Related Research Articles

The mole (symbol mol) is a unit of measurement, the base unit in the International System of Units (SI) for amount of substance, a quantity proportional to the number of elementary entities of a substance. One mole contains exactly 6.02214076×1023 elementary entities (approximately 602 sextillion or 602 billion times a trillion), which can be atoms, molecules, ions, ion pairs, or other particles. The number of particles in a mole is the Avogadro number (symbol N0) and the numerical value of the Avogadro constant (symbol NA) expressed in mol-1. The value was chosen on the basis of the historical definition of the mole as the amount of substance that corresponds to the number of atoms in 12 grams of 12C, which made the mass of a mole of a compound expressed in grams, numerically equal to the average molecular mass or formula mass of the compound expressed in daltons. With the 2019 revision of the SI, the numerical equivalence is now only approximate but may be assumed for all practical purposes.

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though more often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business. The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets.

In finance, discounting is a mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date. This transaction is based on the fact that most people prefer current interest to delayed interest because of mortality effects, impatience effects, and salience effects. The discount, or charge, is the difference between the original amount owed in the present and the amount that has to be paid in the future to settle the debt.

In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor. The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure.

In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has interest-earning potential, a characteristic referred to as the time value of money, except during times of negative interest rates, when the present value will be equal or more than the future value. Time value can be described with the simplified phrase, "A dollar today is worth more than a dollar tomorrow". Here, 'worth more' means that its value is greater than tomorrow. A dollar today is worth more than a dollar tomorrow because the dollar can be invested and earn a day's worth of interest, making the total accumulate to a value more than a dollar by tomorrow. Interest can be compared to rent. Just as rent is paid to a landlord by a tenant without the ownership of the asset being transferred, interest is paid to a lender by a borrower who gains access to the money for a time before paying it back. By letting the borrower have access to the money, the lender has sacrificed the exchange value of this money, and is compensated for it in the form of interest. The initial amount of borrowed funds is less than the total amount of money paid to the lender.

In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum, at a particular rate. It is distinct from a fee which the borrower may pay to the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit or reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs.

The time value of money refers to the fact that there is normally a greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference.

A mutual fund is an investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe, and the open-ended investment company (OEIC) in the UK.

In finance, the rule of 72, the rule of 70 and the rule of 69.3 are methods for estimating an investment's doubling time. The rule number is divided by the interest percentage per period to obtain the approximate number of periods required for doubling. Although scientific calculators and spreadsheet programs have functions to find the accurate doubling time, the rules are useful for mental calculations and when only a basic calculator is available.

The dividend yield or dividend–price ratio of a share is the dividend per share divided by the price per share. It is also a company's total annual dividend payments divided by its market capitalization, assuming the number of shares is constant. It is often expressed as a percentage.

In finance, the yield on a security is a measure of the ex-ante return to a holder of the security. It is one component of return on an investment, the other component being the change in the market price of the security. It is a measure applied to fixed income securities, common stocks, preferred stocks, convertible stocks and bonds, annuities and real estate investments.

Future value is the value of an asset at a specific date. It measures the nominal future sum of money that a given sum of money is "worth" at a specified time in the future assuming a certain interest rate, or more generally, rate of return; it is the present value multiplied by the accumulation function. The value does not include corrections for inflation or other factors that affect the true value of money in the future. This is used in time value of money calculations.

The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card, etc. It is a finance charge expressed as an annual rate. Those terms have formal, legal definitions in some countries or legal jurisdictions, but in the United States:

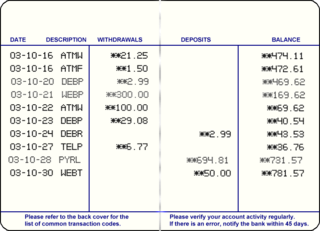

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transactions on savings accounts were widely recorded in a passbook, and were sometimes called passbook savings accounts, and bank statements were not provided; however, currently such transactions are commonly recorded electronically and accessible online.

A money market fund is an open-end mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are managed with the goal of maintaining a highly stable asset value through liquid investments, while paying income to investors in the form of dividends. Although they are not insured against loss, actual losses have been quite rare in practice.

In the United States, 30-day yield is a standardized yield calculation for bond funds. The formula for calculating 30-day yield is specified by the U.S. Securities and Exchange Commission (SEC). The formula translates the bond fund's current portfolio income into a standardized yield for reporting and comparison purposes. A bond fund's 30-day yield may appear in the fund's "Statement of Additional Information (SAI)" in its prospectus.

In finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium-term notes, swaps, and forward rate agreements (FRAs). This determines the number of days between two coupon payments, thus calculating the amount transferred on payment dates and also the accrued interest for dates between payments. The day count is also used to quantify periods of time when discounting a cash-flow to its present value. When a security such as a bond is sold between interest payment dates, the seller is eligible to some fraction of the coupon amount.

Credit card interest is a way in which credit card issuers generate revenue. A card issuer is a bank or credit union that gives a consumer a card or account number that can be used with various payees to make payments and borrow money from the bank simultaneously. The bank pays the payee and then charges the cardholder interest over the time the money remains borrowed. Banks suffer losses when cardholders do not pay back the borrowed money as agreed. As a result, optimal calculation of interest based on any information they have about the cardholder's credit risk is key to a card issuer's profitability. Before determining what interest rate to offer, banks typically check national, and international, credit bureau reports to identify the borrowing history of the card holder applicant with other banks and conduct detailed interviews and documentation of the applicant's finances.

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows which the investor receives from that investment over a specified time period, such as interest payments, coupons, cash dividends and stock dividends. It may be measured either in absolute terms or as a percentage of the amount invested. The latter is also called the holding period return.

Annual percentage yield (APY) is a normalized representation of an interest rate, based on a compounding period of one year. APY figures allow a reasonable, single-point comparison of different offerings with varying compounding schedules. However, it does not account for the possibility of account fees affecting the net gain. APY generally refers to the rate paid to a depositor by a financial institution, while the analogous annual percentage rate (APR) refers to the rate paid to a financial institution by a borrower.

References

- ↑ "What Is a Seven-Day Yield? Definition and Formula for Calculation". Investopedia. Retrieved 2016-06-02.

- ↑ Nellie S. Huang (2020-11-25). "The ABCs of Yields". Kiplinger.com. Retrieved 2016-06-02.