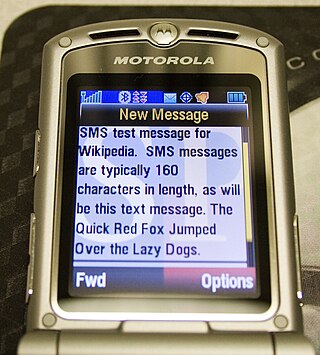

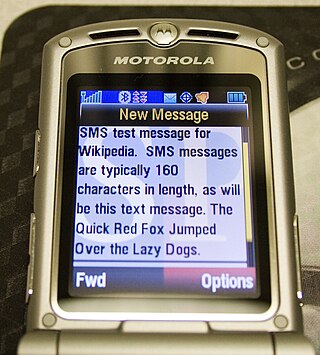

Short Message/Messaging Service, commonly abbreviated as SMS, is a text messaging service component of most telephone, Internet and mobile device systems. It uses standardized communication protocols that let mobile devices exchange short text messages. An intermediary service can facilitate a text-to-voice conversion to be sent to landlines.

A SIMcard is an integrated circuit (IC) intended to securely store an international mobile subscriber identity (IMSI) number and its related key, which are used to identify and authenticate subscribers on mobile telephone devices. Technically the actual physical card is known as a universal integrated circuit card (UICC); this smart card is usually made of PVC with embedded contacts and semiconductors, with the SIM as its primary component. In practice the term "SIM card" is still used to refer to the entire unit and not simply the IC.

Roaming is a wireless telecommunication term typically used with mobile devices, such as mobile phones. It refers to a mobile phone being used outside the range of its native network and connecting to another available cell network.

Mobile payment, also referred to as mobile money, mobile money transfer and mobile wallet, is any of various payment processing services operated under financial regulations and performed from or via a mobile device. Instead of paying with cash, cheque, or credit card, a consumer can use a payment app on a mobile device to pay for a wide range of services and digital or hard goods. Although the concept of using non-coin-based currency systems has a long history, it is only in the 21st century that the technology to support such systems has become widely available.

Near-field communication (NFC) is a set of communication protocols that enables communication between two electronic devices over a distance of 4 centimetres (1.6 in) or less. NFC offers a low-speed connection through a simple setup that can be used for the bootstrapping of capable wireless connections. Like other proximity card technologies, NFC is based on inductive coupling between two electromagnetic coils present on a NFC-enabled device such as a smartphone. NFC communicating in one or both directions uses a frequency of 13.56 MHz in the globally available unlicensed radio frequency ISM band, compliant with the ISO/IEC 18000-3 air interface standard at data rates ranging from 106 to 848 kbit/s.

A mobile virtual network operator (MVNO) is a wireless communications services provider that does not own the wireless network infrastructure over which it provides services to its customers. An MVNO enters into a business agreement with a mobile network operator to obtain bulk access to network services at wholesale rates, then sets retail prices independently. An MVNO may use its own customer service, billing support systems, marketing, and sales personnel, or it could employ the services of a mobile virtual network enabler (MVNE).

The Open Mobile Terminal Platform (OMTP) was a forum created by mobile network operators to discuss standards with manufacturers of mobile phones and other mobile devices. During its lifetime, the OMTP included manufacturers such as Huawei, LG Electronics, Motorola, Nokia, Samsung and Sony Ericsson.

Mobile banking is a service provided by a bank or other financial institution that allows its customers to conduct financial transactions remotely using a mobile device such as a smartphone or tablet. Unlike the related internet banking it uses software, usually called an app, provided by the financial institution for the purpose. Mobile banking is usually available on a 24-hour basis. Some financial institutions have restrictions on which accounts may be accessed through mobile banking, as well as a limit on the amount that can be transacted. Mobile banking is dependent on the availability of an internet or data connection to the mobile device.

Wi-Fi calling refers to mobile phone voice calls and data that are made over IP networks using Wi-Fi, instead of the cell towers provided by cellular networks. Using this feature, compatible handsets are able to route regular cellular calls through a wireless LAN (Wi-Fi) network with broadband Internet, while seamlessly change connections between the two where necessary. This feature makes use of the Generic Access Network (GAN) protocol, also known as Unlicensed Mobile Access (UMA).

Gemalto was an international digital security company providing software applications, secure personal devices such as smart cards and tokens, e-wallets and managed services. It was formed in June 2006 by the merger of two companies, Axalto and Gemplus International. Gemalto N.V.'s revenue in 2018 was €2.969 billion.

A mobile signature is a digital signature generated either on a mobile phone or on a SIM card on a mobile phone.

Wireless Application Protocol (WAP) is a technical standard for accessing information over a mobile wireless network. A WAP browser is a web browser for mobile devices such as mobile phones that use the protocol. Introduced in 1999, WAP achieved some popularity in the early 2000s, but by the 2010s it had been largely superseded by more modern standards such as XHTML. Modern phones have proper Web browsers, so they do not need WAP markup for compatibility, and therefore, most are no longer able to render and display pages written in WML, WAP's markup language.

MIFARE4Mobile is a technical specification published by NXP Semiconductors in December 2008 to manage MIFARE-based applications in mobile devices. The specification provides mobile network operators and service providers with a single, interoperable programming interface, easing the use of the contactless MIFARE technology in future mobile Near Field Communication (NFC) devices.

Application enablement is an approach which brings telecommunications network providers and developers together to combine their network and web abilities in creating and delivering high demand advanced services and new intelligent applications.

JVL Ventures, LLC d/b/a Softcard, was a joint venture between AT&T, T-Mobile and Verizon which produced a mobile payments platform known as Softcard, which used near-field communication (NFC) technology to allow users to pay for items at stores and restaurants with credit and debit card credentials stored on their smartphones. The partnership was first announced on November 16, 2010; following a trial period in 2012, the service officially launched nationwide on November 14, 2013. The official Softcard app was available for NFC-compatible smartphones using the Android operating system and later on Windows Phone 8.1.

ip.access Limited is a multinational corporation that designs, manufactures, and markets small cells technologies and infrastructure equipment for GSM, GPRS, EDGE, 3G, 4G and 5G. The company was acquired by Mavenir in September 2020.

CIPURSE is an open security standard for transit fare collection systems. It makes use of smart card technologies and additional security measures.

Mobile payments is a mode of payment using mobile phones. Instead of using methods like cash, cheque, and credit card, a customer can use a mobile phone to transfer money or to pay for goods and services. A customer can transfer money or pay for goods and services by sending an SMS, using a Java application over GPRS, a WAP service, over IVR or other mobile communication technologies. In India, this service is bank-led. Customers wishing to avail themselves of this service will have to register with banks which provide this service. Currently, this service is being offered by several major banks and is expected to grow further. Mobile Payment Forum of India (MPFI) is the umbrella organisation which is responsible for deploying mobile payments in India.

A trusted execution environment (TEE) is a secure area of a main processor. It helps code and data loaded inside it to be protected with respect to confidentiality and integrity. Data confidentiality prevents unauthorized entities from outside the TEE from reading data, while code integrity prevents code in the TEE from being replaced or modified by unauthorized entities, which may also be the computer owner itself as in certain DRM schemes described in SGX.

Host card emulation (HCE) is the software architecture that provides exact virtual representation of various electronic identity cards using only software. Prior to the HCE architecture, near field communication (NFC) transactions were mainly carried out using hardware-based secure elements.