A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks, which represent ownership claims on businesses; these may include securities listed on a public stock exchange as well as stock that is only traded privately, such as shares of private companies that are sold to investors through equity crowdfunding platforms. Investments are usually made with an investment strategy in mind.

Barings Bank was a British merchant bank based in London, and one of England's oldest merchant banks after Berenberg Bank, Barings' close collaborator and German representative. It was founded in 1762 by Francis Baring, a British-born member of the German–British Baring family of merchants and bankers.

Nicholas William Leeson is an English former derivatives trader whose fraudulent, unauthorised and speculative trades resulted in the 1995 collapse of Barings Bank, the United Kingdom's oldest merchant bank. Leeson was convicted of financial crime in a Singapore court and served over four years in Changi Prison.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

A trench coat is a variety of coat made of waterproof heavy-duty fabric, originally developed for British Army officers before the First World War, and becoming popular while used in the trenches, hence the name trench coat.

The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. For most of its history, the exchange was in the then common form of a non-profit organization, owned by members of the exchange. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

The Chicago Board of Trade (CBOT), established on April 3, 1848, is one of the world's oldest futures and options exchanges. On July 12, 2007, the CBOT merged with the Chicago Mercantile Exchange (CME) to form CME Group. CBOT and three other exchanges now operate as designated contract markets (DCM) of the CME Group.

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

The London International Financial Futures and Options Exchange was a futures exchange based in London. In 2014, following a series of takeovers, LIFFE became part of Intercontinental Exchange, and was renamed ICE Futures Europe.

The International Exchange, now ICE Futures, based in London, was one of the world's largest energy futures and options exchanges. Its flagship commodity, Brent Crude was a world benchmark for oil prices, but the exchange also handled futures contracts and options on fuel oil, natural gas, electricity, coal contracts and, as of 22 April 2005, carbon emission allowances with the European Climate Exchange (ECX).

Open outcry is a method of communication between professionals on a stock exchange or futures exchange, typically on a trading floor. It involves shouting and the use of hand signals to transfer information primarily about buy and sell orders. The part of the trading floor where this takes place is called a pit.

John Joseph LouisJohnson III is an American professional ice hockey defenseman who is currently playing for the Colorado Avalanche of the National Hockey League (NHL). He has previously played for the Los Angeles Kings, Columbus Blue Jackets, Pittsburgh Penguins, New York Rangers, and Chicago Blackhawks. In his prime, he was a capable two-way defenseman, combining physical prowess and offensive capability. Johnson won the Stanley Cup with the Avalanche in 2022.

Nicholas Foligno is an American professional ice hockey left winger and alternate captain for the Chicago Blackhawks of the National Hockey League (NHL). He was selected in the first round, 28th overall by the Ottawa Senators during the 2006 NHL Entry Draft. Foligno was traded to the Columbus Blue Jackets six years later, and eventually was named the team's captain for six seasons.

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets.

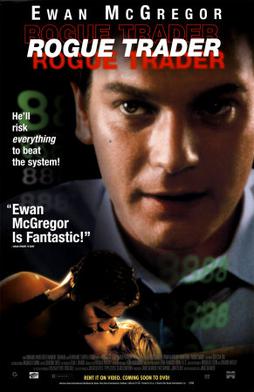

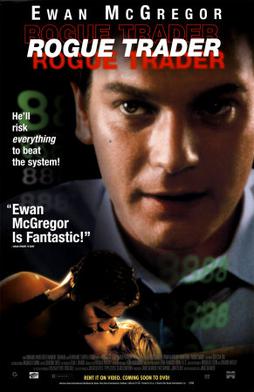

Rogue Trader is a 1999 British biographical drama film written and directed by James Dearden and starring Ewan McGregor and Anna Friel. The film centers on the life of former derivatives broker Nick Leeson and the 1995 collapse of Barings Bank.

Ugly Americans: The True Story of the Ivy League Cowboys Who Raided the Asian Markets for Millions is a book by Ben Mezrich that recounts the exploits of an American called John Malcolm arbitraging index futures in Japan in the 1990s. The book was released on May 4, 2004 by William Morrow and Company.

A floor trader is a member of a stock or commodities exchange who trades on the floor of that exchange for his or her own account. The floor trader must abide by trading rules similar to those of the exchange specialists who trade on behalf of others. The term should not be confused with floor broker. Floor traders are occasionally referred to as registered competitive traders, individual liquidity providers or locals.

A floor broker also known as a "Pit broker" is an independent member of an exchange who can act as a broker on the trading floor. They would act on behalf of floor traders or large clients such as financial firms, as an agent on the floor of the exchange. With the advent of electronic trading in the 1990s and the closing of physical trading floors, this role has largely disappeared.

An order matching system or simply matching system is an electronic system that matches buy and sell orders for a stock market, commodity market or other financial exchanges. The order matching system is the core of all electronic exchanges and are used to execute orders from participants in the exchange.

Interactive Brokers LLC (IB) is an American multinational brokerage firm. It operates the largest electronic trading platform in the United States by number of daily average revenue trades. The company brokers stocks, options, futures, EFPs, futures options, forex, bonds, funds, and some cryptocurrencies.