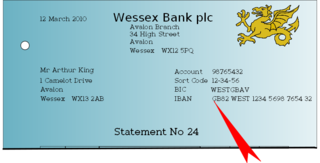

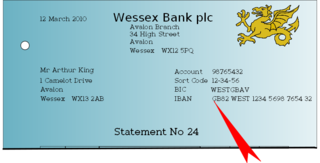

The International Bank Account Number (IBAN) is an internationally agreed upon system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution. It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. By July 2024, 88 countries were using the IBAN numbering system.

ISO 9362 is an international standard for Business Identifier Codes (BIC), a unique identifier for business institutions, approved by the International Organization for Standardization (ISO). BIC is also known as SWIFT-BIC, SWIFT ID, or SWIFT code, after the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which is designated by ISO as the BIC registration authority. BIC was defined originally as Bank Identifier Code and is most often assigned to financial organizations; when it is assigned to non-financial organization, the code may also be known as Business Entity Identifier (BEI). These codes are used when transferring money between banks, particularly for international wire transfers, and also for the exchange of other messages between banks. The codes can sometimes be found on account statements.

In the United States, an ABA routing transit number is a nine-digit code printed on the bottom of checks to identify the financial institution on which it was drawn. The American Bankers Association (ABA) developed the system in 1910 to facilitate the sorting, bundling, and delivering of paper checks to the drawer's bank for debit to the drawer's account.

A telephone numbering plan is a type of numbering scheme used in telecommunication to assign telephone numbers to subscriber telephones or other telephony endpoints. Telephone numbers are the addresses of participants in a telephone network, reachable by a system of destination code routing. Telephone numbering plans are defined in each of the administrative regions of the public switched telephone network (PSTN) and in private telephone networks.

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office.

ISO/IEC 7812Identification cards – Identification of issuers is an international standard published jointly by the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC). It specifies "a numbering system for the identification of the card issuers, the format of the issuer identification number (IIN) and the primary account number (PAN)", and procedures for registering IINs. It was first published in 1989.

A national identification number, national identity number, or national insurance number or JMBG/EMBG is used by the governments of many countries as a means of tracking their citizens, permanent residents, and temporary residents for the purposes of work, taxation, government benefits, health care, and other governmentally-related functions.

A Bank State Branch is the name used in Australia for a bank code, which is a branch identifier. The BSB is normally used in association with the account number system used by each financial institution. The structure of the BSB + account number does not permit for account numbers to be transferable between financial institutions. While similar in structure, the New Zealand and Australian systems are only used in domestic transactions and are incompatible with each other. For international transfers, a SWIFT code is used in addition to the BSB and account number.

Sort codes are the domestic bank codes used to route money transfers between financial institutions in the United Kingdom, and formerly in the Republic of Ireland. They are six-digit hierarchical numerical addresses that specify clearing banks, clearing systems, regions, large financial institutions, groups of financial institutions and ultimately resolve to individual branches. In the UK they continue to be used to route transactions domestically within clearance organizations and to identify accounts, while in the Republic of Ireland they have been deprecated and replaced by the Single European Payment Area (SEPA) systems and infrastructure.

The International Article Number is a standard describing a barcode symbology and numbering system used in global trade to identify a specific retail product type, in a specific packaging configuration, from a specific manufacturer. The standard has been subsumed in the Global Trade Item Number standard from the GS1 organization; the same numbers can be referred to as GTINs and can be encoded in other barcode symbologies, defined by GS1. EAN barcodes are used worldwide for lookup at retail point of sale, but can also be used as numbers for other purposes such as wholesale ordering or accounting. These barcodes only represent the digits 0–9, unlike some other barcode symbologies which can represent additional characters.

In Germany and Austria, the Bankleitzahl (BLZ) is a code that uniquely identifies a bank. The bank code always consists of eight digits in Germany and five digits in Austria. In Switzerland and Liechtenstein, the bank clearing number has the same meaning. The bank sort code must be specified for many business transactions in payment transactions.

"Bookland" is the informal name for the Unique Country Code (UCC) prefix allocated in the 1980s for European Article Number (EAN) identifiers of published books, regardless of country of origin, so that the EAN namespace can catalogue books by ISBN rather than maintaining a redundant parallel numbering system. In other words, Bookland is a fictitious country that exists solely in EAN for the purposes of non-geographically cataloguing books in the otherwise geographically keyed EAN coding system.

The CLABE is a banking standard for the numbering of bank accounts in Mexico. This standard is a requirement for the sending and receiving of domestic inter-bank electronic funds transfer since June 1, 2004.

A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit cards, as well as stored-value cards, gift cards and other similar cards. In some situations the card number is referred to as a bank card number. The card number is primarily a card identifier and may not directly identify the bank account number(s) to which the card is/are linked by the issuing entity. The card number prefix identifies the issuer of the card, and the digits that follow are used by the issuing entity to identify the cardholder as a customer and which is then associated by the issuing entity with the customer's designated bank accounts. In the case of stored-value type cards, the association with a particular customer is only made if the prepaid card is reloadable. Card numbers are allocated in accordance with ISO/IEC 7812. The card number is typically embossed on the front of a payment card, and is encoded on the magnetic stripe and chip, but may also be imprinted on the back of the card.

National conventions for writing telephone numbers vary by country. The International Telecommunication Union (ITU) publishes a recommendation entitled Notation for national and international telephone numbers, e-mail addresses and Web addresses. Recommendation E.123 specifies the format of telephone numbers assigned to telephones and similar communication endpoints in national telephone numbering plans.

Telephone numbers in Georgia consist of 9 digits and follow a closed numbering plan in which the initial 2 or 3 digits indicate the service or area code and the remaining 6 or 7 digits identify the subscriber.

New Zealand bank account numbers in NZD follow a standardised format of 16 digits:

A bank clearing number or BC number is a number used for the identification of financial institutions in Switzerland and Liechtenstein. Bank clearing numbers are connected to the Swiss Interbank Clearing and the euroSIC system.

A routing number is the term for bank codes in Canada. Routing numbers consist of eight numerical digits with a dash between the fifth and sixth digit for paper financial documents encoded with magnetic ink character recognition and nine numerical digits without dashes for electronic funds transfers. Routing numbers are regulated by Payments Canada, formerly known as the Canadian Payments Association, to allow easy identification of the branch location and financial institution associated with an account.

The national identity number is a unique eleven-digit unique identifier issued to residents and citizens of Norway. The issuing of the identity number corresponds to being registered in the national population register. The ID number is used throughout government administration and a number of private sector services, in particular banking and insurance. All official IDs, including passports, national ID cards, driving licenses and bank cards contain the National Identity Number.