Related Research Articles

A nonprofit organization (NPO) or non-profit organization, also known as a non-business entity, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in contrary with an entity that operates as a business aiming to generate a profit for its owners. A nonprofit is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. An array of organizations are nonprofit, including some political organizations, schools, business associations, churches, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may incorporate as a nonprofit entity without securing tax-exempt status.

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being.

United States non-profit laws relate to taxation, the special problems of an organization which does not have profit as its primary motivation, and prevention of charitable fraud. Some non-profit organizations can broadly be described as "charities" — like the American Red Cross. Some are strictly for the private benefit of the members — like country clubs, or condominium associations. Others fall somewhere in between — like labor unions, chambers of commerce, or cooperative electric companies. Each presents unique legal issues.

Americans United for Separation of Church and State is a 501(c)(3) nonprofit organization that advocates for the disassociation of religion and religious organizations from government. The separation of church and state in the United States is sometimes interpreted to be provided in the Establishment Clause of the First Amendment to the United States Constitution, which states "Congress shall make no law respecting an establishment of religion..."

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

NatureServe, Inc. is a non-profit organization based in Arlington County, Virginia, US, that provides proprietary wildlife conservation-related data, tools, and services to private and government clients, partner organizations, and the public. NatureServe reports being "headquartered in Arlington, Virginia, with regional offices in four U.S. locations and in Canada." In calendar year 2011 they reported having 86 employees, 6 volunteers, and 15 independent officers.

A nonprofit corporation is any legal entity which has been incorporated under the law of its jurisdiction for purposes other than making profits for its owners or shareholders. Depending on the laws of the jurisdiction, a nonprofit corporation may seek official recognition as such, and may be taxed differently from for-profit corporations, and treated differently in other ways.

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

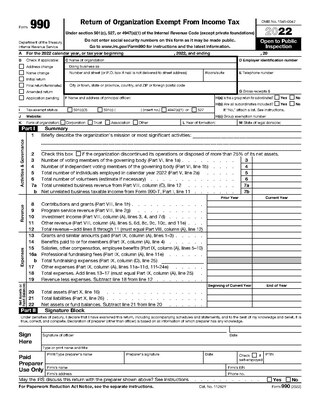

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

A religious corporation is a type of religious non-profit organization, which has been incorporated under the law. Often these types of corporations are recognized under the law on a subnational level, for instance by a state or province government. The government agency responsible for regulating such corporations is usually the official holder of records, for instance, the Secretary of State. In the United States, religious corporations are formed like all other nonprofit corporations by filing articles of incorporation with the state. Religious corporation articles need to have the standard tax-exempt language the IRS requires. Religious corporations are permitted to designate a person to act in the capacity of corporation sole. This is a person who acts as the official holder of the title on the property, etc.

Form 990 is a United States Internal Revenue Service (IRS) form that provides the public with information about a nonprofit organization. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Some nonprofits, such as hospitals and other healthcare organizations, have more comprehensive reporting requirements.

Candid is an information service specializing in reporting on U.S. nonprofit companies. In 2016, its database provided information on 2.5 million organizations. It is the product of the February 2019 merger of GuideStar with Foundation Center.

Nonpartisanism in the United States is organized under United States Internal Revenue Code that qualifies certain non-profit organizations for tax-exempt status because they refrain from engaging in certain political activities prohibited for them. The designation "nonpartisan" usually reflects a claim made by organizations about themselves, or by commentators, and not an official category per American law. Rather, certain types of nonprofit organizations are under varying requirements to refrain from election-related political activities, or may be taxed to the extent they engage in electoral politics, so the word affirms a legal requirement. In this context, "nonpartisan" means that the organization, by US tax law, is prohibited from supporting or opposing political candidates, parties, and in some cases other votes like propositions, directly or indirectly, but does not mean that the organization cannot take positions on political issues.

The Church of Scientology International (CSI) is a California 501(c)(3) non-profit corporation. Within the worldwide network of Scientology corporations and entities, CSI is officially referred to as the "mother church" of the Church of Scientology.

In 2013, the United States Internal Revenue Service (IRS), under the Obama administration, revealed that it had selected political groups applying for tax-exempt status for intensive scrutiny based on their names or political themes. This led to wide condemnation of the agency and triggered several investigations, including a Federal Bureau of Investigation (FBI) criminal probe ordered by United States Attorney General Eric Holder. Conservatives claimed that they were specifically targeted by the IRS, but an exhaustive report released by the Treasury Department's Inspector General in 2017 found that from 2004 to 2013, the IRS used both conservative and liberal keywords to choose targets for further scrutiny.

The Henge of Keltria (HoK) was an international druid order, founded in 1988 as a religious and educational organization. It was a 501(c)(3) nonprofit corporation. It is commonly regarded as being one of the first explicitly Celtic-focused American Druid Orders. The order drew upon the Mythological Cycle of Irish mythology and some other early Celtic/British texts for inspiration.

The bill H.Res. 565, official title "Calling on Attorney General Eric H. Holder, Jr., to appoint a special counsel to investigate the targeting of conservative nonprofit groups by the Internal Revenue Service," was passed by the United States House of Representatives during the 113th United States Congress. The simple resolution asks U.S. Attorney General Eric Holder to appoint a special counsel to investigate that 2013 IRS scandal. The Internal Revenue Service revealed in 2013 that it had selected political groups applying for tax-exempt status for closer scrutiny based on their names or political themes.

Form 1023 is a United States IRS tax form, also known as the Application for Recognition of Exemption Under 501(c)(3) of the Internal Revenue Code. It is filed by nonprofits to get exemption status. On January 31, 2020, the IRS abandoned the paper format of the form 1023. Those who used the paper version were given 90 days grace period and that ended on April 30, 2020. Going forward, every application has to be filed online through Pay.gov portal.

A 501(h) election or Conable election is a procedure in United States tax law that allows a 501(c)(3) non-profit organization to participate in lobbying limited only by the financial expenditure on that lobbying, regardless of its overall extent. This allows organizations taking the 501(h) election to potentially perform a large amount of lobbying if it is done using volunteer labor or through inexpensive means. The 501(h) election is available to most types of 501(c)(3) organizations that are not churches or private foundations. It was introduced by Representative Barber Conable as part of the Tax Reform Act of 1976 and codified as , and the corresponding Internal Revenue Service (IRS) regulations were finalized in 1990.

References

- ↑ "Western Cave Conservancy" . Retrieved 2017-01-30.

- ↑ "Bylaws of the WCC" (PDF). Retrieved 2017-01-30.

- ↑ "Bylaws of the WCC" (PDF). Retrieved 2017-01-30.

- ↑ "An extraordinary new family of spiders from caves in the Pacific Northwest" . Retrieved 2017-01-30.

- ↑ "IRS Letter of Determination" (PDF). Retrieved 2017-01-30.

- ↑ "IRS Letter of Determination" (PDF). Retrieved 2017-01-30.