Related Research Articles

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Many central banks also have supervisory or regulatory powers to ensure the stability of commercial banks in their jurisdiction, to prevent bank runs, and in some cases also to enforce policies on financial consumer protection and against bank fraud, money laundering, or terrorism financing.

The European Central Bank (ECB) is the prime component of the Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important central banks.

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

The monetary policy of The United States is the set of policies which the Federal Reserve follows to achieve its twin objectives of high employment and stable inflation.

The Bank of Japan is the central bank of Japan. The bank is often called Nichigin (日銀) for short. It is headquartered in Nihonbashi, Chūō, Tokyo.

The Monetary Authority of Singapore or (MAS), is the central bank and financial regulatory authority of Singapore. It administers the various statutes pertaining to money, banking, insurance, securities and the financial sector in general, as well as currency issuance and manages the foreign-exchange reserves. It was established in 1971 to act as the banker to and as a financial agent of the Government of Singapore. The body is duly accountable to the Parliament of Singapore through the Minister-in-charge, who is also the Incumbent Chairman of the central bank.

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability. Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since that, though it is still the official strategy in a number of emerging economies.

The Reserve Bank of New Zealand (RBNZ) is the central bank of New Zealand. It was established in 1934 and is currently constituted under the Reserve Bank of New Zealand Act 2021. The governor of the Reserve Bank, currently Adrian Orr, is responsible for New Zealand's currency and operating monetary policy.

The Taylor rule is a monetary policy targeting rule. The rule was proposed in 1992 by American economist John B. Taylor for central banks to use to stabilize economic activity by appropriately setting short-term interest rates. The rule considers the federal funds rate, the price level and changes in real income. The Taylor rule computes the optimal federal funds rate based on the gap between the desired (targeted) inflation rate and the actual inflation rate; and the output gap between the actual and natural output level. According to Taylor, monetary policy is stabilizing when the nominal interest rate is higher/lower than the increase/decrease in inflation. Thus the Taylor rule prescribes a relatively high interest rate when actual inflation is higher than the inflation target.

The Bank of Israel is the central bank of Israel. The bank's headquarters is located in Kiryat HaMemshala in Jerusalem with a branch office in Tel Aviv. The current governor is Amir Yaron.

The Central Bank of the Republic of Turkey (CBRT) is the central bank of Turkey. Its responsibilities include conducting monetary and exchange rate policy, managing international reserves of Turkey, as well as printing and issuing banknotes, and establishing, maintaining and regulating payment systems in the country.

The State Bank of Pakistan (SBP) is the Central Bank of Pakistan. Its Constitution, as originally laid down in the State Bank of Pakistan Order 1948, remained basically unchanged until 1 January 1974, when the bank was nationalised and the scope of its functions was considerably enlarged. The State Bank of Pakistan Act 1956, with subsequent amendments, forms the basis of its operations today. The headquarters are located in the financial capital of the country in Karachi. The bank has a fully owned subsidiary with the name SBP Banking Services Corporation (SBP-BSC), the operational arm of the Central Bank with Branch Office in 16 cities across Pakistan, including the capital Islamabad and the four provincial capitals Lahore, Karachi, Peshawar, Quetta. The State Bank of Pakistan has other fully owned subsidiaries as well: National Institute of Banking and Finance, the training arm of the bank providing training to Commercial Banks, the Deposit Protection Corporation, and ownership of the Pakistan Security Printing Corporation.

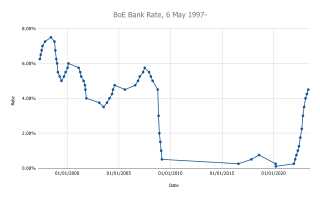

The Monetary Policy Committee (MPC) is a committee of the Bank of England, which meets for three and a half days, eight times a year, to decide the official interest rate in the United Kingdom.

The Federal Reserve System, commonly known as "the Fed," has faced various criticisms since its establishment in 1913. Critics have questioned its effectiveness in managing inflation, regulating the banking system, and stabilizing the economy. Notable critics include Nobel laureate economist Milton Friedman and his fellow monetarist Anna Schwartz, who argued that the Fed's policies exacerbated the Great Depression. More recently, former Congressman Ron Paul has advocated for the abolition of the Fed and a return to a gold standard.

The Hungarian National Bank is the central bank of Hungary and as such part of the European System of Central Banks (ESCB). It was established in 1924 as a successor entity of the Austro-Hungarian Bank, under the economic assistance provided to Hungary by the Economic and Financial Organization of the League of Nations. The bank calls itself the Magyar Nemzeti Bank in its English communications and occasionally clarifies that name with the expression the central bank of Hungary. The bank doesn't call itself the Hungarian National Bank in English.

In macroeconomics, inflation targeting is a monetary policy where a central bank follows an explicit target for the inflation rate for the medium-term and announces this inflation target to the public. The assumption is that the best that monetary policy can do to support long-term growth of the economy is to maintain price stability, and price stability is achieved by controlling inflation. The central bank uses interest rates as its main short-term monetary instrument.

Modern monetary theory or modern money theory (MMT) is a heterodox macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires. According to MMT, governments do not need to worry about accumulating debt since they can create new money by using fiscal policy in order to pay interest. MMT argues that the primary risk once the economy reaches full employment is inflation, which acts as the only constraint on spending. MMT also argues that inflation can be addressed by increasing taxes on everyone to reduce the spending capacity of the private sector.

The Bank of Mozambique is the central bank of Mozambique. The bank does not function as a commercial bank, and has the responsibility of governing the monetary policies of the country. The president of the Republic appoints the governor. The bank is situated in the capital, Maputo, and has two branches, one in Beira and one in Nampula. The Bank of Mozambique is active in developing financial inclusion policy and is a member of the Alliance for Financial Inclusion.

Sir Vito Antonio Muscatelli is the Principal of the University of Glasgow and one of the United Kingdom's top economists.

Inflationary bias is the outcome of discretionary monetary policy that leads to a higher than optimal level of inflation. Depending on the way expectations are formed in the private sector of the economy, there may or may not be a transitory income increase. The term may also refer to the practice of a public debt-ridden nation enacting policies which encourage inflation in the medium/long term.

References

- ↑ "Central Bank Accountability, Independence, and Transparency". IMF. 25 November 2019. Retrieved 2023-02-13.

- ↑ "Central Bank Independence: Issues and Evidence." Journal of Monetary Economics, vol. 47, no. 3, 2001, pp. 523–550., doi:10.1016/s0304-3932(00)00090-x.

- ↑ "The Theory of Central Bank Independence." Journal of Monetary Economics, vol. 24, no. 2, 1989, pp. 177–197., doi:10.1016/0304-3932(89)90034-6.

- ↑ Central Bank Independence, Accountability, and Transparency. 2009-07-15. doi:10.5089/9780230201071.071. ISBN 9780230201071.

- ↑ Gersbach, Hans; Hahn, Volker (August 2009). "Voting Transparency in a Monetary Union". Journal of Money, Credit and Banking. 41 (5): 831–853. doi:10.1111/j.1538-4616.2009.00235.x.

- ↑ Wei, Lingling (2021-12-08). "Beijing Reins In China's Central Bank" . The Wall Street Journal . ISSN 0099-9660 . Retrieved 2023-08-31.

Beijing has little tolerance for any talk of central-bank independence; the monetary authority, just like any other part of the government, answers to the party.