Related Research Articles

CIBC World Markets Inc. is the investment banking subsidiary of the Canadian Imperial Bank of Commerce. The firm operates as an investment bank both in the domestic and international equity and debt capital markets. The firm provides a variety of financial services including credit and capital market products, mergers and acquisitions, merchant banking and other investment banking advisory services.

Financial risk management is the practice of economic value in a firm by using financial instruments to manage exposure to risk: operational risk, credit risk and market risk, foreign exchange risk, shape risk, volatility risk, liquidity risk, inflation risk, business risk, legal risk, reputational risk, sector risk etc. Similar to general risk management, financial risk management requires identifying its sources, measuring it, and plans to address them.

Investment management is the professional asset management of various securities and other assets in order to meet specified investment goals for the benefit of the investors. Investors may be institutions or private investors.

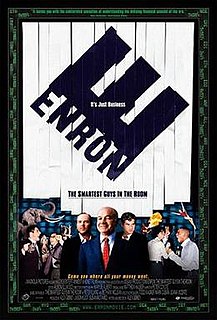

Enron: The Smartest Guys in the Room is a 2005 American documentary film based on the best-selling 2003 book of the same name by Fortune reporters Bethany McLean and Peter Elkind, a study of one of the largest business scandals in American history. McLean and Elkind are credited as writers of the film alongside the director, Alex Gibney.

James D. Sinegal, also known as Jim Sinegal, is a retired American billionaire businessman who is the co-founder and former CEO of the Costco Wholesale Corporation, an international retail chain.

Nicholas D. Chabraja is an American lawyer and former Chief Executive Officer of General Dynamics Corporation.

Renaissance Capital is an emerging and frontier markets focused investment bank founded in 1995 in Russia. The firm has offices in Moscow, London, New York, Lagos, Nairobi, Johannesburg, Cape Town, Dubai, Cairo and Nicosia.

Within the finance industry, professional designations have served as external validation of expertise for decades, and the literature supports the importance of these professional designations within the larger finance community. As the field of finance has increased in complexity in recent years, the number of available designations has also increased. Correspondingly, some will have more recognition than others. Following is a partial list of professional certifications in financial services; see Category:Professional certification in finance for all articles. Note that in the US, many state securities and insurance regulators do not allow financial professionals to use a designation —in particular a "senior" designation — unless it has been accredited by either the American National Standards Institute or the National Commission for Certifying Agencies.

Martin Steven Fridson is an American author known for his application of rigorous financial theory to the field of high yield bonds. He is also a philanthropist and an author in the subjects of financial reporting, financial history, and political economy. Fridson has been referred to as the "dean of high yield debt." He is currently Chief Investment Officer of Lehman, Livian, Fridson Advisors LLC, an investment firm based in New York and Miami, and lives on Manhattan's Upper West Side with his wife, Elaine Sisman.

A portfolio manager is a professional responsible for making investment decisions and carrying out investment activities on behalf of vested individuals or institutions. The investors invest their money into the portfolio manager's investment policy for future fund growth such as a retirement fund, endowment fund, education fund, or for other purposes. Portfolio managers work with a team of analysts and researchers, and are responsible for establishing an investment strategy, selecting appropriate investments, and allocating each investment properly towards an investment fund or asset management vehicle.

LatinFinance is the leading global source of intelligence on the financial markets and economies of Latin America and the Caribbean. Drawing on 30 years of editorial excellence, its English-language publications deliver high-value information to an international readership of companies, governments, financiers and investors, while its events convene those same communities for high-level networking forums focused on the dynamics of those markets, by geography and sector.

Keefe, Bruyette & Woods, Inc., a Stifel Company, is an investment banking firm headquartered in New York City, specializing exclusively in the financial services sector. KBW's primary business lines include Research, Corporate Finance, Equity Sales and Trading, Equity Capital Markets, Debt Capital Markets, and Asset Management.

Friedman Fleischer & Lowe (FFL) is an American private equity firm, founded in 1997 by Tully Friedman, Spencer Fleischer, David Lowe, and Christopher Masto. The firm makes investments primarily through leveraged buyouts and growth capital investments and is focused on investing in the U.S. middle-market.

Motilal Oswal Financial Services Ltd. is an Indian diversified financial services firm offering a range of financial products and services.

Campbell Russell "Cam" Harvey is a Canadian economist, known for his work on asset allocation with changing risk and risk premiums and the problem of separating luck from skill in investment management. He is currently the J. Paul Sticht Professor of International Business at Duke University's Fuqua School of Business in Durham, North Carolina, as well as a research associate with the National Bureau of Economic Research in Cambridge, Massachusetts. He is also a research associate with the Institute of International Integration Studies at Trinity College Dublin and a visiting researcher at the University of Oxford. He served as the 2016 president of the American Finance Association.

İş Yatırım Menkul Değerler A.Ş. is a Turkish investment bank arm of the bank İş Bankası.

Liquidnet is a global institutional investment network that connects asset managers with liquidity. Liquidnet trades in 46 equity markets for over 1000 institutional investment firms who collectively manage US$33 trillion in equity and fixed income assets.

Andrew James Hartsfield is an American entrepreneur and finance professional. He founded WalkerHaven Capital Management, LLC and currently serves as the portfolio manager of WalkerHaven Equities, L.P.. He previously co-founded and served as Chairman and CEO of Wilife, an IP-enabled, DIY video surveillance company. Prior to Wilife, he served as CFO of Omniture, CFO of Zuka Juice, and financial analyst/associate at Bear Stearns.

References

https://archive.is/20130123212734/http://www.forbes.com/2009/06/22/top-gun-ceos-intelligent-investing-survey_slide.html

https://web.archive.org/web/20100119084916/http://kinross.com/about-kinross/our-history/2009.aspx

http://www.canadianbusiness.com/markets/marketwire/article.jsp?content=20090902_181511_12_ccn_ccn%5B%5D

http://blogs.reuters.com/great-debate/tag/topgun-ceo/