The net present value (NPV) or net present worth (NPW) is a way of measuring the value of an asset that has cashflow by adding up the present value of all the future cash flows that asset will generate. The present value of a cash flow depends on the interval of time between now and the cash flow because of the Time value of money. It provides a method for evaluating and comparing capital projects or financial products with cash flows spread over time, as in loans, investments, payouts from insurance contracts plus many other applications.

Value at risk (VaR) is a measure of the risk of loss of investment/Capital. It estimates how much a set of investments might lose, given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses.

In financial markets, market impact is the effect that a market participant has when it buys or sells an asset. It is the extent to which the buying or selling moves the price against the buyer or seller, i.e., upward when buying and downward when selling. It is closely related to market liquidity; in many cases "liquidity" and "market impact" are synonymous.

The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading period. The indicator should not be confused with relative strength.

In statistics, a moving average is a calculation to analyze data points by creating a series of averages of different selections of the full data set. Variations include: simple, cumulative, or weighted forms.

Alpha is a measure of the active return on an investment, the performance of that investment compared with a suitable market index. An alpha of 1% means the investment's return on investment over a selected period of time was 1% better than the market during that same period; a negative alpha means the investment underperformed the market. Alpha, along with beta, is one of two key coefficients in the capital asset pricing model used in modern portfolio theory and is closely related to other important quantities such as standard deviation, R-squared and the Sharpe ratio.

In finance, volume-weighted average price (VWAP) is the ratio of the value of a security or financial asset traded to the total volume of transactions during a trading session. It is a measure of the average trading price for the period.

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This type of trading attempts to leverage the speed and computational resources of computers relative to human traders. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. A study in 2019 showed that around 92% of trading in the Forex market was performed by trading algorithms rather than humans.

Average true range (ATR) is a technical analysis volatility indicator originally developed by J. Welles Wilder, Jr. for commodities. The indicator does not provide an indication of price trend, simply the degree of price volatility. The average true range is an N-period smoothed moving average (SMMA) of the true range values. Wilder recommended a 14-period smoothing.

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows which the investor receives from that investment over a specified time period, such as interest payments, coupons, cash dividends and stock dividends. It may be measured either in absolute terms or as a percentage of the amount invested. The latter is also called the holding period return.

An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or cryptocurrency exchange. These instructions can be simple or complicated, and can be sent to either a broker or directly to a trading venue via direct market access. There are some standard instructions for such orders.

Dollar cost averaging (DCA) is an investment strategy that aims to apply value investing principles to regular investment. The term was first coined by Benjamin Graham in his book The Intelligent Investor. Graham writes that dollar cost averaging "means simply that the practitioner invests in common stocks the same number of dollars each month or each quarter. In this way he buys more shares when the market is low than when it is high, and he is likely to end up with a satisfactory overall price for all his holdings."

Best execution refers to the duty of an investment services firm executing orders on behalf of customers to ensure the best execution possible for their customers' orders. Some of the factors the broker must consider when seeking best execution of their customers' orders include: the opportunity to get a better price than what Is currently quoted, and the likelihood and speed of execution.

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in over-the-counter (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts.

An automated trading system (ATS), a subset of algorithmic trading, uses a computer program to create buy and sell orders and automatically submits the orders to a market center or exchange. The computer program will automatically generate orders based on predefined set of rules using a trading strategy which is based on technical analysis, advanced statistical and mathematical computations or input from other electronic sources.

In finance, volatility is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns.

The modified Dietz method is a measure of the ex post performance of an investment portfolio in the presence of external flows.

Smart order routing (SOR) is an automated process of handling orders, aimed at taking the best available opportunity throughout a range of different trading venues.

Transaction cost analysis (TCA), as used by institutional investors, is defined by the Financial Times as "the study of trade prices to determine whether the trades were arranged at favourable prices – low prices for purchases and high prices for sales". It is often split into two parts – pre-trade and post-trade. Recent regulations, such as the European Markets in Financial Instruments Directive, have required institutions to achieve best execution.

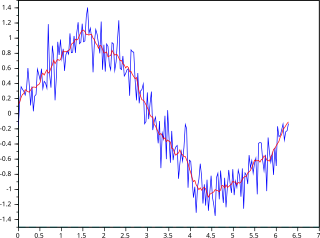

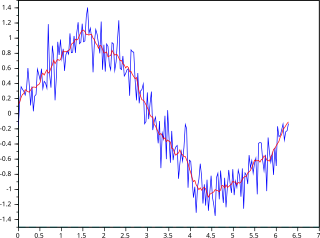

Alpha profiling is an application of machine learning to optimize the execution of large orders in financial markets by means of algorithmic trading. The purpose is to select an execution schedule that minimizes the expected implementation shortfall, or more generally, ensures compliance with a best execution mandate. Alpha profiling models learn statistically-significant patterns in the execution of orders from a particular trading strategy or portfolio manager and leverages these patterns to associate an optimal execution schedule to new orders. In this sense, it is an application of statistical arbitrage to best execution. For example, a portfolio manager specialized in value investing may have a behavioral bias to place orders to buy while an asset is still declining in value. In this case, a slow or back-loaded execution schedule would provide better execution results than an urgent one. But this same portfolio manager will occasionally place an order after the asset price has already begun to rise in which case it should best be handled with urgency; this example illustrates the fact that Alpha Profiling must combine public information such as market data with private information including as the identity of the portfolio manager and the size and origin of the order, to identify the optimal execution schedule.