Related Research Articles

Evanston is a city in Cook County, Illinois, United States, situated on the North Shore along Lake Michigan. A suburb of Chicago, Evanston is 12 miles (19 km) north of Downtown Chicago, bordered by Chicago to the south, Skokie to the west, Wilmette to the north, and Lake Michigan to the east. Evanston had a population of 78,110 as of 2020.

A traffic enforcement camera is a camera which may be mounted beside or over a road or installed in an enforcement vehicle to detect motoring offenses, including speeding, vehicles going through a red traffic light, vehicles going through a toll booth without paying, unauthorized use of a bus lane, or for recording vehicles inside a congestion charge area. It may be linked to an automated ticketing system.

An environmental tax, ecotax, or green tax is a tax levied on activities which are considered to be harmful to the environment and is intended to promote environmentally friendly activities via economic incentives. One notable example is a carbon tax. Such a policy can complement or avert the need for regulatory approaches. Often, an ecotax policy proposal may attempt to maintain overall tax revenue by proportionately reducing other taxes ; such proposals are known as a green tax shift towards ecological taxation. Ecotaxes address the failure of free markets to consider environmental impacts.

Congestion pricing or congestion charges is a system of surcharging users of public goods that are subject to congestion through excess demand, such as through higher peak charges for use of bus services, electricity, metros, railways, telephones, and road pricing to reduce traffic congestion; airlines and shipping companies may be charged higher fees for slots at airports and through canals at busy times. Advocates claim this pricing strategy regulates demand, making it possible to manage congestion without increasing supply.

Electronic toll collection (ETC) is a wireless system to automatically collect the usage fee or toll charged to vehicles using toll roads, HOV lanes, toll bridges, and toll tunnels. It is a faster alternative which is replacing toll booths, where vehicles must stop and the driver manually pays the toll with cash or a card. In most systems, vehicles using the system are equipped with an automated radio transponder device. When the vehicle passes a roadside toll reader device, a radio signal from the reader triggers the transponder, which transmits back an identifying number which registers the vehicle's use of the road, and an electronic payment system charges the user the toll.

The Chicago Transit Authority (CTA) is the operator of mass transit in Chicago, Illinois, United States, and some of its suburbs, including the trains of the Chicago "L" and CTA bus service. In 2023, the system had a ridership of 279,146,200, or about 977,000 per weekday as of the second quarter of 2024.

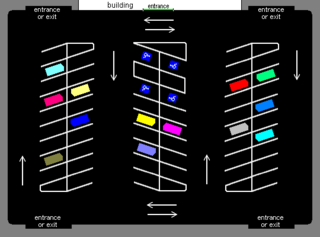

A parking lot or car park, also known as a car lot, is a cleared area intended for parking vehicles. The term usually refers to an area dedicated only for parking, with a durable or semi-durable surface. In most jurisdictions where cars are the dominant mode of transportation, parking lots are a major feature of cities and suburban areas. Shopping malls, sports stadiums, and other similar venues often have immense parking lots.

Vehicle Excise Duty is an annual tax levied as an excise duty, and which must be paid for most types of powered vehicles which are to be used or parked on public roads in the United Kingdom. Registered vehicles that are not being used or parked on public roads and which have been taxed since 31 January 1998 must be covered by a Statutory Off Road Notification (SORN) to avoid VED. In 2016, VED generated approximately £6 billion for the Exchequer.

Automatic number-plate recognition is a technology that uses optical character recognition on images to read vehicle registration plates to create vehicle location data. It can use existing closed-circuit television, road-rule enforcement cameras, or cameras specifically designed for the task. ANPR is used by police forces around the world for law enforcement purposes, including checking if a vehicle is registered or licensed. It is also used for electronic toll collection on pay-per-use roads and as a method of cataloguing the movements of traffic, for example by highways agencies.

Road tax, known by various names around the world, is a tax which has to be paid on, or included with, a motorised vehicle to use it on a public road.

The economy of the State of California is the largest in the United States, with a $3.987 trillion gross state product (GSP) as of 2024. It is the largest sub-national economy in the world. If California were a nation it would rank in terms of nominal GDP as the world's fifth largest economy, behind Japan and ahead of India. Additionally, California's Silicon Valley is home to some of the world's most valuable technology companies, including Apple, Alphabet, and Nvidia. In total, 11 of the Fortune 100 companies and 53 of the Fortune 500 companies are headquartered in California.

