The Bank for International Settlements (BIS) is an international financial institution which is owned by member central banks. Its primary goal is to foster international monetary and financial cooperation while serving as a bank for central banks. With its establishment in 1929, its initial purpose was to oversee the settlement of World War I war reparations.

The Islamic Development Bank is a multilateral development finance institution that is focused on Islamic finance for infrastructure development and located in Jeddah, Saudi Arabia. There are 57 shareholding member states with the largest single shareholder being Saudi Arabia.

The Organization of the Black Sea Economic Cooperation (BSEC) is a regional international organization focusing on multilateral political and economic initiatives aimed at fostering cooperation, peace, stability and prosperity in the Black Sea region. It traces its origin to 25 June 1992, when Turkish President Turgut Özal and leaders of ten other countries gathered in Istanbul and signed the Summit Declaration and the "Bosphorus Statement". BSEC Headquarters – the Permanent International Secretariat of the Organization of the Black Sea Economic Cooperation – was established in March 1994, also in Istanbul.

The Central Bank of Armenia is the central bank of Armenia with its headquarters in Yerevan. The CBA is an independent institution responsible for issuing all banknotes and coins in the country, overseeing and regulating the banking sector and keeping the government's currency reserves. The CBA is also the sole owner of the Armenian Mint.

Mahmoud Mohieldin, is an economist with more than 30 years of experience in international finance and development. He is the UN Climate Change High-Level Champion for Egypt. He is an Executive Director at the International Monetary Fund. He has been the United Nations Special Envoy on Financing the 2030 Sustainable Development Agenda since February 2020. He was the Minister of Investment of Egypt from 2004-2010, and most recently, served as the World Bank Group Senior Vice President for the 2030 Development Agenda, United Nations Relations and Partnerships. His roles at the World Bank also included Managing Director, responsible for Human Development, Sustainable Development, Poverty Reduction and Economic Management, Finance and Private Sector Development, and the World Bank Institute; World Bank President's Special Envoy on the Millennium Development Goals (MDGs), the Post-2015 Development Agenda, and Financing for Development; and Corporate Secretary and Executive Secretary to the Development Committee of the World Bank Group's Board of Governors. Dr Mohieldin also served on several Boards of Directors in the Central Bank of Egypt and the corporate sector. He was a member of the Commission on Growth and Development and was selected for the Young Global Leader of the World Economic Forum in 2005. His professional experience extends into the academic arena as a Professor of Economics and Finance at the Faculty of Economics and Political Science, Cairo University and as a Visiting Professor at several renowned Universities in Egypt, Korea, the UAE, the UK and the USA. He is a member of the International Advisory Board of Durham University Business School. He also holds leading positions in national, regional and international research centres and associations. He has authored numerous publications and articles in leading journals in the fields of economics, finance and development.

The Central Bank of the United Arab Emirates is the state institution responsible for managing the currency, monetary policy, banking and insurance regulation in the United Arab Emirates.

The Arab Monetary Fund (AMF) is a regional Arab organization, a working sub-organization of the Arab League. It was founded 1976, and has been operational since 1977.

Malcolm D. Knight is a Canadian economist, policymaker and banker. He is currently Visiting Professor of Finance at the London School of Economics and Political Science and a Distinguished Fellow at the Center for International Governance Innovation. From 2008 to 2012, Knight was Vice Chairman of Deutsche Bank Group where he was responsible for developing and coordinating the bank's global approach to issues in financial regulation, supervision, and financial stability. He served as general manager of the Bank for International Settlements from 2003 to 2008 and as Senior Deputy Governor of the Bank of Canada (1999-2003), after holding senior positions at the International Monetary Fund (1975-1999).

The Institute of Bankers Pakistan (IBP), established in 1951, is Pakistan's premier banking training institute, which aims to develop and groom a cadre of banking and financial services professionals on continuous basis. It is an ISO-9001-2000 Certified Organization. IBP has its head office in Karachi.

National Bank of the Republic of Uzbekistan for Foreign Economic Activity' Joint Stock Company, same as the National Bank of Uzbekistan (NBU) is universal commercial bank of Uzbekistan. It is the largest bank of Uzbekistan in the volume of assets combining the functions of project financing, universal commercial, investment and savings banks.

