Related Research Articles

The Liberal Party of Canada is a federal political party in Canada. The party espouses the principles of liberalism, and generally sits at the centre to centre-left of the Canadian political spectrum, with their rival, the Conservative Party, positioned to their right and the New Democratic Party, who at times aligned itself with the Liberals during minority governments, positioned to their left. The party is described as "big tent", practising "brokerage politics", attracting support from a broad spectrum of voters. The Liberal Party is the longest-serving and oldest active federal political party in the country, and has dominated federal politics of Canada for much of its history, holding power for almost 70 years of the 20th century. As a result, it has sometimes been referred to as Canada's "natural governing party".

James Michael Flaherty was a Canadian politician who served as the federal minister of finance from 2006 to 2014 under Conservative Prime Minister Stephen Harper.

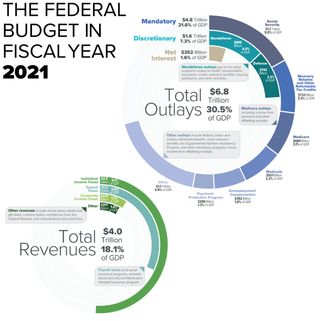

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

The Canadian federal budget for the fiscal year 2006–2007, was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on May 2, 2006. Among the most notable elements of the federal budget were its reduction of the Goods and Services Tax by one percentage point, income tax cuts for middle-income earners, and $1,200-per-child childcare payment for Canadian parents.

Several policies regarding interior and domestic issues in Canada were planned and adopted by the Cabinet of Canadian Prime Minister Stephen Harper, after he came to office as the head of a minority government on February 6, 2006. At the beginning of the government's appointment, five policy priorities were identified in the areas of federal accountability, tax reform, crime, child care and health care.

The Canadian federal budget for the 2007–2008 fiscal year was presented to the House of Commons of Canada by Finance Minister Jim Flaherty. Flaherty presented the 2007 budget on March 19, 2007. No income tax or GST cuts were announced but there were tax credits for some families with children under 18. The federal budget included $14 billion in new spending and $5.7 billion in tax cuts. This was the second budget of the 39th Canadian Parliament.

Kevin Page is a Canadian economist. He was the first Parliamentary Budget Officer for Canada. He was appointed to the position on March 25, 2008, and his term was completed on March 22, 2013. He now teaches at the University of Ottawa. In 2013, Page was named as the Jean-Luc Pepin Research Chair on Canadian Government. In 2016, Page became the head of the newly created Institute of Fiscal Studies and Democracy (IFSD), a think tank with a focus on public finance and policy at the University of Ottawa.

The American Recovery and Reinvestment Act of 2009 (ARRA), nicknamed the Recovery Act, was a stimulus package enacted by the 111th U.S. Congress and signed into law by President Barack Obama in February 2009. Developed in response to the Great Recession, the primary objective of this federal statute was to save existing jobs and create new ones as soon as possible. Other objectives were to provide temporary relief programs for those most affected by the recession and invest in infrastructure, education, health, and renewable energy.

The 2009 Australian federal budget for the Australian financial year ended 30 June 2010 was presented on 12 May 2009 by the Treasurer of Australia, Wayne Swan, the second federal budget presented by Swan, and the second budget of the first Rudd Government. Swan commented that the budget would be tougher than in previous years. "Projected government revenue has fallen by $200 billion since the last budget because of the global economic crisis."

In Canada, the federal government makes equalization payments to provincial governments of lesser fiscal capacity so that "reasonably comparable" levels of public services can be provided at similar levels of taxation. Equalization payments are entrenched in the Constitution Act of 1982, subsection 36(2).

The Canadian federal budget for the 2010-2011 fiscal year was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on March 4, 2010 after returning from a two-month prorogued parliament.

The Canadian federal budget for the 2008-2009 fiscal year was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on February 26, 2008.

The Canadian federal budget for the 2011–2012 fiscal year was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on March 22, 2011, then again on June 6 following a May 2 election.

Political debates about the United States federal budget discusses some of the more significant U.S. budgetary debates of the 21st century. These include the causes of debt increases, the impact of tax cuts, specific events such as the United States fiscal cliff, the effectiveness of stimulus, and the impact of the Great Recession, among others. The article explains how to analyze the U.S. budget as well as the competing economic schools of thought that support the budgetary positions of the major parties.

The Canadian federal budget for fiscal year 2012–13 was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on 29 March 2012. Among the most notable elements of the federal budget were changes to Old Age Security and a reduction of the budget for the Canadian Forces and the Canadian Broadcasting Corporation.

The Canadian federal budget for fiscal year 2013–2014 was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on 21 March 2013. The budget bill was tabled in the legislature on 29 April 2013 as the Economic Action Plan 2013 Act, No. 1. A second budget bill will be tabled in the autumn, which will include elements excluded from the first bill, such as the Canada Job Grant. The deficit was projected to be $18.7 billion for the fiscal year 2013-2014, however this was adjusted to $8.1 billion by end of the fiscal year and once the Auditor General's recommendations on the Government's unfunded pension obligations were taken into account.

