The government of Puerto Rico is a republican form of government with separation of powers, subject to the jurisdiction and sovereignty of the United States. Article I of the Constitution of Puerto Rico defines the government and its political power and authority pursuant to U.S. Pub.L. 82–447. Said law mandated the establishment of a local constitution due to Puerto Rico's political status as a commonwealth of the United States. Ultimately, the powers of the government of Puerto Rico are all delegated by Congress and lack full protection under the U.S. Constitution. Because of this, the head of state of Puerto Rico is the President of the United States.

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then outstanding Treasury securities that have been issued by the Treasury and other federal government agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

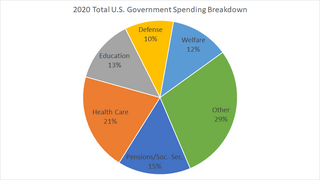

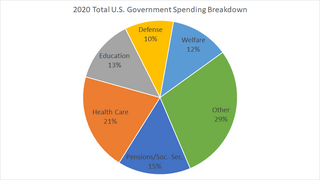

The United States federal budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. It emphasizes accountability rather than profitability, and is used by Nonprofit organizations and by governments. In this method, a fund consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions.

The economy of Puerto Rico is classified as a high income economy by the World Bank and as the most competitive economy in Latin America by the World Economic Forum. The main drivers of Puerto Rico's economy are manufacturing, primarily pharmaceuticals, textiles, petrochemicals, and electronics; followed by the service industry, notably finance, insurance, real estate, and tourism. The geography of Puerto Rico and its political status are both determining factors on its economic prosperity, primarily due to its relatively small size as an island; its lack of natural resources used to produce raw materials, and, consequently, its dependence on imports; as well as its relationship with the United States federal government, which controls its foreign policies while exerting trading restrictions, particularly in its shipping industry.

Canadian government debt, also called Canada's "public debt", is the liabilities of the government sector. For 2019, total financial liabilities or gross debt was $2.434 trillion for the consolidated Canadian general government . This corresponds to 105.3% as a ratio of GDP . Of the gross debt, $1145 billion or 47% was federal (central) government liabilities . Provincial government liabilities comprise most of the remaining liabilities.

The Australian government debt is the amount owed by the Australian federal government. The Australian Office of Financial Management, which is part of the Treasury Portfolio, is the agency which manages the government debt and does all the borrowing on behalf of the Australian government. Australian government borrowings are subject to limits and regulation by the Loan Council, unless the borrowing is for defence purposes or is a 'temporary' borrowing. Government debt and borrowings have national macroeconomic implications, and are also used as one of the tools available to the national government in the macroeconomic management of the national economy, enabling the government to create or dampen liquidity in financial markets, with flow on effects on the wider economy.

The United States federal budget consists of mandatory expenditures, discretionary spending for defense, Cabinet departments and agencies, and interest payments on debt. This is currently over half of U.S. government spending, the remainder coming from state and local governments.

Fiscal policy are "measures employed by governments to stabilize the economy, specifically by manipulating the levels and allocations of taxes and government expenditures. Fiscal measures are frequently used in tandem with monetary policy to achieve certain goals." In the Philippines, this is characterized by continuous and increasing levels of debt and budget deficits, though there have been improvements in the last few years.

Central government spending in the United Kingdom, also called public expenditure, is the responsibility of the UK government, the Scottish Government, the Welsh Government and the Northern Ireland Executive. In the budget for financial year 2019–20, proposed total government spending was £842 billion.

The executive branch of the government of Puerto Rico is responsible for executing the laws of Puerto Rico, as well as causing them to be executed. Article IV of the Constitution of Puerto Rico vests the executive power on the Governor—whom by its nature forms the executive branch.

The public debt of Puerto Rico is the money borrowed by the government of Puerto Rico through the issue of securities by the Government Development Bank and other government agencies.

The 2012 Puerto Rico government transition process is the ongoing process in Puerto Rico regarding the government transition between the outgoing governorship of incumbent Governor Luis Fortuño and the incoming governorship of Alejandro García Padilla, governor-elect. The process is mandated and regulated by Law No. 197 of 2002 and started on November 13, 2012, three working days after the Puerto Rican general election of 2012 as the law requires, once García Padilla was preliminarily certified as Governor-elect by the State Elections Commission.

The Ontario government debt consists of the liabilities of the Government of Ontario. Approximately 82% of Ontario's debt is in the form of debt securities, while other liabilities include government employee pension plan obligations, loans, and accounts payable. The Ontario Financing Authority, which manages the provinces' debt, says that as of March 31, 2020, the Ontario government's net debt is CDN $353.3 billion. Net debt is projected to rise to $398 billion in 2020-21. The Debt-to-GDP ratio for 2019-2020 was 39.7%, and is projected to rise to 47.1% in 2020-21. Interest on the debt in 2019-20 was CDN$12.5 billion, representing 8.0% of Ontario's revenue and its fourth-largest spending area.

The Puerto Rican government-debt crisis is an ongoing financial crisis affecting the government of Puerto Rico. The crisis began in 2014 when three major credit agencies downgraded several bond issues by Puerto Rico to "junk status" after the government was unable to demonstrate that it could pay its debt. The downgrading, in turn, prevented the government from selling more bonds in the open market. Unable to obtain the funding to cover its budget imbalance, the government began using its savings to pay its debt while warning that those savings would eventually be exhausted. To prevent such a scenario, the United States Congress enacted a law known as PROMESA, which appointed an oversight board with ultimate control over the Commonwealth's budget. As the PROMESA board began to exert that control, the government sought to increase revenues and reduce its expenses by increasing taxes while curtailing public services and reducing government pensions. Those measures further compounded the crisis by provoking social distrust and unrest. In August 2018, a debt investigation report of the Financial Oversight and Management Board for Puerto Rico reported the Commonwealth had $74 billion in bond debt and $49 billion in unfunded pension liabilities as of May 2017.

The Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) is a US federal law enacted in 2016 that established a financial oversight board, a process for restructuring debt, and expedited procedures for approving critical infrastructure projects in order to combat the Puerto Rican government-debt crisis. Through PROMESA, the US Congress established an appointed Fiscal Control Board (FCB), known colloquially in Puerto Rico as "la junta," to oversee the debt restructuring. With this protection the then-governor of Puerto Rico, Alejandro García Padilla, suspended payments due on July 1, 2016. The FCB's approved fiscal austerity plan for 2017-2026 cut deeply into Puerto Rico's public service budget, including cuts to health care, pensions, and education, in order to repay creditors. By May 2017, with $123 billion in debt owed by the Puerto Rican government and its corporations, the FCB requested the "immediate" appointment of a federal judge to resolve the "largest bankruptcy case in the history of the American public bond market."

Government spending in the United States is the spending of the federal government of the United States, and the spending of its state and local governments.