Related Research Articles

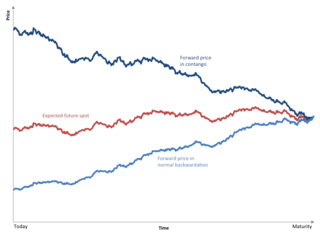

Contango is a situation where the futures price of a commodity is higher than the expected spot price of the contract at maturity. In a contango situation, arbitrageurs or speculators are "willing to pay more [now] for a commodity [to be received] at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, hedgers are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a normal market, or carrying-cost market.

Morgan Stanley is an American multinational investment management and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in more than 41 countries and more than 75,000 employees, the firm's clients include corporations, governments, institutions, and individuals. Morgan Stanley ranked No. 61 in the 2021 Fortune 500 list of the largest United States corporations by total revenue.

Citigroup Inc. or Citi is an American multinational investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in 1998; Travelers was subsequently spun off from the company in 2002. Citigroup owns Citicorp, the holding company for Citibank, as well as several international subsidiaries. Citigroup is incorporated in Delaware.

Citibank, N. A. is the primary U.S. banking subsidiary of financial services multinational Citigroup. Citibank was founded in 1812 as the City Bank of New York, and later became First National City Bank of New York. The bank has 2,649 branches in 19 countries, including 723 branches in the United States and 1,494 branches in Mexico operated by its subsidiary Banamex. The U.S. branches are concentrated in six metropolitan areas: New York, Chicago, Los Angeles, San Francisco, Washington, D.C., and Miami.

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York. It was one of the five largest investment banking enterprises in the United States and the most profitable firm on Wall Street during the 1980s and 1990s. Its CEO and chairman at that time, John Gutfreund, was nicknamed "the King of Wall Street".

Steven A. Cohen is an American hedge fund manager and owner of the New York Mets of Major League Baseball since September 14, 2020, owning roughly 97.2% of the team. He is the founder of hedge fund Point72 Asset Management and now-closed S.A.C. Capital Advisors, both based in Stamford, Connecticut.

Commodities Corporation was a financial services company, based in Princeton, New Jersey that traded actively across various commodities. The firm was noted as one of the leading commodity and futures trading firms. CC is credited for launching the careers of many notable hedge fund investors and for its influence on global macro investing.

Vikram Shankar Pandit is an Indian-American banker and investor who was the chief executive officer of Citigroup from December 2007 to 16 October 2012 and is the current chairman and chief executive officer of The Orogen Group.

Phibro is an international physical commodities trading firm. Phibro trades in crude oil, oil products, natural gas, precious and base metals, agricultural products, commodity-related equities, and other products. Phibro’s headquarters are located in Stamford, Connecticut.

Thomas G. Maheras is a managing partner of Tegean Capital Management, LLC, a New York-based hedge fund founded in 2008.

Mercuria Energy Group Ltd is a Cypriot-domiciled multinational commodity trading company active in a wide spectrum of global energy markets including crude oil and refined petroleum products, natural gas, power, biodiesel, base metals and agricultural products. The company is one of the world's five largest independent energy traders and asset operators and is based in Geneva, Switzerland, with 37 additional offices worldwide. The group operates in 50 different countries.

Sir David Winton Harding is a British billionaire businessman, and the founder and CEO of Winton Group. He had previously co-founded Man AHL. His approach favours quantitative investment strategies, using scientific research as the basis of trading decisions.

John E. Havens is the former chairman of Citigroup spinoff, Napier Park Global Capital, and is also the former president and chief operating officer of Citigroup.

Pierre Andurand is a French businessman and hedge fund manager. In 2008, Forbes Magazine placed him in its list of the top 20 highest-earning hedge-fund managers. His funds have approximately $2bn in assets under management and have produced cumulative returns of between 900-1300% for investors since 2008. He is also the majority shareholder of the international kickboxing league Glory.

The forex scandal is a 2013 financial scandal that involves the revelation, and subsequent investigation, that banks colluded for at least a decade to manipulate exchange rates on the forex market for their own financial gain. Market regulators in Asia, Switzerland, the United Kingdom, and the United States began to investigate the $4.7 trillion per day foreign exchange market (forex) after Bloomberg News reported in June 2013 that currency dealers said they had been front-running client orders and rigging the foreign exchange benchmark WM/Reuters rates by colluding with counterparts and pushing through trades before and during the 60-second windows when the benchmark rates are set. The behavior occurred daily in the spot foreign-exchange market and went on for at least a decade according to currency traders.

Brigade Capital Management, LP, more commonly referred to as Brigade Capital, is a global alternative investment manager specializing in credit investment strategies. The firm employs a multi-strategy, multi-asset class investment approach focused on leveraged balance sheets and manages core strategies across long/short credit, distressed debt, capital structure arbitrage, long/short equities and structured credit. The hedge fund invests primarily in the retail, media, telecommunications, healthcare, finance, utilities and energy sectors with particular expertise in distressed securities, bankruptcy and reorganization.

Goldman Sachs controversies are the controversies surrounding the American multinational investment bank Goldman Sachs. The bank and its activities have generated substantial controversy and legal issues around the world and is the subject of speculation about its involvement in global finance and politics. In a widely publicized story in Rolling Stone, Matt Taibbi characterized Goldman Sachs as a "great vampire squid" sucking money instead of blood, allegedly engineering "every major market manipulation since the Great Depression."

Oscar Israel Philipp (1882–1965) was a German-born metal trader who co-founded Philipp Brothers.

Mismarking in securities valuation takes place when the value that is assigned to securities does not reflect what the securities are actually worth, due to intentional fraudulent mispricing. Mismarking misleads investors and fund executives about how much the securities in a securities portfolio managed by a trader are worth, and thus misrepresents performance. When a trader engages in mismarking, it allows him to obtain a higher bonus from the financial firm for which he works, where his bonus is calculated by the performance of the securities portfolio that he is managing.

References

- ↑ "Commodities Star Absorbs Loss ," The Wall Street Journal , June 25, 2010

- ↑ David Sheppard (April 5, 2019), The $100m oil trader Andy Hall finally sticks his oar in Financial Times .

- ↑ The Lion, Hampton Grammar School Magazine (Autumn Term 1968) pp 52-7

- ↑ "Commodities Star Absorbs Loss ," The Wall Street Journal, June 25, 2010

- ↑ Gregory Meyer (February 2, 2015), Rise and fall of a commodities powerhouse Financial Times .

- ↑ Gregory Meyer (February 2, 2015), Rise and fall of a commodities powerhouse Financial Times .

- ↑ "Citi trader Andrew Hall fights for $100m bonus ," The Telegraph (UK), July 25, 2009

- ↑ "Citi in $100 Million Pay Clash," The Wall Street Journal, July 25, 2009

- ↑ "Ex-Citigroup Trader Hall Raises $1 Billion for Commodities Fund," Archived June 26, 2010, at the Wayback Machine Bloomberg Businessweek, June 22, 2010

- ↑ Alison Sider and Rob Copeland (August 3, 2017), Oil Trader Andrew Hall Is Closing His Astenbeck Hedge Fund The Wall Street Journal .

- ↑ "About the Hall Art Foundation" Hall Art Foundation, June 2, 2015

- ↑ Art collectors who turn obstacles into opportunities, Financial Times, 26 May 2017

- ↑ "Step Inside the Hall Art Foundation's New Home", Architectural Digest, 1 November 2017

- ↑ "Olafur Eliasson brings the Hall Art Foundation back to nature", The Boston Globe, 16 May 2014

- ↑ "Massachusetts Museum of Contemporary Art, North Adams, Massachusetts", Financial Times, 31 August 2015