. Like the pound sterling, it was subdivided into 20 shillings each of 12 pence.

Ireland has a history of trading its own banknotes for several centuries, both when the whole of Ireland was one legal entity, and following partition of the island into the Republic of Ireland and Northern Ireland. Notes have been issued by individual banks and by state agencies of the Republic of Ireland and the United Kingdom. Currently, various commercial banks in Northern Ireland locally issue notes of the Pound sterling, while the Central Bank of Ireland, in the Republic of Ireland, issues local euro banknotes.

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

The Revised Standard Reference Guide to Indian Paper Money is a 2012 book by Rezwan Razack and Kishore Jhunjhunwalla. The book is a comprehensive compilation of facts, milestones, and other details regarding paper money in India. It was published in India by Coins & Currencies. Kishore Jhunjhunwalla and Rezwan Razack are avid collectors of Indian currency. The book traces the evolution of Indian currency dating back to 1770. It captures the various nuances of modern-day currency as well as incidents that helped shape this sector over the years. The book is in its second edition—the first was authored by Jhunjhunwalla, whose collection was later purchased by Rezwan Razack. The revised edition was published after 10 years of research. The book was introduced to the public by Uma Shankar, Regional Director of the Reserve Bank of India on 13 January 2012.

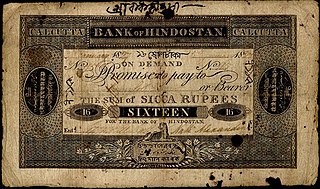

Bank of Hindostan (1770–1832), a now defunct bank, was the third oldest bank in India.

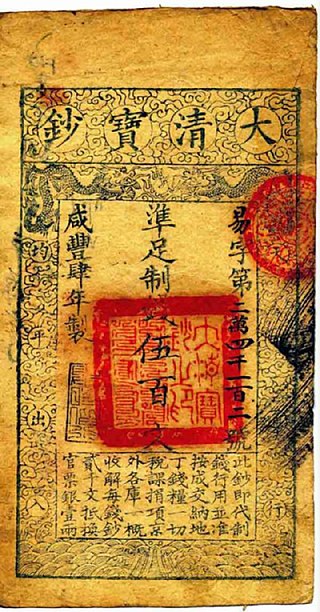

The paper money of the Qing dynasty was periodically used alongside a bimetallic coinage system of copper-alloy cash coins and silver sycees; paper money was used during different periods of Chinese history under the Qing dynasty, having acquired experiences from the prior Song, Jin, Yuan, and Ming dynasties which adopted paper money but where uncontrolled printing led to hyperinflation. During the youngest days of the Qing dynasty paper money was used but this was quickly abolished as the government sought not to repeat history for a fourth time; however, under the reign of the Xianfeng Emperor, due to several large wars and rebellions, the Qing government was forced to issue paper money again.

The Great Qing Treasure Note or Da-Qing Baochao refers to a series of Qing dynasty banknotes issued under the reign of the Xianfeng Emperor issued between the years 1853 and 1859. These banknotes were all denominated in wén and were usually introduced to the general market through the salaries of soldiers and government officials.

The General Bank of Bengal and Bihar was a bank in British India that operated between 1773 and 1775.

The Bengal Bank was a bank founded in 1784 in British India. The bank was the fifth oldest bank in India.

Many European trading companies came to India's during the 18th century. These trading companies set up private banks which issued paper currencies in Indian subcontinent first. But these notes were text-based. Charles Canning, 1st Earl Canning first introduced paper currency in Indian subcontinent in 1861 officially.

The Commercial Bank was a bank founded in the year 1819 in British India. The bank was the eleventh oldest bank in India.

The Calcutta Bank was a bank founded in the year 1824 in British India. The bank was the twelfth oldest bank in India.

References

- ↑ "Reserve Bank of India". www.rbi.org.in.

- 1 2 "Cash of the titans: How India's paper money came to be". Hindustan Times. 26 March 2021.

- ↑ Burange, L. G.; Ranadive, Rucha R. (December 2011). "Indian Currency, Exchange Rate Regime and Policy: A Retrospective View" (PDF). University of Mumbai.

- ↑ "Dose of history: How paper currency came in India 150 years ago". India Today. 22 November 2016.