The economy of Botswana is currently one of the world's fastest growing economies, averaging about 5% per annum over the past decade. Growth in private sector employment averaged about 10% per annum during the first 30 years of the country's independence. After a period of stagnation at the turn of the 21st century, Botswana's economy registered strong levels of growth, with GDP growth exceeding 6-7% targets. Botswana has been praised by the African Development Bank for sustaining one of the world's longest economic booms. Economic growth since the late 1960s has been on par with some of Asia's largest economies. The government has consistently maintained budget surpluses and has extensive foreign-exchange reserves.

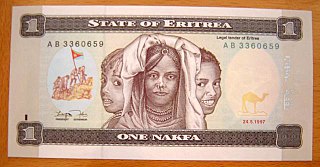

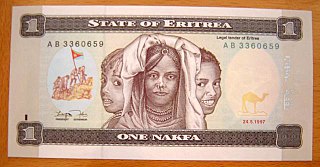

The economy of Eritrea has experienced considerable growth in recent years, indicated by an improvement in gross domestic product (GDP) in October 2012 of 7.5 percent over 2011. However, worker remittances from abroad are estimated to account for 32 percent of gross domestic product. Eritrea has an extensive amount of resources such as copper, gold, granite, marble, and potash. The Eritrean economy has undergone extreme changes due to the War of Independence.

The economy of Haiti is a free market economy with low labor costs. Haiti's major trading partner is the United States (US), which provides the country with preferential trade access to the US market through the Haiti Hemispheric Opportunity through Partnership Encouragement (HOPE) and the Haiti Economic Lift Program Encouragement Acts (HELP) legislation.

The economy of Lesotho is based on agriculture, livestock, manufacturing, mining, and depends heavily on inflows of workers’ remittances and receipts from the Southern African Customs Union (SACU). Lesotho is geographically surrounded by South Africa and is economically integrated with it as well. The majority of households subsist on farming. The formal sector employment consist of mainly the female workers in the apparel sector, the male migrant labor, primarily miners in South Africa for 3 to 9 months and employment in the Government of Lesotho (GOL). The western lowlands form the main agricultural zone. Almost 50% of the population earn income through informal crop cultivation or animal husbandry with nearly two-thirds of the country's income coming from the agricultural sector. About 70% of the population lives in rural areas and works in agriculture.

Mining is the extraction of valuable minerals or other geological materials from the Earth, usually from an ore body, lode, vein, seam, reef or placer deposit. These deposits form a mineralized package that is of economic interest to the miner.

The economy of Namibia has a modern market sector, which produces most of the country's wealth, and a traditional subsistence sector. Although the majority of the population engages in subsistence agriculture and herding, Namibia has more than 200,000 skilled workers and a considerable number of well-trained professionals and managerials.

The economy of South Africa is the second largest in Africa, after Nigeria. As a regional manufacturing hub, it is the most industrialized and diversified economy on the continent. South Africa is an upper-middle-income economy – one of only eight such countries in Africa. Since 1996, at the end of over twelve years of international sanctions, South Africa's Gross Domestic Product almost tripled to peak at $400 billion in 2011, but has since declined to roughly $385 billion in 2019. In the same period, foreign exchange reserves increased from $3 billion to nearly $50 billion creating a diversified economy with a growing and sizable middle class, within two decades of ending apartheid. South African state owned enterprises play a significant role in the country's economy with the government owning a share in around 700 SOEs involved in a wide array of important industries. In 2016 the top five challenges to doing business in the country were inefficient government bureaucracy, restrictive labour regulations, a shortage of skilled workers, political instability, and corruption, whilst the country's strong banking sector was rated as a strongly positive feature of the economy. The nation is among the G20, and is the only African member of the group.

Rabobank is a Dutch multinational banking and financial services company headquartered in Utrecht, Netherlands. It is a global leader in food and agriculture financing and sustainability-oriented banking. The group comprises 129 independent local Dutch Rabobanks (2013), a central organisation, and many specialised international offices and subsidiaries. Food and agribusiness constitute the primary international focus of the Rabobank Group. Rabobank is the second-largest bank in the Netherlands in terms of total assets.

