A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. A dividend tax is in addition to any tax imposed directly on the corporation on its profits. Some jurisdictions do not tax dividends.

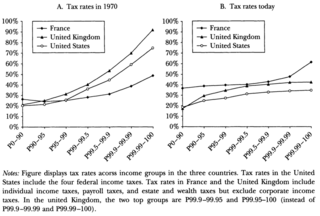

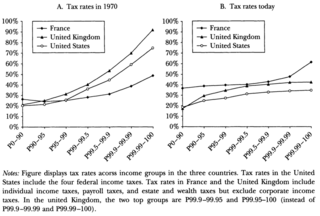

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich.

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they describe a range of activities that intend to subvert a state's tax system.

A wealth tax is a tax on an entity's holdings of assets or an entity's net worth. This includes the total value of personal assets, including cash, bank deposits, real estate, assets in insurance and pension plans, ownership of unincorporated businesses, financial securities, and personal trusts. Typically, wealth taxation often involves the exclusion of an individual's liabilities, such as mortgages and other debts, from their total assets. Accordingly, this type of taxation is frequently denoted as a netwealth tax.

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

Income tax in India is governed by Entry 82 of the Union List of the Seventh Schedule to the Constitution of India, empowering the central government to tax non-agricultural income; agricultural income is defined in Section 10(1) of the Income-tax Act, 1961. Income-tax law consists of the 1961 act, Income Tax Rules 1962, Notifications and Circulars issued by the Central Board of Direct Taxes (CBDT), annual Finance Acts, and judicial pronouncements by the Supreme and high courts.

The economic policy and legacy of the George W. Bush administration was characterized by significant income tax cuts in 2001 and 2003, the implementation of Medicare Part D in 2003, increased military spending for two wars, a housing bubble that contributed to the subprime mortgage crisis of 2007–2008, and the Great Recession that followed. Economic performance during the period was adversely affected by two recessions, in 2001 and 2007–2009.

In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-term capital gains, on dispositions of assets held for more than one year, are taxed at a lower rate.

The history of taxation in the United States begins with the colonial protest against British taxation policy in the 1760s, leading to the American Revolution. The independent nation collected taxes on imports ("tariffs"), whiskey, and on glass windows. States and localities collected poll taxes on voters and property taxes on land and commercial buildings. In addition, there were the state and federal excise taxes. State and federal inheritance taxes began after 1900, while the states began collecting sales taxes in the 1930s. The United States imposed income taxes briefly during the Civil War and the 1890s. In 1913, the 16th Amendment was ratified, however, the United States Constitution Article 1, Section 9 defines a direct tax. The Sixteenth Amendment to the United States Constitution did not create a new tax.

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

Carried interest, or carry, in finance, is a share of the profits of an investment paid to the investment manager specifically in alternative investments. It is a performance fee, rewarding the manager for enhancing performance. Since these fees are generally not taxed as normal income, some believe that the structure unfairly takes advantage of favorable tax treatment, e.g. in the United States.

The economic policy of the Barack Obama administration, or in its colloquial portmanteau form "Obamanomics", was characterized by moderate tax increases on higher income Americans designed to fund health care reform, reduce the federal budget deficit, and decrease income inequality. President Obama's first term (2009–2013) included measures designed to address the Great Recession and subprime mortgage crisis, which began in 2007. These included a major stimulus package, banking regulation, and comprehensive healthcare reform. As the economy improved and job creation continued during his second term (2013–2017), the Bush tax cuts were allowed to expire for the highest income taxpayers and a spending sequester (cap) was implemented, to further reduce the deficit back to typical historical levels. The number of persons without health insurance was reduced by 20 million, reaching a record low level as a percent of the population. By the end of his second term, the number of persons with jobs, real median household income, stock market, and real household net worth were all at record levels, while the unemployment rate was well below historical average.

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, also known as the 2010 Tax Relief Act, was passed by the United States Congress on December 16, 2010, and signed into law by President Barack Obama on December 17, 2010.

We are the 99% is a political slogan widely used and coined during the 2011 Occupy movement. The phrase directly refers to the income and wealth inequality in the United States, with a concentration of wealth among the top-earning 1%. It reflects the belief that "the 99%" are paying the price for the mistakes of a tiny minority within the upper class.

Political debates about the United States federal budget discusses some of the more significant U.S. budgetary debates of the 21st century. These include the causes of debt increases, the impact of tax cuts, specific events such as the United States fiscal cliff, the effectiveness of stimulus, and the impact of the Great Recession, among others. The article explains how to analyze the U.S. budget as well as the competing economic schools of thought that support the budgetary positions of the major parties.

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

The United States fiscal cliff refers to the combined effect of several previously-enacted laws that came into effect simultaneously in January 2013, increasing taxes and decreasing spending.

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "Bush tax cuts".

The economic policy of the first Trump administration was characterized by the individual and corporate tax cuts, attempts to repeal the Affordable Care Act ("Obamacare"), trade protectionism, deregulation focused on the energy and financial sectors, and responses to the COVID-19 pandemic.