The M'Naghten rule(s) (pronounced, and sometimes spelled, McNaughton) is a legal test defining the defence of insanity, first formulated by House of Lords in 1843. It is the established standard in UK criminal law, and versions have also been adopted in some US states (currently or formerly), and other jurisdictions, either as case law or by statute. Its original wording is a proposed jury instruction:

that every man is to be presumed to be sane, and ... that to establish a defence on the ground of insanity, it must be clearly proved that, at the time of the committing of the act, the party accused was labouring under such a defect of reason, from disease of the mind, as not to know the nature and quality of the act he was doing; or if he did know it, that he did not know he was doing what was wrong.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

Sir Robert Peel, 2nd Baronet,, was a British Conservative statesman who served twice as Prime Minister of the United Kingdom, simultaneously serving as Chancellor of the Exchequer (1834–1835), and twice as Home Secretary. He is regarded as the father of modern British policing, owing to his founding of the Metropolitan Police Service. Peel was one of the founders of the modern Conservative Party.

The Corn Laws were tariffs and other trade restrictions on imported food and corn enforced in the United Kingdom between 1815 and 1846. The word corn in British English denoted all cereal grains, including wheat, oats and barley. They were designed to keep corn prices high to favour domestic producers, and represented British mercantilism. The Corn Laws blocked the import of cheap corn, initially by simply forbidding importation below a set price, and later by imposing steep import duties, making it too expensive to import it from abroad, even when food supplies were short. The House of Commons passed the corn law bill on 10 March 1815, the House of Lords on 20 March and the bill received royal assent on 23 March 1815.

John Russell, 1st Earl Russell,, known by his courtesy title Lord John Russell before 1861, was a British Whig and Liberal statesman who served as Prime Minister of the United Kingdom from 1846 to 1852 and again from 1865 to 1866.

The Test Acts were a series of penal laws originating in Restoration England, passed by the Parliament of England, that served as a religious test for public office and imposed various civil disabilities on Catholics and nonconformist Protestants.

The Coinage Act of 1873 or Mint Act of 1873 was a general revision of laws relating to the Mint of the United States. By ending the right of holders of silver bullion to have it coined into standard silver dollars, while allowing holders of gold to continue to have their bullion made into money, the act created a gold standard by default. It also authorized a Trade dollar, with limited legal tender, intended for export, mainly to Asia, and abolished three small-denomination coins. The act led to controversial results and was denounced by critics as the "Crime of '73".

The Indian rupee is the official currency in India. The rupee is subdivided into 100 paise. The issuance of the currency is controlled by the Reserve Bank of India. The Reserve Bank manages currency in India and derives its role in currency management on the basis of the Reserve Bank of India Act, 1934.

The pound was the currency of Australia from 1910 until 14 February 1966, when it was replaced by the Australian dollar. Like other £sd currencies, it was subdivided into 20 shillings, each of 12 pence.

The United States Gold Reserve Act of January 30, 1934 required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury. It also prohibited the Treasury and financial institutions from redeeming dollar bills for gold, established the Exchange Stabilization Fund under control of the Treasury to control the dollar's value without the assistance of the Federal Reserve, and authorized the president to establish the gold value of the dollar by proclamation.

The Factory Acts were a series of acts passed by the Parliament of the United Kingdom beginning in 1802 to regulate and improve the conditions of industrial employment.

The Bank Restriction Act 1797 was an Act of the Parliament of Great Britain which removed the requirement for the Bank of England to convert banknotes into gold. The period lasted until 1821, when convertibility was restored. The period between these two dates is known as the Restriction period.

Unemployment was the dominant issue of British society during the interwar years. Unemployment levels rarely dipped below 1,000,000 and reached a peak of more than 3,000,000 in 1933, a figure which represented more than 20% of the working population. The unemployment rate was even higher in areas including South Wales and Liverpool. The Government extended unemployment insurance schemes in 1920 to alleviate the effects of unemployment.

The Panic of 1847 was a major British commercial and banking crisis, possibly triggered by the announcement in early March 1847 of government borrowing to pay for relief to combat the Great Famine in Ireland. It is also associated with the end of the 1840s railway industry boom and the failure of many non-bank lenders. The crisis was composed of two phases, one in April 1847 and one in October 1847, which was more serious and known as 'The Week of Terror'.

The United States dollar is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color.

The Factories Act 1847, also known as the Ten Hours Act was a United Kingdom Act of Parliament which restricted the working hours of women and young persons (13–18) in textile mills to 10 hours per day. The practicalities of running a textile mill were such that the Act should have effectively set the same limit on the working hours of adult male mill-workers.

The Great Recoinage of 1816 was an attempt by the government of the United Kingdom of Great Britain and Ireland to re-stabilise its currency, the pound sterling, after the economic difficulties brought about by the French Revolutionary Wars and the Napoleonic Wars.

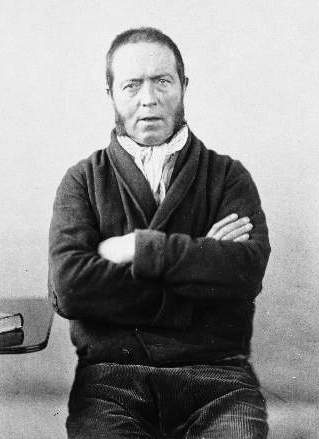

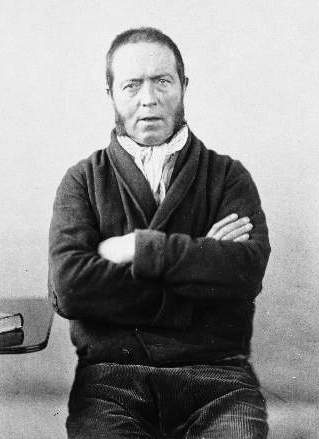

The Health and Morals of Apprentices Act 1802, sometimes known as the Factory Act 1802, was an Act of the Parliament of the United Kingdom designed to improve conditions for apprentices working in cotton mills. The Act was introduced by Sir Robert Peel, who had become concerned in the issue after a 1784 outbreak of a "malignant fever" at one of his cotton mills, which he later blamed on 'gross mismanagement' by his subordinates.

The Cotton Mills and Factories Act 1819 was an Act of the Parliament of the United Kingdom, which was its first attempt to regulate the hours and conditions of work of children in the cotton industry. It was introduced by Sir Robert Peel, who had first introduced a bill on the matter in 1815. The 1815 bill had been instigated by Robert Owen, but the Act as passed was much weaker than the 1815 bill; the Act forbade the employment of children under 9; children aged 9–16 years were limited to 12 hours' work per day and could not work at night. There was no effective means of its enforcement, but it established the precedent for Parliamentary intervention on conditions of employment which was followed by subsequent Factory Acts.

Peel's Bill, or the Resumption of Cash Payments Act 1819, marked the return of the British currency to the gold standard, after the Bank Restriction Act 1797 saw paper money replacing convertibility to gold and silver under the financial pressures of the French Revolutionary Wars.