The historical cost of an asset at the time it is acquired or created is the value of the costs incurred in acquiring or creating the asset, comprising the consideration paid to acquire or create the asset plus transaction costs. Historical cost accounting involves reporting assets and liabilities at their historical costs, which are not updated for changes in the items' values. Consequently, the amounts reported for these balance sheet items often differ from their current economic or market values.

Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding sides, known as debit and credit; this is based on the fundamental accounting principle that for every debit, there must be an equal and opposite credit. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud.

An expense is an item requiring an outflow of money, or any form of fortune in general, to another person or group as payment for an item, service, or other category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture, or an automobile is often referred to as an expense. An expense is a cost that is "paid" or "remitted", usually in exchange for something of value. Something that seems to cost a great deal is "expensive". Something that seems to cost little is "inexpensive". "Expenses of the table" are expenses for dining, refreshments, a feast, etc.

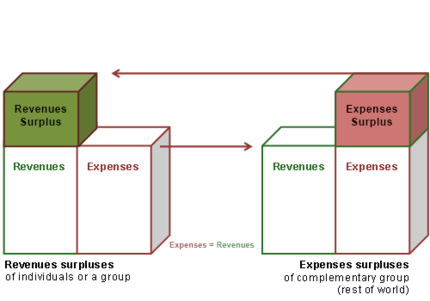

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. A central point of controversy in economics, government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression.

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited.

In macroeconomics and international finance, a country's current account records the value of exports and imports of both goods and services and international transfers of capital. It is one of the two components of the balance of payments, the other being the capital account. Current account measures the nation's earnings and spendings abroad and it consists of the balance of trade, net primary income or factor income and net unilateral transfers, that have taken place over a given period of time. The current account balance is one of two major measures of a country's foreign trade. A current account surplus indicates that the value of a country's net foreign assets grew over the period in question, and a current account deficit indicates that it shrank. Both government and private payments are included in the calculation. It is called the current account because goods and services are generally consumed in the current period.

In bookkeeping, an account refers to assets, liabilities, income, expenses, and equity, as represented by individual ledger pages, to which changes in value are chronologically recorded with debit and credit entries. These entries, referred to as postings, become part of a book of final entry or ledger. Examples of common financial accounts are sales, accountsreceivable, mortgages, loans, PP&E, common stock, sales, services, wages and payroll.

In economics, a country's national saving is the sum of private and public saving. It equals a nation's income minus consumption and the government spending.

Working capital (WC) is a financial metric which represents operating liquidity available to a business, organisation, or other entity, including governmental entities. Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital. Gross working capital is equal to current assets. Working capital is calculated as current assets minus current liabilities. If current assets are less than current liabilities, an entity has a working capital deficiency, also called a working capital deficit and negative working capital.

A chart of accounts (COA) is a list of financial accounts and reference numbers, grouped into categories, such as assets, liabilities, equity, revenue and expenses, and used for recording transactions in the organization's general ledger. Accounts may be associated with an identifier and a caption or header and are coded by account type. In computerized accounting systems with computable quantity accounting, the accounts can have a quantity measure definition. Account numbers may consist of numerical, alphabetic, or alpha-numeric characters, although in many computerized environments, like the SIE format, only numerical identifiers are allowed. The structure and headings of accounts should assist in consistent posting of transactions. Each nominal ledger account is unique, which allows its ledger to be located. The accounts are typically arranged in the order of the customary appearance of accounts in the financial statements: balance sheet accounts followed by profit and loss accounts.

The paradox of thrift is a paradox of economics. The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower total saving. The paradox is, narrowly speaking, that total saving may fall because of individuals' attempts to increase their saving, and, broadly speaking, that increase in saving may be harmful to an economy. The paradox of thrift is an example of the fallacy of composition, the idea that what is true of the parts must always be true of the whole. The narrow claim transparently contradicts the fallacy, and the broad one does so by implication, because while individual thrift is generally averred to be good for the individual, the paradox of thrift holds that collective thrift may be bad for the economy.

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. It emphasizes accountability rather than profitability, and is used by nonprofit organizations and by governments. In this method, a fund consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions.

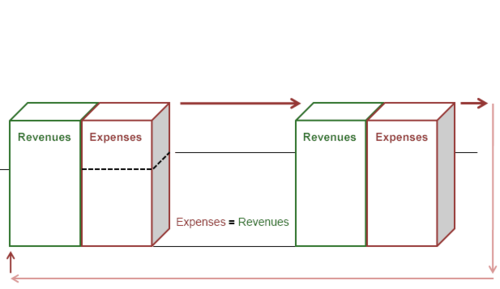

In accounting, finance and economics, an accounting identity is an equality that must be true regardless of the value of its variables, or a statement that by definition must be true. Where an accounting identity applies, any deviation from numerical equality signifies an error in formulation, calculation or measurement.

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash . The balance sheet of a firm records the monetary value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. Total assets can also be called the balance sheet total.

Dr. Wilhelm Lautenbach was a German economist and financial expert who served as a consultant for financial matters in the Ministry of Economics during the 1930s. He primarily focused on currency issues, the German banking crisis, the impact of reparations payments, and the prevalent mass unemployment of the time.

The sectoral balances are a sectoral analysis framework for macroeconomic analysis of national economies developed by British economist Wynne Godley.

Wolfgang Stützel was a German economist and professor of economics at the Saarland University, Germany. From 1966 to 1968 he was member of the German Council of Economic Experts.

Paradox of competition in economics names a model of a situation where measures, which offer a competitive advantage to an individual economic entity, lead to nullification of advantage if all others behave in the same way. In some cases the finite state is even more disadvantageous for everybody than before. The term Paradox of competition was coined by German economist Wolfgang Stützel. It is about a case of a rationality trap.

Heiner Flassbeck is a German economist and public intellectual. From 1998 to 1999 he was a State Secretary in the German Federal Ministry of Finance where he also advised former finance minister Oskar Lafontaine on a reform of the European Monetary System. He became the Chief of Macroeconomics and Development of the United Nations Conference on Trade and Development (UNCTAD) in Geneva in January 2003, a position that he held until resigning at the end of 2012 due to his age.