Labour economics, or labor economics, seeks to understand the functioning and dynamics of the markets for wage labour. Labour is a commodity that is supplied by labourers, usually in exchange for a wage paid by demanding firms. Because these labourers exist as parts of a social, institutional, or political system, labour economics must also account for social, cultural and political variables.

Macroeconomics is a branch of economics which deals with the performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism."

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production.

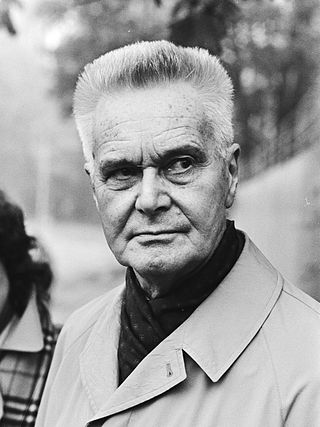

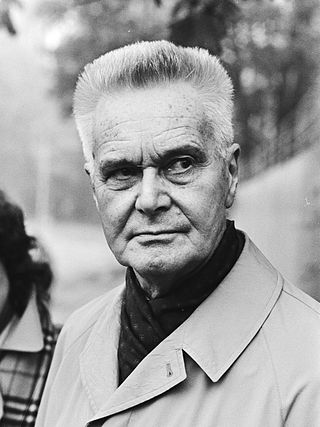

Jan Tinbergen was a Dutch economist who was awarded the first Nobel Memorial Prize in Economic Sciences in 1969, which he shared with Ragnar Frisch for having developed and applied dynamic models for the analysis of economic processes. He is widely considered to be one of the most influential economists of the 20th century and one of the founding fathers of econometrics.

A macroeconomic model is an analytical tool designed to describe the operation of the problems of economy of a country or a region. These models are usually designed to examine the comparative statics and dynamics of aggregate quantities such as the total amount of goods and services produced, total income earned, the level of employment of productive resources, and the level of prices.

Constantine Christos "Costas" Azariadis is a macroeconomist born in Athens, Greece. He has worked on numerous topics, such as labor markets, business cycles, and economic growth and development. Azariadis originated and developed implicit contract theory.

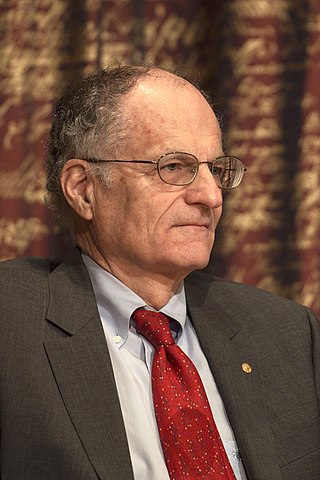

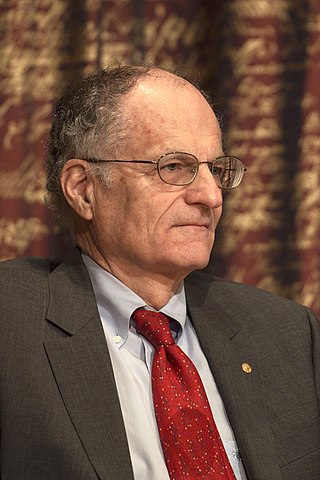

Thomas John Sargent is an American economist and the W.R. Berkley Professor of Economics and Business at New York University. He specializes in the fields of macroeconomics, monetary economics, and time series econometrics. As of 2020, he ranks as the 29th most cited economist in the world. He was awarded the Nobel Memorial Prize in Economics in 2011 together with Christopher A. Sims for their "empirical research on cause and effect in the macroeconomy".

Edmund Strother Phelps is an American economist and the recipient of the 2006 Nobel Memorial Prize in Economic Sciences.

Sir Christopher Antoniou Pissarides is a Cypriot economist. He is the School Professor of Economics & Political Science and Regius Professor of Economics at the London School of Economics, and Professor of European Studies at the University of Cyprus. His research focuses on topics of macroeconomics, notably labour, economic growth, and economic policy. In 2010, he was awarded the Nobel Prize in Economics, jointly with Peter A. Diamond and Dale Mortensen, "for their analysis of markets with theory of search frictions."

Dynamic stochastic general equilibrium modeling is a macroeconomic method which is often employed by monetary and fiscal authorities for policy analysis, explaining historical time-series data, as well as future forecasting purposes. DSGE econometric modelling applies general equilibrium theory and microeconomic principles in a tractable manner to postulate economic phenomena, such as economic growth and business cycles, as well as policy effects and market shocks.

Guillermo Antonio Calvo is an Argentine-American economist who is director of Columbia University's mid-career Program in Economic Policy Management in their School of International and Public Affairs (SIPA).

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of rigorous foundations based on microeconomics, especially rational expectations.

Jordi Galí is a Spanish macroeconomist who is regarded as one of the main figures in New Keynesian macroeconomics today. He is currently the director of the Centre de Recerca en Economia Internacional at Universitat Pompeu Fabra and a Research Professor at the Barcelona Graduate School of Economics. After obtaining his doctorate from MIT in 1989 under the supervision of Olivier Blanchard, he held faculty positions at Columbia University and New York University before moving to Barcelona.

In economics, search and matching theory, is a mathematical framework attempting to describe the formation of mutually beneficial relationships over time. It is closely related to stable matching theory.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

Albert Marcet Torrens is a Spanish economist, specialized in macroeconomics, time series, financial economics and economic dynamic theory. He is currently serving as Professor of Macroeconomics at the UCL Department of Economics, on leave from his position as ICREA Research Professor and Director of the Institute for Economic Analysis (IAE), a research centre of the Spanish National Research Council (CSIC), and AXA Research Chair on Macroeconomic Risk at the Barcelona Graduate School of Economics. He is also a Fellow of the Econometric Society and he has been a Research Fellow of Centre for Economic Policy Research (CEPR) since 1992.

Wim Driehuis is a Dutch economist, Emeritus Professor Economics and Business at the University of Amsterdam.

Andrew John Scott is a British economist, currently Professor of Economics at London Business School, known for his work on longevity and macroeconomics. Previously he was a lecturer at Oxford University, a visiting professor at Harvard University and a researcher at the London School of Economics.

Eran Yashiv is an Israeli economist and policy advisor. His research focuses on topics of macroeconomics, including the labour market and business cycles. More specifically, he is interested in the connections between the value of labour and the value of the firm.