A motorized bicycle is a bicycle with an attached motor or engine and transmission used either to power the vehicle unassisted, or to assist with pedalling. Since it sometimes retains both pedals and a discrete connected drive for rider-powered propulsion, the motorized bicycle is in technical terms a true bicycle, albeit a power-assisted one. Typically they are incapable of speeds above 52 km/h (32 mph); however, in recent years larger motors have been built, allowing bikes to reach speeds of upwards of 113 km/h.

A vehicle licence is issued by a motor registration authority in a jurisdiction in respect of a particular motor vehicle. A current licence is required for a motor vehicle to be legally permitted to be used or kept on a public road in the jurisdiction. Usually a licence is valid for one year and an annual licence fee is payable before a new one is issued.

A parking violation is the act of parking a motor vehicle in a restricted place or in an unauthorized manner. It is against the law virtually everywhere to park a vehicle in the middle of a highway or road; parking on one or both sides of a road, however, is commonly permitted. However, restrictions apply to such parking, and may result in an offense being committed. Such offenses are usually cited by a police officer or other government official in the form of a traffic ticket.

Video tolling is a form of electronic toll collection that uses video or still images of a vehicle's license plate to identify a vehicle liable to pay a road toll. The system dispenses with collection of road tolls using road-side cash or payment card methods, and may be used in conjunction with "all electronic" open road tolling, to permit drivers without an RFID device to use the toll road.

The government of Vermont is a republican form of government modeled after the Government of the United States. The Constitution of Vermont is the supreme law of the state, followed by the Vermont Statutes. This is roughly analogous to the Federal United States Constitution, United States Code and Code of Federal Regulations respectively. Provision is made for the following frame of government under the Constitution of the State of Vermont: the executive branch, the legislative branch, and the judicial branch. All members of the executive and legislative branch serve two-year terms including the governor and senators. There are no term limits for any office.

GNSS road pricing or GNSS-based tolling is the charging of road users using Global Navigation Satellite System (GNSS) sensors inside vehicles. Road pricing using GNSS simplifies distance-based tolling for all types of roads in a tolled road network since it does not require the installation and operation of roadside infrastructure, such as tollbooths or microwave-based toll gantries. Instead, all vehicles required to pay the distance-based fees are equipped with an On Board Unit (OBU).

Oklahoma Tax Commission v. Sac & Fox Nation, 508 U.S. 114 (1993), was a case in which the Supreme Court of the United States held that absent explicit congressional direction to the contrary, it must be presumed that a State does not have jurisdiction to tax tribal members who live and work in Indian country, whether the particular territory consists of a formal or informal reservation, allotted lands, or dependent Indian communities.

In response to widespread concerns about a general increase in the temperature of the Earth's climate, a number of tax jurisdictions have proposed or imposed global warming taxes intended to generate revenues to mitigate the effects of the human activities contributing to global warming or to discourage such activities.

California Proposition 6 was a measure that was submitted to California voters as part of the November 2018 election. The ballot measure proposed a repeal of the Road Repair and Accountability Act, which is also known as Senate Bill 1. The measure failed with about 57% of the voters against and 43% in favor.

References

- ↑ Walters, Steven (August 25, 2014). "The State of Politics: The Battle Over the Wheel Tax". Urban Milwaukee. Archived from the original on August 28, 2014. Retrieved August 31, 2014.

- 1 2 3 Bob Seidenberg,, Chicago Sun-Times, Evanston will still require wheel tax, but no sticker Archived 2014-09-04 at the Wayback Machine , Retrieved Sept. 3, 2014, "...owners of all vehicles registered through the Illinois Secretary of State to an Evanston address were required to pay an annual wheel tax, ..."

- 1 2 3 Associated Press, January 27, 2011, Boston Globe, Neb. senators debate bill aimed at Omaha wheel tax Archived 2014-09-04 at the Wayback Machine , Retrieved Sept. 3, 2014, "...Omaha's ordinance, passed last year, imposes the $50 tax on people who live elsewhere but work inside Omaha city limits..."

- ↑ 2016, City of Chicago, Office of the City Clerk, Archived 2016-03-23 at the Wayback Machine , Retrieved Mar 27, 2016, "All Chicago residents ..."

- ↑ September 17, 1998, Pat Clawson, Chicago Tribune, Wheel Tax Sought On Business Vehicles, Retrieved Sept. 3, 2014, "..The wheel tax, which ranges from $22 to $160 a year depending on the size of the vehicle, helps fund road repairs....."

- 1 2 Chris Walker, March 26, 2013, Chicago Tribune, New cameras use software to enforce vehicle tax Archived 2014-09-04 at the Wayback Machine , Retrieved Sept. 3, 2014