Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss.

Maxwell Sieben Baucus is an American politician who served as a United States senator from Montana from 1978 to 2014. A member of the Democratic Party, he was a U.S. senator for over 35 years, making him the longest-serving U.S. senator in Montana history. President Barack Obama appointed Baucus to replace Gary Locke as the 11th U.S. Ambassador to the People's Republic of China, a position he held from 2014 until 2017.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses.

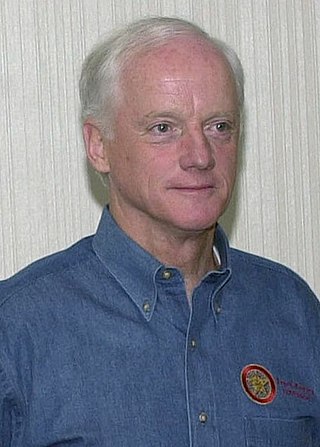

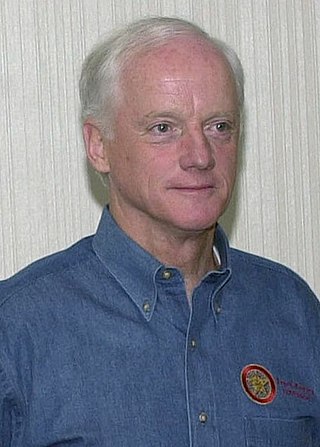

Dirk Arthur Kempthorne is an American politician who served as the 49th United States Secretary of the Interior from 2006 to 2009 under President George W. Bush. A member of the Republican Party, he previously served as a United States Senator from Idaho from 1993 to 1999 and the 30th governor of Idaho from 1999 to 2006.

Francis Anthony Keating II is an American attorney and politician who served as the 25th governor of Oklahoma from 1995 to 2003.

In insurance, the insurance policy is a contract between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language.

The savings and loan crisis of the 1980s and 1990s was the failure of 32% of savings and loan associations (S&Ls) in the United States from 1986 to 1995. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual members.

Catastrophe modeling is the process of using computer-assisted calculations to estimate the losses that could be sustained due to a catastrophic event such as a hurricane or earthquake. Cat modeling is especially applicable to analyzing risks in the insurance industry and is at the confluence of actuarial science, engineering, meteorology, and seismology.

An insurance broker is an intermediary who sells, solicits, or negotiates insurance on behalf of a client for compensation. An insurance broker is distinct from an insurance agent in that a broker typically acts on behalf of a client by negotiating with multiple insurers, while an agent represents one or more specific insurers under a contract.

Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is a type of insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted default, insolvency or bankruptcy. This insurance product is a type of property and casualty insurance, and should not be confused with such products as credit life or credit disability insurance, which individuals obtain to protect against the risk of loss of income needed to pay debts. Trade credit insurance can include a component of political risk insurance which is offered by the same insurers to insure the risk of non-payment by foreign buyers due to currency issues, political unrest, expropriation etc.

Farmers Insurance Group is an American insurer group of vehicles, homes and small businesses and also provides other insurance and financial services products. Farmers Insurance has more than 48,000 exclusive and independent agents and approximately 21,000 employees. Farmers is the trade name for three reciprocal exchanges, Farmers, Fire, and Truck, each a managed by Farmers Group, Inc. as attorney-in-fact on behalf of their respective policyholders. Farmers Group, Inc. is a wholly owned subsidiary of Swiss-based Zurich Insurance Group.

Australia's insurance market can be divided into roughly three components: life insurance, general insurance and health insurance. These markets are fairly distinct, with most larger insurers focusing on only one type, although in recent times several of these companies have broadened their scope into more general financial services, and have faced competition from banks and subsidiaries of foreign financial conglomerates. With services such as disability insurance, income protection and even funeral insurance, these insurance giants are stepping in to fill the gap where people may have otherwise been in need of a personal or signature loan from their financial institution.

The Korea Deposit Insurance Corporation (KDIC) is a deposit insurance corporation, established in 1996 in South Korea to protect depositors and maintain the stability of the financial system. The main functions of KDIC are insurance management, risk surveillance, resolution, recovery, and investigation.

Insurance in the United States refers to the market for risk in the United States, the world's largest insurance market by premium volume. According to Swiss Re, of the $6.782 trillion of global direct premiums written worldwide in 2022, $2.959 trillion (43.6%) were written in the United States.

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act (PPACA) and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by President Barack Obama on March 23, 2010. Together with the Health Care and Education Reconciliation Act of 2010 amendment, it represents the U.S. healthcare system's most significant regulatory overhaul and expansion of coverage since the enactment of Medicare and Medicaid in 1965.

Michael J. Hunter is an American politician from the state of Oklahoma. Hunter served as the Secretary of State of Oklahoma from 1999 to 2002, having been appointed by Governor of Oklahoma Frank Keating. On November 1, 2016, he was appointed to the same post by Governor Mary Fallin. He also served as Special Counsel to the Governor. On February 20, 2017, Hunter was appointed Attorney General of Oklahoma to replace Scott Pruitt who resigned to become the Administrator of the Environmental Protection Agency. On November 8, 2018, Hunter won election as Attorney General.

The Insurance Regulatory and Development Authority of India (IRDAI) is a statutory body under the jurisdiction of Ministry of Finance, Government of India and is tasked with regulating and licensing the insurance and re-insurance industries in India. It was constituted by the Insurance Regulatory and Development Authority Act, 1999, an Act of Parliament passed by the Government of India. The agency's headquarters are in Hyderabad, Telangana, where it moved from Delhi in 2001.

The Insurance Capital Standards Clarification Act of 2014 is a United States bill that would amend the Dodd–Frank Wall Street Reform and Consumer Protection Act to "clarify the application of certain leverage and risk-based requirements".

Ullico Inc. is a privately held insurance and financial services holding company in the United States. Formerly known as Union Labor Life Insurance Company, it was founded in 1927 by the American Federation of Labor (AFL) and its then president, Samuel Gompers, to offer health and life insurance products specifically to working men and women. Matthew Woll, president of the International Photo-Engravers Union of North America, became the company's first president. Ullico is one of the largest insurance and investment services companies for trade union members in the United States.

Thomas Benedict Leonardi, is United States business executive in the insurance and financial services fields, who has worked in the public and private sectors. His career includes decades as the head of investment banking and venture capital firms specializing in insurance, and he also has a background as a regulator and government adviser.