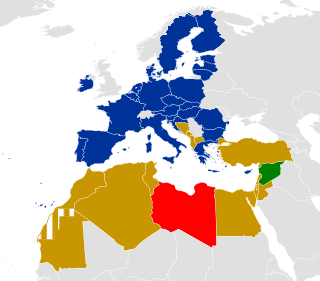

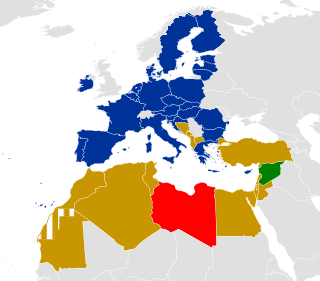

The Union for the Mediterranean is an intergovernmental organization of 43 member states from Europe and the Mediterranean Basin: the 27 EU member states and 16 Mediterranean partner countries from North Africa, Western Asia and Southern Europe. It was founded on 13 July 2008 at the Paris Summit for the Mediterranean, with an aim of reinforcing the Euro-Mediterranean Partnership (Euromed) that was set up in 1995 as the Barcelona Process. Its general secretariat is located in Barcelona, Catalonia, Spain.

The Nepal Rastra Bank was established April 26, 1956 A.D. under the Nepal Rastra Bank Act, 1955, to discharge the central banking responsibilities including guiding the development of the embryonic domestic financial sector. As of now, the NRB is functioning under the new Nepal Rastra Bank Act, 2002. The functions of NRB are to formulate required monetary and foreign exchange policies so as to maintain the stability in market prices, to issue currency notes, to regulate and supervise the banking and financial sector, to develop efficient payment and banking systems among others. The NRB is also the economic advisor to the government of Nepal. As the central bank of Nepal, it is the monetary, supervisory and regulatory body of all the commercial banks. development banks, finance companies and micro-finances institutions.

Shadi A. Karam received degrees from the American University of Beirut (AUB), Columbia University, and Harvard University. In his primary professional capacity, he is known as a specialist in the restructuring of organizations and distressed companies, most notably occupying the post of Financial Adviser to the Director General of UNESCO and serving as a Chairman and CEO of several major companies in Europe and the Middle East in various sectors, ranging from industry to real estate development, hotels, trading and financial services.

Ukrainian Academy of Banking of the National Bank of Ukraine is a state-owned higher educational institution within the system of the National Bank of Ukraine of the IVth level of accreditation. It is located in the city of Sumy, in the north-eastern part of Ukraine.

The Arab Chamber of Commerce and Industry (ARABCCI) or (ArabCham) in Hong Kong was established in 2006 to promote commercial ties between Hong Kong and Greater China with the Arab world. The Arab Chamber of Commerce is a not for profit organisation, The President is Edwin Hitti.

KAZANSUMMIT is one of the leading international economic events of the Russian Federation and the Organization of Islamic Cooperation (OIC). From the first day of its existence, the Summit has been held under the patronage of the President of the Republic of Tatarstan, Rustam Minnikhanov. Since 2009, KazanSummit is held annually and strongly supported by the Federation Council of the Federal Assembly of the Russian Federation and the Government of the Republic of Tatarstan. Top international investment conference remains the main and unique platform for cooperation between the Russian Federation and the OIC member states.

Hassan Abdallah is an Egyptian financier. He is the current governor of the Central Bank of Egypt. He previously held the chief executive officer position of the Arab African International Bank (AAIB), a regional financial services institution that was Egypt's first Arab multinational bank. Abdalla joined the AAIB in 1982 and, by 2002, had become CEO. In parallel to his executive mandate, Abdalla has also been an adjunct finance professor at the American University in Cairo (AUC) for the past 18 years. In August 2022, Hassan Abdallah was appointed as the new acting governor of the Central Bank of Egypt (CBE) by presidential decree.

The Mongolian Bankers Association (MBA) is an independent, non-profit and non-government organization under which the banking and nonbanking financial institutions officially licensed to operate within the territory of Mongolia are unified.

The European Association for Banking and Financial History (eabh) is an independent, non-profit association based in Frankfurt am Main. Founded in 1990, the eabh aims to promote research on banking history; support the preservation historically valuable archive material of public and private banking institutions; and facilitate dialogue on key challenges and opportunities to the historical study of finance, insurance, and globalization. It maintains a global network of financial professionals and academics who meet to discuss and encourage projects in the field of financial and banking history. The eabh currently has 80 member organisations.

Banking in Turkey is an important aspect of the financial system Turkey's dynamic economy. Banks handle the majority of money and capital market transactions and activity. Commercial banks make up the majority of Turkey's financial sector, accounting for 91 percent of overall financial sector assets as of 2020.