The Canadian federal budget for fiscal year 2014–2015 was presented to the House of Commons of Canada by Jim Flaherty on 11 February 2014. This was the last budget presented by the Finance Minister before his resignation in March and death in April. At the end of the fiscal year, the government was surprised to post a budgetary surplus of $1.9 billion. This however would later be overturned to a small deficit of $550 million due to improper accounting methodologies for the Government's unfunded pension obligations, as pointed out for years by the Auditor General.

The Canadian federal budget for fiscal year 2015–2016 was presented to the House of Commons of Canada by Joe Oliver on 21 April 2015. This was the last budget before the 2015 federal election. The budget was supposed to be presented in February or March before the fiscal year began on April 1, but was delayed because of the steep drop in oil prices in the winter of 2014–15. A surplus of $1.4 billion was projected for the fiscal year 2015-2016, however this was adjusted by the new government to a deficit of $1.0 billion by end of March 2016. This was later adjusted to $2.9 billion after reflecting a change requested by the Auditor General dating back 10 years' worth of federal budgets, specifically with regards to the discount rate methodology used to determine the present value of the Government's unfunded pension obligations.

The Canadian federal budget for fiscal year 2017–2018 was presented to the Canadian House of Commons by Finance Minister Bill Morneau on March 22, 2017. The deficit was initially projected to be $28.5 billion, including a $3 billion adjustment for risk. This was later adjusted to $19.0 billion after reflecting a change in the discount rate methodology used to determine the present value of the Government's unfunded pension obligations. The Auditor General's recommendations resulted in revisions to 10 years' worth of budget numbers, which included turning the slim surplus the previous Conservative government left in 2014-15 into a small deficit.

The Government of Canada introduced multiple temporary social security and financial aid programs in response to the economic impacts of the COVID-19 pandemic in Canada. The initial CA$82-billion aid package was announced on March 18, 2020 by Justin Trudeau.

References

- 1 2 3 4 5 Department of Finance Canada (January 27, 2009). "The budget plan". Department of Finance Canada. Archived (PDF) from the original on March 13, 2009. Retrieved 2009-05-08.

- ↑ "Feds pull Yahoo! ads after EAP banner shows up on The Pirate Bay". Ottawa Citizen. 26 September 2012. Archived from the original on 2012-10-18. Retrieved 2012-10-18.

- ↑ "Ignatieff puts Tories 'on probation' with budget demand" (Press release). CBC News. 2009-01-28. Archived from the original on 30 January 2009. Retrieved 2009-01-31.

- ↑ "MPs vote in favour of Liberal budget amendment". cbc.ca. 2009-02-02. Archived from the original on 27 February 2009. Retrieved 2009-02-18.

- ↑ "MPs approve federal budget". cbc.ca. 2009-02-03. Archived from the original on 7 February 2009. Retrieved 2009-02-18.

- ↑ CTV News. "'Technical' recession possible: Flaherty". CTV. Archived from the original on July 24, 2012.

- ↑ CTV News (November 24, 2008). "Budget advanced to deal with deteriorating economy". CTV. Archived from the original on July 29, 2012.

- ↑ CTV Ottawa (November 24, 2008). "PSAC reaches deal with federal government". CTV. Archived from the original on July 27, 2011.

- ↑ CTV Ottawa (November 28, 2008). "Public service unions lash out at government plans". CTV. Archived from the original on July 27, 2011.

- ↑ CTV News (November 25, 2008). "Government to curb Parliamentary perks". CTV. Archived from the original on December 5, 2008.

- ↑ CTV News (November 28, 2008). "Harper pushes political showdown back a week". CTV. Archived from the original on December 3, 2008.

- ↑ CTV News (November 26, 2008). "Tories slammed for lack of stimulus package". CTV. Archived from the original on December 6, 2008.

- ↑ CTV (November 30, 2008). "Flaherty to table budget on January 27". CTV. Archived from the original on December 4, 2008.

- ↑ Akin, David (December 20, 2008). "Feds to spend $30B on economy". The Ottawa Citizen. Archived from the original on December 23, 2008. Retrieved October 4, 2018.

- ↑ CBC News (January 27, 2009). "Bad-times budget delivers billions in tax cuts, spending". CBC.ca.

- ↑ CTV News (January 27, 2009). "Federal budget forecasts massive $85B deficit". CTV.ca. Archived from the original on March 2, 2009.

- ↑ CTV News (February 2, 2009). "Liberal amendment to federal budget passes". CTV.ca. Archived from the original on February 5, 2009.

- ↑ CBC News (January 27, 2008). "Early reviews mixed from Ignatieff; more expected Wednesday". CBC.ca.

- ↑ CBC News (February 3, 2009). "MPs approve federal budget". CBC.ca.

- ↑ CTV News (January 30, 2009). "Canadians support budget, but with reservations". CTV.ca. Archived from the original on February 5, 2009.

- ↑ "Budget 2009: Canada's Economic Action Plan" (Press release). Department of Finance. 2009-01-27. Archived from the original on 21 February 2009. Retrieved 2009-01-30.

- ↑ "Canada News Centre - Federal, provincial and territorial governments cooperate to improve foreign credential recognition for newcomers to Canada". Archived from the original on 2011-09-28. Retrieved 2010-01-28.