Patrice Tlhopane Motsepe is a South African mining billionaire businessman of Tswana descent. He is the founder and executive chairman of African Rainbow Minerals, which has interests in gold, ferrous metals, base metals, and platinum. He sits on several company boards, including being the non-executive chairman of Harmony Gold, the world's 12th largest gold mining company, and the deputy chairman of Sanlam. In 2012, Motsepe was named South Africa's richest man, topping the Sunday Times' annual Rich List with an estimated fortune of R20.07 billion.

Lonmin plc, formerly the mining division of Lonrho plc, is a British producer of platinum group metals operating in the Bushveld Complex of South Africa. It is listed on the London Stock Exchange. Its registered office is in London, and its operational headquarters are in Johannesburg, South Africa.

Anglo American Platinum Limited is the world's largest primary producer of platinum, accounting for about 38% of the world's annual supply.

Anil Agarwal is the founder and Chairman of Vedanta Resources Limited. He controls Vedanta Resources through Volcan Investments, a holding vehicle with a 100% stake in the business.

Itaú CorpBanca is the fourth largest commercial bank in Chile, the bank is owned by Itaú Unibanco (36%), the largest bank in Latin America by assets and CorpGroup (30%), a Chilean financial holding. Currently the bank has 398 bank branches in Chile and Colombia, being 224 in Chile and 174 in Colombia. Itaú Corpbanca is headquartered in Santiago and has offices in Madrid, New York City and Panama City.

First Bank of Nigeria, sometimes referred to as FirstBank, is a Nigerian multinational bank and financial services company headquartered in Lagos. It is the biggest bank in Nigeria by total deposits and gross earnings. It operates a network of over 750 business locations across Africa, the United Kingdom and representative offices in Abu Dhabi, Beijing and Johannesburg set up to capture trade-related business between geographies. The bank specialises in retail banking and has the largest retail client base in Nigeria. In 2015, The Asian Banker awarded FirstBank the Best Retail Bank in Nigeria award for the fifth consecutive year.

The Mining industry of Ghana accounts for 5% of the country's GDP and minerals make up 37% of total exports, of which gold contributes over 90% of the total mineral exports. Thus, the main focus of Ghana's mining and minerals development industry remains focused on gold. Ghana is Africa's largest gold producer, producing 80.5 t in 2008. Ghana is also a major producer of bauxite, manganese and diamonds. Ghana has 23 large-scale mining companies producing gold, diamonds, bauxite and manganese, and, there are also over 300 registered small scale mining groups and 90 mine support service companies.

The most important difference between non-banking financial companies and banks is that NBFCs don't take demand deposits. A non-banking financial institution (NBFI) or non-bank financial company (NBFC) is a financial institution that does not have a full banking license or is not supervised by a national or international banking regulatory agency. NBFI facilitate bank-related financial services, such as investment, risk pooling, contractual savings, and market brokering. Examples of these include insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations. Alan Greenspan has identified the role of NBFIs in strengthening an economy, as they provide "multiple alternatives to transform an economy's savings into capital investment which act as backup facilities should the primary form of intermediation fail."

Before Uganda's independence in 1962, the main banks in Uganda were Barclays ; Grindlays, Standard Bank and the Bank of Baroda from India. The currency was issued by the East African Currency Board, a London-based body. In 1966, the Bank of Uganda (BoU), which controlled the issue of currency and managed foreign exchange reserves, became the central bank and national banking regulator. The government ownedUganda Commercial Bank and the Uganda Development Bank were launched in the 1960s. The Uganda Development bank was a state-owned development finance institution, which channeled loans from international sources into Ugandan enterprises and administered most of the development loans made to Uganda.

UBank is an Australian direct bank, that operates as a division of National Australia Bank (NAB). It was established in 2008, and provides savings products and home loans over the Internet and telephone.

KCB Group Limited, also known as the KCB Group, is a financial services holding company based in the African Great Lakes region. The Group's headquarters are in Nairobi, Kenya, with its subsidiaries being KCB Bank Kenya Limited, KCB Bank Burundi Limited, KCB Bank Rwanda Limited, KCB Bank South Sudan Limited, KCB Bank Tanzania Limited, and KCB Bank Uganda Limited.

An artisanal miner or small-scale miner (ASM) is a subsistence miner who is not officially employed by a mining company, but works independently, mining minerals using their own resources, usually by hand.