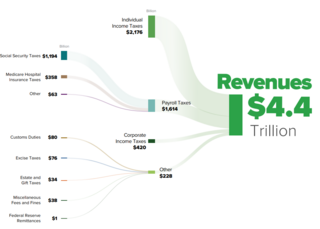

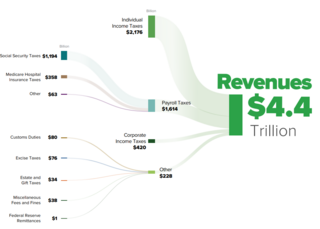

The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

The Sixteenth Amendment to the United States Constitution allows Congress to levy an income tax without apportioning it among the states on the basis of population. It was passed by Congress in 1909 in response to the 1895 Supreme Court case of Pollock v. Farmers' Loan & Trust Co. The Sixteenth Amendment was ratified by the requisite number of states on February 3, 1913, and effectively overruled the Supreme Court's ruling in Pollock.

Tax noncompliance is a range of activities that are unfavorable to a government's tax system. This may include tax avoidance, which is tax reduction by legal means, and tax evasion which is the illegal non-payment of tax liabilities. The use of the term "noncompliance" is used differently by different authors. Its most general use describes non-compliant behaviors with respect to different institutional rules resulting in what Edgar L. Feige calls unobserved economies. Non-compliance with fiscal rules of taxation gives rise to unreported income and a tax gap that Feige estimates to be in the neighborhood of $500 billion annually for the United States.

Irwin Allen Schiff was an American libertarian and tax resistance advocate known for writing and promoting literature in which he argued that the way in which the income tax in the United States is enforced upon individuals as a tax on one's time or wages, is illegal and unconstitutional. Judges in several civil and criminal cases ruled in favor of the federal government and against Schiff. As a result of these judicial rulings Schiff was in a hospital prison serving a sentence of 162 months at the time of his death.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Cheek v. United States, 498 U.S. 192 (1991), was a United States Supreme Court case in which the Court reversed the conviction of John L. Cheek, a tax protester, for willful failure to file tax returns and tax evasion. The Court held that an actual good-faith belief that one is not violating the tax law, based on a misunderstanding caused by the complexity of the tax law, negates willfulness, even if that belief is irrational or unreasonable. The Court also ruled that an actual belief that the tax law is invalid or unconstitutional is not a good faith belief based on a misunderstanding caused by the complexity of the tax law, and is not a defense.

James v. United States, 366 U.S. 213 (1961), was a case in which the United States Supreme Court held that the receipt of money obtained by a taxpayer illegally was taxable income even though the law might require the taxpayer to repay the ill-gotten gains to the person from whom they had been taken.

A tax protester, in the United States, is a person who denies that he or she owes a tax based on the belief that the Constitution of the United States, statutes, or regulations do not empower the government to impose, assess or collect the tax. The tax protester may have no dispute with how the government spends its revenue. This differentiates a tax protester from a tax resister, who seeks to avoid paying a tax because the tax is being used for purposes with which the resister takes issue.

The Law That Never Was: The Fraud of the 16th Amendment and Personal Income Tax is a 1985 book by William J. Benson and Martin J. "Red" Beckman which claims that the Sixteenth Amendment to the United States Constitution, commonly known as the income tax amendment, was never properly ratified. In 2007, and again in 2009, Benson's contentions were ruled to be fraudulent.

Tax protesters in the United States have advanced a number of arguments asserting that the assessment and collection of the federal income tax violates statutes enacted by the United States Congress and signed into law by the President. Such arguments generally claim that certain statutes fail to create a duty to pay taxes, that such statutes do not impose the income tax on wages or other types of income claimed by the tax protesters, or that provisions within a given statute exempt the tax protesters from a duty to pay.

Tax protesters in the United States advance a number of conspiracy arguments asserting that Congress, the courts and various agencies within the federal government—primarily the Internal Revenue Service (IRS)—are involved in a deception deliberately designed to procure from individuals or entities their wealth or profits in contravention of law. Conspiracy arguments are distinct from, though related to, constitutional, statutory, and administrative arguments. Proponents of such arguments contend that all three branches of the United States government are working covertly to defraud the taxpayers of the United States through the illegal imposition, assessment and collection of a federal income tax.

Marrita Murphy and Daniel J. Leveille, Appellants v. Internal Revenue Service and United States of America, Appellees, is a tax case in which the United States Court of Appeals for the District of Columbia Circuit originally held that the taxation of emotional distress awards by the federal government is unconstitutional. That decision was vacated, or rendered void, by the Court on December 22, 2006. The Court eventually overturned its original decision, finding against Murphy in an opinion issued on July 3, 2007.

Tommy Keith Cryer, also known as Tom Cryer, was an attorney in Shreveport, Louisiana who was charged with and later acquitted of willful failure to file U.S. Federal income tax returns in a timely fashion. In a case in United States Tax Court, Cryer contested a determination by the U.S. Internal Revenue Service that he owed $1.7 million in taxes and penalties. Before the case could come to trial, Cryer died June 4, 2012. He was 62.

The 861 argument is a statutory argument used by tax protesters in the United States, which interprets a portion of the Internal Revenue Code as invalidating certain applications of income tax. The argument has uniformly been held by courts to be incorrect, and persons who have cited the argument as a basis for refusing to pay income taxes have been penalized, and in some cases jailed.

Tax protester Sixteenth Amendment arguments are assertions that the imposition of the U.S. federal income tax is illegal because the Sixteenth Amendment to the United States Constitution, which reads "The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration", was never properly ratified, or that the amendment provides no power to tax income. Proper ratification of the Sixteenth Amendment is disputed by tax protesters who argue that the quoted text of the Amendment differed from the text proposed by Congress, or that Ohio was not a State during ratification, despite its admission to the Union on March 1, 1803, more than a century prior. Sixteenth Amendment ratification arguments have been rejected in every court case where they have been raised and have been identified as legally frivolous.

Tax protesters in the United States advance a number of constitutional arguments asserting that the imposition, assessment and collection of the federal income tax violates the United States Constitution. These kinds of arguments, though related to, are distinguished from statutory and administrative arguments, which presuppose the constitutionality of the income tax, as well as from general conspiracy arguments, which are based upon the proposition that the three branches of the federal government are involved together in a deliberate, on-going campaign of deception for the purpose of defrauding individuals or entities of their wealth or profits. Although constitutional challenges to U.S. tax laws are frequently directed towards the validity and effect of the Sixteenth Amendment, assertions that the income tax violates various other provisions of the Constitution have been made as well.

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries.

Tax protester arguments are arguments made by people, primarily in the United States, who contend that tax laws are unconstitutional or otherwise invalid.

Regan v. Taxation with Representation of Washington, 461 U.S. 540 (1983), was a case in which the United States Supreme Court upheld lobbying restrictions imposed on tax-exempt non-profit corporations.

Tax protesters in the United States advance a number of administrative arguments asserting that the assessment and collection of the federal income tax violates regulations enacted by responsible agencies –primarily the Internal Revenue Service (IRS)– tasked with carrying out the statutes enacted by the United States Congress and signed into law by the President. Such arguments generally include claims that the administrative agency fails to create a duty to pay taxes, or that its operation conflicts with some other law, or that the agency is not authorized by statute to assess or collect income taxes, to seize assets to satisfy tax claims, or to penalize persons who fail to file a return or pay the tax.