Providence Equity Partners L.L.C. is a specialist private equity investment firm focused on media, communications, education, and technology investments across North America and Europe. The firm specializes in growth-oriented private equity investments and has invested in more than 170 companies globally since its inception in 1989.

In finance, the private-equity secondary market refers to the buying and selling of pre-existing investor commitments to private-equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private-equity funds as well as hedge funds can be more complex and labor-intensive.

Thomas H. Lee Partners, L.P. is an American private equity firm headquartered in Boston. The firm focuses on investing in middle market growth companies across various sectors, including financial technology, services, healthcare, technology, and business solutions.

Silver Lake, legally Silver Lake Technology Management, L.L.C., is an American global private equity firm focused on technology and technology-enabled investments. Silver Lake is headquartered in Silicon Valley, and has offices in New York, London and Hong Kong.

Accel, formerly known as Accel Partners, is an American venture capital firm. Accel works with startups in seed, early and growth-stage investments. The company has offices in Palo Alto, California and San Francisco, California, with additional operating funds in London, India and China.

Lexington Partners is one of the largest manager of secondary acquisition and co-Investment funds in the world, founded in 1994. Lexington manages approximately $55 billion of which an unprecedented $14 billion was committed to the firm's ninth fund, the largest dedicated secondaries pool of capital ever raised at the time.

HCI Equity Partners is a Washington, DC-based private equity firm with an additional office in Chicago, IL.

Avista Capital Partners is an American private equity firm headquartered in New York City focused on growth capital and leveraged buyout investments in middle-market companies in the domestic healthcare sector.

TSG Consumer Partners is an American private equity company based in San Francisco, California. The firm was founded in 1986, and was among the first private equity firms to invest exclusively in consumer companies.

Irving Place Capital, formerly known as Bear Stearns Merchant Banking (BSMB), is an American private equity firm focused on leveraged buyout and growth capital investments in middle-market companies in the industrial, packaging, consumer and retail industries. Based in New York City, it has total committed capital across its funds of $5.9 billion.

Andreessen Horowitz is a private American venture capital firm, founded in 2009 by Marc Andreessen and Ben Horowitz. The company is headquartered in Menlo Park, California. As of April 2023, Andreessen Horowitz ranks first on the list of venture capital firms by assets under management.

New Enterprise Associates (NEA) is an American-based venture capital firm. NEA focuses investment stages ranging from seed stage through growth stage across an array of industry sectors. With ~$25 billion in committed capital, NEA is one of the world's largest venture capital firms.

Hg is a private equity firm targeting technology buyouts primarily in Europe and the US. Hg focuses on investments in technology and services sectors. It invests out of its 8th £2.5 billion core fund and its 2nd £575 million Mercury fund, targeting smaller technology buyouts, both raised in February 2017. Both funds were closed on their hard-caps and were more than 3x oversubscribed versus their targets, receiving strong re-ups from existing investors. The company raised its 1st time £1.5B Saturn large-cap fund in March 2018 and in 2020 raised $11B across three funds, Mercury 3, Genesis 9 and Saturn 2.

Kinderhook Industries, LLC is an American private equity firm based in New York City. Since 2003, the firm has raised over $5 billion under management and has made in excess of 300 investments.

HGGC is an American middle-market private equity firm based in Palo Alto, California, with over $7 billion of cumulative capital commitments. Since its inception in 2007, HGGC has completed transactions with an aggregate transaction value of $50 billion. The firm was named 2014 M&A Mid-Market Private Equity Firm of the Year by Mergers & Acquisitions magazine.

Sentinel Capital Partners, L.L.C. is an American private-equity firm focusing on mid-market companies. The company is headquartered in New York City and was founded in 1994 by David Lobel and John McCormack after working together at Salomon Smith Barney.

Coatue is an American technology-focused investment manager led by founder and portfolio manager Philippe Laffont. Coatue invests in public and private markets with a focus on technology, media, telecommunications, the consumer and healthcare sectors. Coatue has offices in New York City, Menlo Park, California, London, Shanghai and Hong Kong.

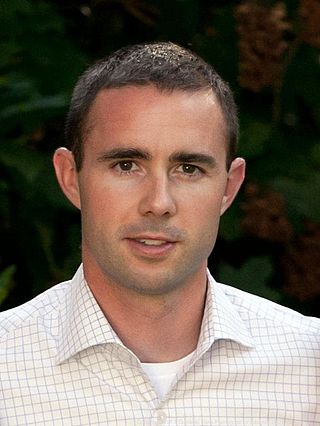

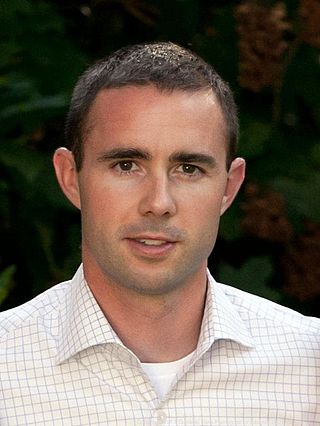

Devin Talbott is an American entrepreneur and private investor, and the son of foreign policy expert Strobe Talbott.

Veritas Capital Fund Management, L.L.C. is a New York–based private-equity firm founded in 1992 that invests in companies providing critical products and services, primarily technology-enabled products and services, to government and commercial customers worldwide. The firm's first fund closed in 1998. They closed an eighth flagship fund in 2022; in all, Veritas has approximately $45 billion of assets under management. Veritas is led by Ramzi Musallam, the firm's Chief Executive Officer and Managing Partner.

Idinvest Partners, founded under the name AGF Private Equity, S.A in 1997, is a European private equity and venture capital firm. Operating as part of Allianz until 2010, Idinvest Partners then became independent. Idinvest Partners is based in Paris, France and has further offices in Frankfurt (Germany), Dubai, Madrid, Spain and Shanghai, China.