Related Research Articles

Organized crime or organised crime is a category of transnational, national, or local groupe of centralized enterprises run to engage in illegal activity, most commonly for profit. While organized crime is generally thought of as a form of illegal business, some criminal organizations, such as terrorist groups, rebel forces, and separatists, are politically motivated. Many criminal organizations rely on fear or terror to achieve their goals or aims as well as to maintain control within the organization and may adopt tactics commonly used by authoritarian regimes to maintain power. Some forms of organized crime simply exist to cater towards demand of illegal goods in a state or to facilitate trade of goods and services that may have been banned by a state. Sometimes, criminal organizations force people to do business with them, such as when a gang extorts protection money from shopkeepers. Street gangs may often be deemed organized crime groups or, under stricter definitions of organized crime, may become disciplined enough to be considered organized. A criminal organization can also be referred to as an outfit, a gang, crime family, mafia, mob, (crime) ring, or syndicate; the network, subculture, and community of criminals involved in organized crime may be referred to as the underworld or gangland. Sociologists sometimes specifically distinguish a "mafia" as a type of organized crime group that specializes in the supply of extra-legal protection and quasi-law enforcement. Academic studies of the original "Mafia", the Italian Mafia generated an economic study of organized crime groups and exerted great influence on studies of the Russian mafia, the Chinese triads, the Hong Kong triads, and the Japanese yakuza.

Business is the practice of making one's living or making money by producing or buying and selling products. It is also "any activity or enterprise entered into for profit."

Private property is a legal designation for the ownership of property by non-governmental legal entities. Private property is distinguishable from public property, which is owned by a state entity, and from collective or cooperative property, which is owned by one or more non-governmental entities.

A grey market or dark market is the trade of a commodity through distribution channels that are not authorized by the original manufacturer or trade mark proprietor. Grey market products are products traded outside the authorized manufacturer's channel.

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on:

- The efficient allocation of available resources;

- The distribution of income among citizens; and

- The stability of the economy.

Hammer v. Dagenhart, 247 U.S. 251 (1918), was a United States Supreme Court decision in which the Court struck down a federal law regulating child labor. The decision was overruled by United States v. Darby Lumber Co. (1941).

A white hat is an ethical security hacker. Ethical hacking is a term meant to imply a broader category than just penetration testing. Under the owner's consent, white-hat hackers aim to identify any vulnerabilities or security issues the current system has. The white hat is contrasted with the black hat, a malicious hacker; this definitional dichotomy comes from Western films, where heroic and antagonistic cowboys might traditionally wear a white and a black hat, respectively. There is a third kind of hacker known as a grey hat who hacks with good intentions but at times without permission.

A parallel import is a non-counterfeit product imported from another country without the permission of the intellectual property owner. Parallel imports are often referred to as grey product and are implicated in issues of international trade, and intellectual property.

A fence, also known as a receiver, mover, or moving man, is an individual who knowingly buys stolen goods in order to later resell them for profit. The fence acts as a middleman between thieves and the eventual buyers of stolen goods who may not be aware that the goods are stolen.

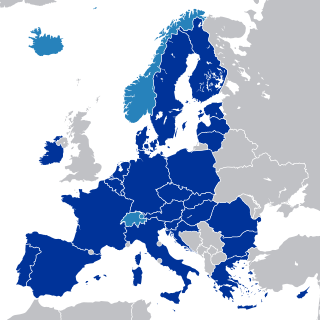

The European single market, also known as the European internal market or the European common market, is the single market comprising mainly the 27 member states of the European Union (EU). With certain exceptions, it also comprises Iceland, Liechtenstein, and Norway and Switzerland. The single market seeks to guarantee the free movement of goods, capital, services, and people, known collectively as the "four freedoms". This is achieved through common rules and standards that all participating states are legally committed to follow.

Counter-economics is an economic theory and revolutionary method consisting of direct action carried out through the black market or the gray market. As a term, it was originally used by American libertarian activists and theorists Samuel Edward Konkin III and J. Neil Schulman. The former defined it as the study or practice "of all peaceful human action which is forbidden by the State".

Joseph Heath is a Canadian philosopher. He is professor of philosophy at the University of Toronto, where he was formerly the director of the Centre for Ethics. He also teaches at the School of Public Policy and Governance. Heath's webpage at the University of Toronto declares his work "is all related, in one way or another, to critical social theory in the tradition of the Frankfurt School." He has published both academic and popular writings, including the bestselling The Rebel Sell, which he coauthored with Andrew Potter. His philosophical work includes papers and books in political philosophy, business ethics, rational choice theory, action theory, and critical theory.

Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of Iran. In 2008, about 55% of the government's budget came from oil and natural gas revenues, the rest from taxes and fees. An estimated 50% of Iran's GDP was exempt from taxes in FY 2004. There are virtually millions of people who do not pay taxes in Iran and hence operate outside the formal economy. The fiscal year begins on March 21 and ends on March 20 of the next year.

Taxes in India are levied by the Central Government and the State Governments by virtue of powers conferred to them from the Constitution of India. Some minor taxes are also levied by the local authorities such as the Municipality.

Green market products are previously owned products that have been previously used and put back into productive use. These products are often repaired, refurbished and recycled by brokers, resellers or the original manufacturer. They are suitable for resale to customers as a lower cost alternative to buying new goods from standard distribution channels.

A black market, underground economy, or shadow economy is a clandestine market or series of transactions that has some aspect of illegality or is characterized by noncompliance with an institutional set of rules. If the rule defines the set of goods and services whose production and distribution is prohibited or restricted by law, non-compliance with the rule constitutes a black-market trade since the transaction itself is illegal. Parties engaging in the production or distribution of prohibited goods and services are members of the illegal economy. Examples include the legal drug trade, prostitution, illegal currency transactions, and human trafficking. Violations of the tax code involving income tax evasion constitute membership in the unreported economy.

Cuba has suffered from widespread and rampant corruption since the establishment of the Republic of Cuba in 1902. The book Corruption in Cuba states that public ownership resulted in "a lack of identifiable ownership and widespread misuse and theft of state resources... when given opportunity, few citizens hesitate to steal from the government." Furthermore, the complex relationship between governmental and economic institutions makes them especially "prone to corruption."

Taxes in Bulgaria are collected on both state and local levels. The most important taxes are collected on state level, these taxes include income tax, social security, corporate taxes and value added tax. On the local level, property taxes as well as various fees are collected. All income earned in Bulgaria is taxed on a flat rate of 10%. Employment income earned in Bulgaria is also subject to various social security insurance contributions. In total the employee pays 12.9% and the employer contributes what corresponds to 17.9%. Corporate income tax is also a flat 10%. Value-Added Tax applies at a flat rate of 20% on virtually all goods and services. A lower rate of 9% applies on only hotel services.

Jangmadang are North Korean local markets, farmers' markets, black markets and bazaars. Since the North Korean famine in the 1990s, they have formed a large informal economy, and the government has become more lenient towards them. However, merchants still face heavy regulations. A majority of North Koreans have become dependent on jangmadang for their survival.

The Occupied Territories Bill is a proposed Irish law that would ban and criminalize "trade with and economic support for illegal settlements in territories deemed occupied under international law", most notably Israeli settlements in Israeli-occupied territories. Violators would face fines of up to €250,000 and up to five years in prison.

References

- ↑ LA Alexander, LH O'Driscoll (1980), Stork Markets: An Analysis of Baby-selling, The journal of libertarian studies