A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies. Exchanges may accept credit card payments, wire transfers or other forms of payment in exchange for digital currencies or cryptocurrencies. A cryptocurrency exchange can be a market maker that typically takes the bid–ask spreads as a transaction commission for its service or, as a matching platform, simply charges fees.

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.

Coinbase Global, Inc., branded Coinbase, is an American publicly traded company that operates a cryptocurrency exchange platform. Coinbase is a distributed company; all employees operate via remote work. It is the largest cryptocurrency exchange in the United States in terms of trading volume. The company was founded in 2012 by Brian Armstrong and Fred Ehrsam. In May 2020, Coinbase announced it would shut its San Francisco, California, headquarters and change operations to remote-first, part of a wave of several major tech companies closing headquarters in San Francisco in the wake of the COVID-19 pandemic.

Bitstamp is a Luxembourg-based cryptocurrency exchange founded in 2011. It is the world’s longest-running cryptocurrency exchange. It allows trading between fiat currency, bitcoin and other cryptocurrencies, such as the U.S. dollar, the euro, the pound sterling, Ethereum, Litecoin, Ripple, Bitcoin Cash, Algorand, Stellar, and USD Coin. Business operations are conducted from its registered headquarters in Luxembourg City, with a satellite office in Ljubljana.

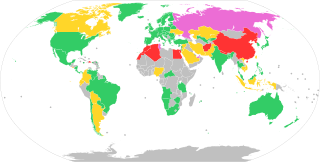

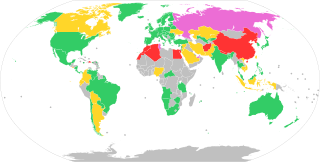

The legal status of cryptocurrencies varies substantially from one jurisdiction to another, and is still undefined or changing in many of them. Whereas, in the majority of countries the usage of cryptocurrency isn't in itself illegal, its status and usability as a means of payment varies, with differing regulatory implications.

Blockchain.com is a cryptocurrency financial services company. The company began as the first Bitcoin blockchain explorer in 2011 and later created a cryptocurrency wallet that accounted for 28% of bitcoin transactions between 2012 and 2020. It also operates a cryptocurrency exchange and provides institutional markets lending business and data, charts, and analytics.

CoinDesk is a news site specializing in bitcoin and digital currencies. Founded by Shakil Khan, the firm also provides guides to bitcoin for those new to digital currencies.

HTX, formerly known as Huobi, is a Seychelles-based cryptocurrency exchange. Founded in China,, HTX now has offices in Hong Kong, South Korea, Japan and the United States. In August 2018, it became a publicly listed Hong Kong company.

Kraken is a United States–based cryptocurrency exchange, founded in 2011. It was one of the first bitcoin exchanges to be listed on Bloomberg Terminal and was valued at US$3 billion in January 2024. The company has been the subject of several regulatory investigations since 2018, and has agreed to cumulative fines of over $30 million. It was the first cryptocurrency company to obtain a bank charter.

Digital Currency Group Inc. (DCG) is a venture capital company focusing on the digital currency market. It is located in Stamford, Connecticut. The company has the subsidiaries Foundry, Genesis, Grayscale Investments, and Luno. It also formerly owned CoinDesk.

Bitfinex is a cryptocurrency exchange owned and operated by iFinex Inc, and is registered in the British Virgin Islands. Bitfinex was founded in 2012. It was originally a peer-to-peer Bitcoin exchange, and later added support for other cryptocurrencies.

An initial coin offering (ICO) or initial currency offering is a type of funding using cryptocurrencies. It is often a form of crowdfunding, although a private ICO which does not seek public investment is also possible. In an ICO, a quantity of cryptocurrency is sold in the form of "tokens" ("coins") to speculators or investors, in exchange for legal tender or other cryptocurrencies such as Bitcoin or Ether. The tokens are promoted as future functional units of currency if or when the ICO's funding goal is met and the project successfully launches.

Tether is a cryptocurrency stablecoin launched by Tether Limited Inc. in 2014.

A cryptocurrency bubble is a phenomenon where the market increasingly considers the going price of cryptocurrency assets to be inflated against their hypothetical value. The history of cryptocurrency has been marked by several speculative bubbles on a boom to bust cycle.

Binance Holdings Ltd., branded Binance, is a global company that operates the largest cryptocurrency exchange in terms of daily trading volume of cryptocurrencies. Binance was founded in 2017 by Changpeng Zhao, a developer who had previously created high-frequency trading software. Binance was initially based in China, then moved to Japan shortly before the Chinese government restricted cryptocurrency companies. Binance subsequently left Japan for Malta and currently has no official company headquarters.

Cryptocurrency and crime describe notable examples of cybercrime related to theft of cryptocurrencies and some methods or security vulnerabilities commonly exploited. Cryptojacking is a form of cybercrime specific to cryptocurrencies used on websites to hijack a victim's resources and use them for hashing and mining cryptocurrency.

OKX, formerly known as OKEx, is a Seychelles-based cryptocurrency exchange. It was founded by Star Xu in 2017, who is also the CEO as of 2023. The President is Hong Fang and the CMO is Haider Rafique. OKX is owned by OK Group, which also owns the crypto exchange Okcoin. As of August 2024, OKX is Top 3 Spot Cryptocurrency exchange in the world according to Coinmarketcap with a Spot Exchange Score of 7.8.

Bithumb is a South Korean cryptocurrency exchange. Founded in 2014, Bithumb Korea has 8 million registered users, 1 million mobile app users, and a current cumulative transaction volume has exceeded USD $1 trillion.

Crypto.com is a cryptocurrency exchange company based in Singapore that offers various financial services, including an app, exchange, and noncustodial DeFi wallet, NFT marketplace, and direct payment service in cryptocurrency. As of June 2023, the company reportedly had 100 million customers and 4,000 employees.