A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. For most of its history, the exchange was in the then common form of a non-profit organization, owned by members of the exchange. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

A commodity price index is a fixed-weight index or (weighted) average of selected commodity prices, which may be based on spot or futures prices. It is designed to be representative of the broad commodity asset class or a specific subset of commodities, such as energy or metals. It is an index that tracks a basket of commodities to measure their performance. These indexes are often traded on exchanges, allowing investors to gain easier access to commodities without having to enter the futures market. The value of these indexes fluctuates based on their underlying commodities, and this value can be traded on an exchange in much the same way as stock index futures.

An energy derivative is a derivative contract based on an underlying energy asset, such as natural gas, crude oil, or electricity. Energy derivatives are exotic derivatives and include exchange-traded contracts such as futures and options, and over-the-counter derivatives such as forwards, swaps and options. Major players in the energy derivative markets include major trading houses, oil companies, utilities, and financial institutions.

Central Japan Commodity Exchange (C-COM) was a futures exchange based in Nagoya, Japan that closed in 2011.

Multi Commodity Exchange of India Ltd (MCX) is a commodity exchange based in India. It was established in 2003 by the Government of India and is currently based in Mumbai. It is India's largest commodity derivatives exchange. The average daily turnover of commodity futures contracts increased by 26% to ₹32,424 crore during FY2019-20, as against ₹25,648 crore in FY2018-19. The total turnover of commodity futures traded on the Exchange stood at ₹83.98 lakh crore in FY2019-20. MCX offers options trading in gold and futures trading in non-ferrous metals, bullion, energy, and a number of agricultural commodities.

Pakistan Mercantile Exchange Limited is Pakistan's first futures commodity market having its registered Head office in Karachi, Sindh. It is the only company in Pakistan to provide a centralized and regulated place for commodity futures trading and is regulated by Securities and Exchange Commission of Pakistan (SECP). It has started full trading activities on 11 May 2007.

The Shanghai Futures Exchange was formed from the amalgamation of the national level futures exchanges of China, the Shanghai Metal Exchange, Shanghai Foodstuffs Commodity Exchange, and the Shanghai Commodity Exchange in December 1999. It is a non-profit-seeking incorporated body regulated by the China Securities Regulatory Commission.

In May 2006, Deutsche Bank launched a new set of commodity index products called the Deutsche Bank Liquid Commodities Indices Optimum Yield, or DBLCI-OY'. The DBLCI-OY indices are available for 24 commodities drawn from the energy, precious metals, industrial metals, agricultural and livestock sectors. A DBLCI-OY index based on the DBLCI benchmark weights is also available and the optimum yield technology has also been applied to the energy, precious metals, industrial metals and agricultural sector indices. Like the DBLCI, the DBLCI-OY is available in USD, EUR, GBP and JPY on a hedged and un-hedge basis. The DBLCI-OY is rebalanced on the fifth index business day of November when each commodity is adjusted to its base weight. The DBLCI-OY is also listed as an exchange-traded fund (ETF) on the American Stock Exchange.

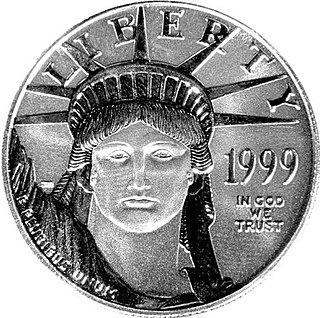

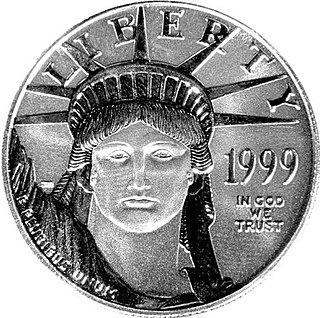

Platinum as an investment is often compared in financial history to gold and silver, which were both known to be used as money in ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold and approximately 60–100 times scarcer than silver, on the basis of annual mine production. Since 2014, platinum prices have fallen lower than gold. Approximately 75% of global platinum is mined in South Africa.

Hong Kong Mercantile Exchange was an electronic commodities exchange established in Hong Kong for the trading of commodity futures, options and other financial derivatives. The exchange was originally pitched as a platform to trade oil futures. In fact, it ended up trading mainly silver and gold futures.

The Iran Mercantile Exchange is a commodities exchange located in Tehran, Iran.

The London bullion market is a wholesale over-the-counter market for the trading of gold, silver, platinum and palladium. Trading is conducted amongst members of the London Bullion Market Association (LBMA), loosely overseen by the Bank of England. Most of the members are major international banks or bullion dealers and refiners.

The Dubai Gold & Commodities Exchange (DGCX) is a financial and commodity derivatives exchange located in Dubai, the United Arab Emirates. DGCX commenced trading in November 2005 as the first derivatives exchange in the Middle East and North Africa (MENA) region. The Exchange is owned by the Dubai Multi Commodities Centre (DMCC).

Japan Exchange Group, Inc., abbreviated as JPX or Nippon Torihikijo, is a Japanese "financial instruments exchange holding company" subject to the regulations of the Financial Instruments and Exchange Act enforced by the Financial Services Agency. JPX owns three licensed "financial instruments exchange" corporations: Tokyo Stock Exchange, Inc. (TSE), Osaka Exchange, Inc. (OSE), and Tokyo Commodity Exchange, Inc. (TOCOM). It was formed by the merger of TSE and OSE on January 1, 2013. As a result of this merger and market reorganization, TSE became the sole securities exchange of JPX and OSE became the largest derivatives exchange of JPX. In 2019, JPX acquired TOCOM to expand derivatives trading business in the commodity market. It also has an IT services and research arm, JPX Market Innovation & Research, Inc. (JPXI), a self-regulatory body, Japan Exchange Regulation (JPX-R), and a central clearing counterparty, Japan Securities Clearing Corporation (JSSC). As of June 2021, it is the world's fifth-largest stock exchange operator, behind NYSE, NASDAQ, SSE, and HKSE.

Indonesia Commodity and Derivatives Exchange (ICDX) (Indonesian: Bursa Komoditi dan Derivatif Indonesia) is the commodity and derivatives based exchange in Indonesia.

Osaka Dojima Exchange, Inc. (ODEX), formerly known as Osaka Dojima Commodity Exchange (ODEX) until 10 August 2021, is a futures exchange based in Osaka, Japan. It started as the Osaka Grain Exchange in 1952. In 1993 it merged with the Osaka Sugar Exchange and the Kobe Grain Exchange, taking the name Kansai Agricultural Commodities Exchange. The exchange merged with the Kobe Raw Silk Exchange in 1997, becoming the Kansai Commodities Exchange (KEX), and with the Fukuoka Commodities Exchange in 2006. In February 2013 it took over the rice exchange from the Tokyo Grain Exchange and renamed Osaka Dojima Commodity Exchange. For most of its history, this exchange was a membership organization owned by members of the exchange, but it demutualized and became a business corporation named Osaka Dojima Commodity Exchange, Inc. on 1 April 2021. In August 2021, the company took its current name, Osaka Dojima Exchange, Inc.